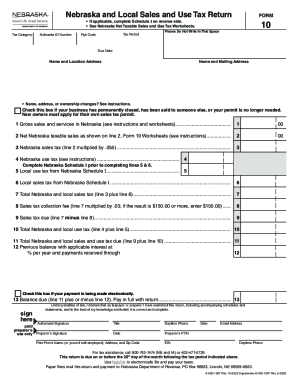

NE Form 10 2021 free printable template

Show details

Use this form for tax period 7/1/2021 3/31/2022 only. Nebraska and Local Sales and Use Tax Returner If applicable, complete Schedule I on reverse side. See Nebraska Net Taxable Sales and Use Tax Worksheets.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NE Form 10

Edit your NE Form 10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NE Form 10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NE Form 10 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NE Form 10. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NE Form 10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NE Form 10

How to fill out NE Form 10

01

Obtain the NE Form 10 from the relevant authority or download it from their official website.

02

Fill out Section A with your personal information, including your name, address, and contact details.

03

Complete Section B by providing details about the nature of the request or the specific purpose of the form.

04

In Section C, include any required documentation or evidence to support your request.

05

Review all the information filled out for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed form through the designated submission method, whether by mail, email, or in person.

Who needs NE Form 10?

01

Individuals or entities who are filing for specific legal or administrative actions that require the use of NE Form 10.

02

Professionals in need of certification for compliance or reporting purposes.

03

Anyone required to submit information to a regulatory body that mandates the completion of NE Form 10.

Fill

form

: Try Risk Free

People Also Ask about

What is exempt from Nebraska sales tax?

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Medicines & medical equipmentPrescription from health care professional (except insulin)NewspapersNonePolitical Campaign FundraisersNoneRepair laborNone9 more rows

Who must file a Nebraska tax return?

A Nebraska Resident: You must file a Nebraska tax return if you are required to file a federal tax return. You have at least $5,000 of net Nebraska adjustments to your federal adjusted gross income.

What is a Nebraska Form 10?

Every retailer must file a Form 10. Retailers include remote sellers and Multivendor Marketplace Platforms (MMPs) with more than $100,000 of gross sales or 200 or more transactions in Nebraska. All retailers must hold a Nebraska Sales Tax Permit.

How to apply for Nebraska state ID number?

When applying for your initial State Identification card you must bring the following documentation to the DMV: Proof of U.S. Citizenship or Lawful Status, containing Name and Date of Birth, and Identity. Principal Address in Nebraska (at least two documents are required).

How do I get a Nebraska sales tax ID number?

To apply for a Nebraska Identification Number, you can either register online, or complete the Nebraska Tax Application, Form 20. If you indicate that you will be collecting sales tax, you will be issued a Sales Tax Permit. The permit must be displayed at each retail location.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NE Form 10 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your NE Form 10 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I sign the NE Form 10 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your NE Form 10 and you'll be done in minutes.

How do I fill out the NE Form 10 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign NE Form 10. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is NE Form 10?

NE Form 10 is a tax form used in certain jurisdictions for reporting income and tax information related to tax-exempt organizations.

Who is required to file NE Form 10?

Tax-exempt organizations that meet specific criteria set by the local tax authority are required to file NE Form 10.

How to fill out NE Form 10?

To fill out NE Form 10, organizations must provide necessary financial information, including income and expenses, follow the form's instructions, and ensure all data is accurate before submission.

What is the purpose of NE Form 10?

The purpose of NE Form 10 is to ensure transparency and compliance with tax regulations for tax-exempt organizations by documenting their financial activities.

What information must be reported on NE Form 10?

NE Form 10 requires reporting of the organization's income, expenses, any grants received, as well as information about its activities and governance structure.

Fill out your NE Form 10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NE Form 10 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.