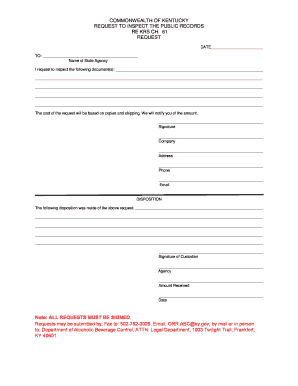

NC DoR NC-3X 2019-2025 free printable template

Show details

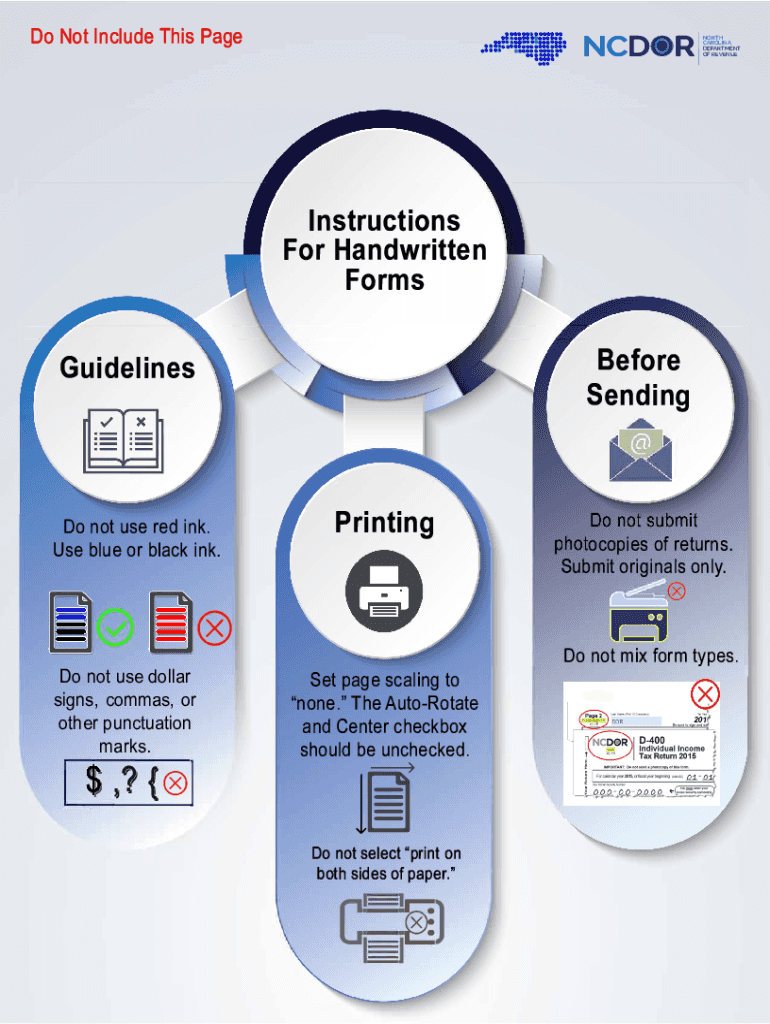

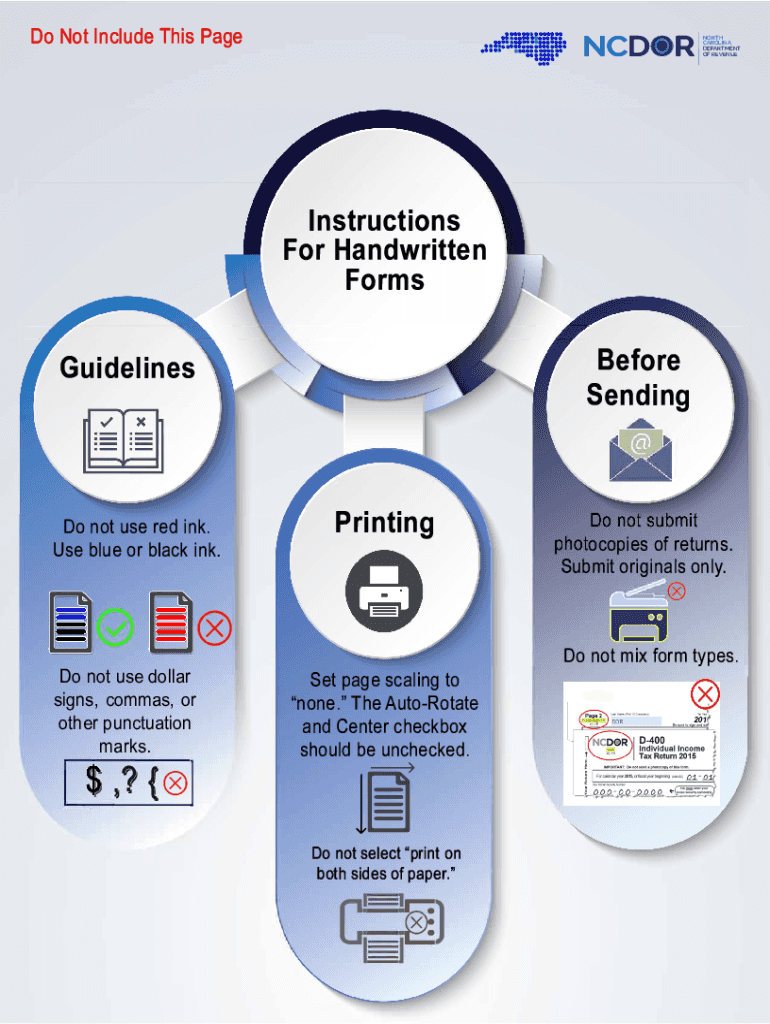

.............. m!u: !!! .::::::: :Do Not Include This Page RI NC D(i)NORTH CAROLINA DEPARTMENT OF REVENUEInstructions For Handwritten Forms Before SendingGuidelinesDo not use red ink. Use blue or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nc amended annual form

Edit your nc 3x form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your north carolina amended form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nc3x withholding form online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nc nc3x withholding form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR NC-3X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nc 3x amended form

How to fill out NC DoR NC-3X

01

Obtain the NC DoR NC-3X form from the North Carolina Department of Revenue website or local office.

02

Fill in the top section with your name, address, and social security number or taxpayer identification number.

03

Complete the income sections, reporting all sources of income as specified.

04

Fill out the appropriate deductions and credits you are eligible for, following the instructions provided.

05

Calculate the total amount owed or the refund due, based on your entries.

06

Sign and date the form at the bottom to certify that the information is accurate.

07

Submit the completed form via mail or electronically as instructed.

Who needs NC DoR NC-3X?

01

Individuals who have unreported income, need to amend a previously filed return, or owe taxes to the state for the tax year.

02

Taxpayers who are self-employed or work freelance and need to report their earnings.

03

Those who wish to claim certain tax credits or deductions that require the submission of this form.

Fill

form

: Try Risk Free

People Also Ask about

Can I file an amended return online?

Can I file my Amended Return electronically? If you need to amend your 2019, 2020 and 2021 Forms 1040 or 1040-SR you can now file Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

Do you get penalized for filing an amended tax return?

Although the IRS appreciates when taxpayers file an amended return to correct a mistake, they can still assess a penalty or charge interest for not paying the proper amount when the taxes were originally due.

When can I expect my amended tax refund?

Your amended return will take up to 3 weeks after you mailed it to show up on our system. Processing it can take up to 16 weeks.

Can you electronically file an amended return for NC?

Description:You cannot eFile a NC Tax Amendment anywhere, except mail it in.

Why are amended tax returns taking so long?

The IRS accepts most amended returns. However, since you have to mail amended returns to the IRS, they take longer to process. If you're going to receive a refund from your amended return, the refund can take up to three months to arrive. You can check the status of your amended return on the IRS website.

How long does it take to get a refund from an amended tax return?

We've received your amended return. We are processing it. It can take up to 16 weeks to complete processing.

Are amended returns being direct deposited?

Per Form 1040X instructions, a refund resulting from an amended return cannot be deposited directly into a bank account. Refunds will be issued by paper check. This is the case even if you e-file. Was this article helpful?

How long after amended return is adjusted do you get refund?

You can use the Where's My Amended Return tool (which is updated every 24 hours) or call 1-866-464-2050 to check the status. Keep in mind it could take up to 16 weeks from the date of receipt for the IRS to process your return and issue your refund via paper check or direct deposit.

How far behind is IRS on amended returns?

The IRS is also delayed in processing individual amended returns and currently says it may take more than 20 weeks to process them.

Does NC accept e file?

If you don't qualify for NC Free File, you can still eFile for a Fee using a competitively priced online eFile provider. Available for current, amended, and prior year returns and payments.

How do I file an amended tax return myself?

Here's a step-by-step guide. Step 1: Collect your documents. Gather your original tax return and any new documents needed to prepare your amended return. Step 2: Get the right forms. The IRS form for amending a return is Form 1040-X. Step 3: Fill out Form 1040-X. Step 4: Submit your amended forms.

Can amended returns be submitted electronically?

Can I file an amended Form 1040-X electronically? You can file Form 1040-X, Amended U.S. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR, and tax year 2021 or later Forms 1040-NR.

Where is my amended NC refund?

How can I check on my amended refund? Call the Department of Revenue toll-free at 1-877-252-4052 .

How do I check my amended tax refund status?

Filers can check the status of a paper or electronically filed Form 1040-X Amended Return using the Where's My Amended Return (WMAR) online tool or the toll-free telephone number 866-464-2050 three weeks after filing the return. Both tools are available in English and Spanish.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify nc 3x form 2019-2025 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your nc 3x form 2019-2025 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send nc 3x form 2019-2025 for eSignature?

Once you are ready to share your nc 3x form 2019-2025, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I edit nc 3x form 2019-2025 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as nc 3x form 2019-2025. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is NC DoR NC-3X?

NC DoR NC-3X is a tax form used in North Carolina to report and amend income tax returns for individuals and businesses.

Who is required to file NC DoR NC-3X?

Any taxpayer in North Carolina who needs to amend their previously filed NC-3 income tax return must file NC DoR NC-3X.

How to fill out NC DoR NC-3X?

To fill out the NC DoR NC-3X, include personal identification information, the tax year being amended, the original amounts reported, the corrected amounts, and a detailed explanation for the changes.

What is the purpose of NC DoR NC-3X?

The purpose of NC DoR NC-3X is to allow taxpayers to correct inaccuracies in their previously filed income tax returns and ensure that the tax records are accurate.

What information must be reported on NC DoR NC-3X?

The information that must be reported includes taxpayer identification details, the original and amended figures for income and deductions, any payments made, and a narrative explaining the reasons for the amendments.

Fill out your nc 3x form 2019-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nc 3x Form 2019-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.