KY 740-NP-R 2021 free printable template

Show details

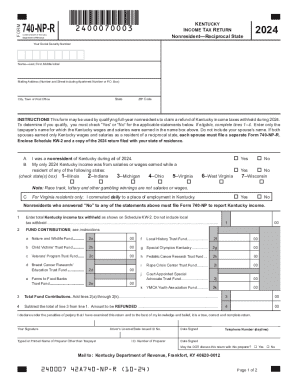

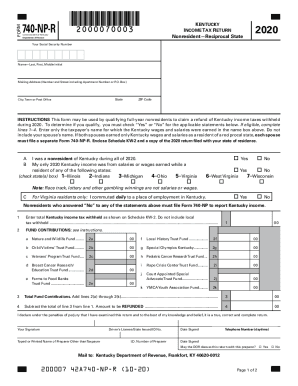

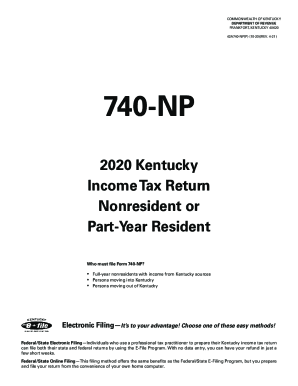

FORMKENTUCKY

INCOME TAX RETURN

NonresidentReciprocal State740NPR

Commonwealth of Kentucky

Department of Revenue2021Your Social Security NumberNameLast, First, Middle Initializing Address (Number and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY 740-NP-R

Edit your KY 740-NP-R form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY 740-NP-R form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KY 740-NP-R online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KY 740-NP-R. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY 740-NP-R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY 740-NP-R

How to fill out KY 740-NP-R

01

Obtain the KY 740-NP-R form from the Kentucky Department of Revenue website or your local tax office.

02

Fill out your personal information including your name, address, and Social Security number.

03

Report your federal adjusted gross income and any additional income including dividends or interest.

04

Claim any deductions and credits applicable to your tax situation.

05

Calculate your Kentucky tax liability based on the information provided.

06

Sign and date the form before submitting it.

07

Submit the completed KY 740-NP-R form to the Kentucky Department of Revenue by the specified deadline.

Who needs KY 740-NP-R?

01

Individuals who earn income from sources outside of Kentucky and have to file a non-resident income tax return.

02

Non-resident individuals who have a filing requirement based on income earned in Kentucky.

Fill

form

: Try Risk Free

People Also Ask about

How does Kentucky tax IRA withdrawals?

Distributions from traditional IRAs are taxed as ordinary income, and if taken before age 59½, may be subject to a 10% federal income tax penalty. Generally, once you reach age 72, you must begin taking required minimum distributions.

Does Kentucky have a state tax form?

If you would like to fill out your Kentucky forms and schedules without software help or assistance, you may use KY File, the New Kentucky Filing Portal, to file your current year return. KY File is designed to be the simple, electronic equivalent of paper forms.

What states have no tax on IRA distributions?

Those eight – Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming – don't tax wages, salaries, dividends, interest or any sort of income. No state income tax means these states also don't tax Social Security retirement benefits, pension payments and distributions from retirement accounts.

Do I need to file a Ky state tax return?

Yes, you must file a Kentucky part-year resident return known as a 740-NP and report all income earned while in Kentucky, as well as any other income from Kentucky sources.

Who is exempt from Kentucky income tax?

Up to $31,110 of income from private, government, and military retirement plans (including IRAs and 401(k) plans) is exempt.

Who has to file Kentucky state taxes?

COVID-19 Tax Relief Frequently Asked Questions For additional information, please visit our COVID-19 Tax Information page. Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources.

Does Kentucky tax Roth IRA withdrawals?

KY will exempt up to $31,110 of taxable pension income, which includes IRA distributions. If the conversion is greater than $31,110, it is likely that some of it will be included in taxable income. If the conversion is less than $31,110, this amount that is taxable on the Federal Return will not be taxable in Kentucky.

Are non residents required to file taxes?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

Does Kentucky require you to file a tax return?

Answer: Yes, you must file a Kentucky part-year resident return known as a 740-NP and report all income earned while earned while in Kentucky and any other income from Kentucky sources.

Does Kentucky tax IRA distributions?

Kentucky Tax Breaks for Other Retirement Income Up to $31,110 of income from private, government, and military retirement plans (including IRAs and 401(k) plans) is exempt. However, government retirement income attributable to service credits earned before 1998 is fully exempt without limits.

What is the minimum income to file taxes in 2022?

Minimum income to file taxes $12,550 if under age 65. $14,250 if age 65 or older.

Do I have to file a Kentucky nonresident tax return?

¶15-115, Nonresidents Unlike residents, full-year nonresidents are subject to Kentucky income tax from any: tangible property located in Kentucky; intangible property that has a business situs in Kentucky; and.

Do I have to file Kentucky state taxes non resident?

A. Yes, you must file a Kentucky part-year resident return known as a 740-NP and report all income earned while in Kentucky, as well as any other income from Kentucky sources.

Who is not required to file a return?

Under age 65. Single. Don't have any special circumstances that require you to file (like self-employment income) Earn less than $12,950 (which is the 2022 standard deduction for a single taxpayer)

Do you have to file state taxes in KY?

It's automatic for all Kentucky taxpayers. While this year is a bit different, generally the deadline for submitting your income tax forms in Kentucky is April 15, the same as the federal deadline.

Do I have to file a KY return?

Yes, you must file a Kentucky part-year resident return known as a 740-NP and report all income earned while in Kentucky, as well as any other income from Kentucky sources.

Does Kentucky have a state income tax withholding form?

Have New Employees Complete Withholding Tax Forms. All new employees for your business must complete a federal Form W-4 and the related Kentucky Form K-4,Employee's Withholding Exemption Certificate. If an employee does not properly complete the K-4, you must withhold the tax as if no exemptions were claimed.

Does Kentucky tax IRA income?

Kentucky Tax Breaks for Other Retirement Income Up to $31,110 of income from private, government, and military retirement plans (including IRAs and 401(k) plans) is exempt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out KY 740-NP-R using my mobile device?

Use the pdfFiller mobile app to complete and sign KY 740-NP-R on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit KY 740-NP-R on an iOS device?

You certainly can. You can quickly edit, distribute, and sign KY 740-NP-R on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete KY 740-NP-R on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your KY 740-NP-R. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is KY 740-NP-R?

KY 740-NP-R is a tax return form used by non-residents of Kentucky to report and pay tax on their Kentucky-sourced income.

Who is required to file KY 740-NP-R?

Non-residents who earn income from sources within Kentucky must file KY 740-NP-R.

How to fill out KY 740-NP-R?

To fill out KY 740-NP-R, complete sections 1 through 7, providing information about your income, deductions, and tax owed, ensuring to include any required documentation.

What is the purpose of KY 740-NP-R?

The purpose of KY 740-NP-R is to allow non-residents of Kentucky to report their income earned in Kentucky and calculate their tax liabilities.

What information must be reported on KY 740-NP-R?

The form requires reporting of all Kentucky-sourced income, any applicable deductions, and personal identification information.

Fill out your KY 740-NP-R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY 740-NP-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.