Get the free www.irs.govpubirs-pdfForm 14039 Identity Theft Affidavit - IRS tax forms

Show details

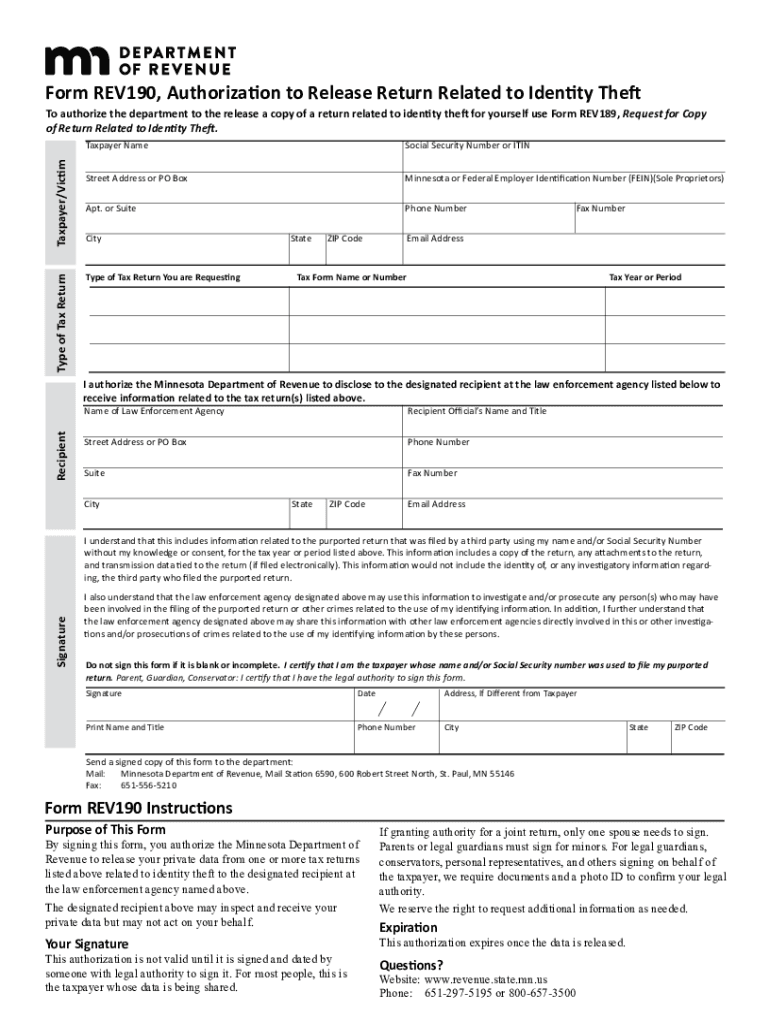

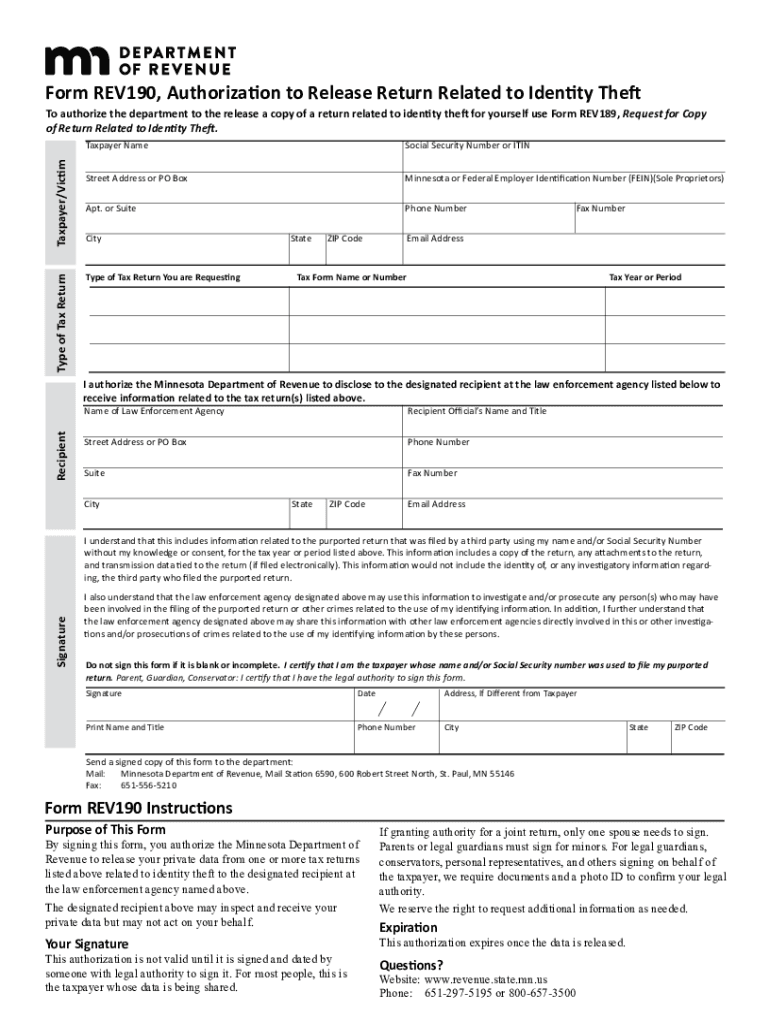

Form REV190, Authorization to Release Return Related to Identity Phenotype of Tax ReturnTaxpayer/Victim authorize the department to the release a copy of a return related to identity theft for yourself

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wwwirsgovpubirs-pdfform 14039 identity formft

Edit your wwwirsgovpubirs-pdfform 14039 identity formft form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wwwirsgovpubirs-pdfform 14039 identity formft form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wwwirsgovpubirs-pdfform 14039 identity formft online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit wwwirsgovpubirs-pdfform 14039 identity formft. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wwwirsgovpubirs-pdfform 14039 identity formft

How to fill out wwwirsgovpubirs-pdfform 14039 identity formft

01

To fill out the www.irsgovpubirs-pdfform 14039 identity formft, follow these steps:

02

Download the form from the IRS website (www.irs.gov) or obtain a hard copy from your local IRS office.

03

Begin by providing your personal information, including your name, social security number, and contact details.

04

Specify the reason for submitting the form, such as if you suspect someone else is using your identity for tax purposes or if you have experienced a stolen identity refund fraud.

05

Answer the questions regarding your tax account information, including your tax returns, payments, and any notices or letters received from the IRS.

06

Complete the sections related to identity theft, providing details about the fraudulent use of your identity and any law enforcement involvement.

07

Attach any supporting documents, such as identity theft affidavits or police reports, as instructed on the form.

08

Review the completed form to ensure accuracy and sign it.

09

Make a copy of the form and all attached documents for your records.

10

Send the original form to the address provided in the form instructions.

11

It is recommended to consult the IRS website or seek professional assistance for any specific or complex situations.

Who needs wwwirsgovpubirs-pdfform 14039 identity formft?

01

The www.irsgovpubirs-pdfform 14039 identity formft is needed by individuals who suspect or have experienced identity theft related to their tax obligations.

02

This form is used to alert the IRS about the fraudulent use of someone's identity for tax purposes and to request assistance in resolving the matters.

03

It is important to file this form if you have reason to believe that your identity has been stolen or misused to prevent further fraudulent activities and ensure the accuracy of your tax records.

04

Individuals who have received notices or letters from the IRS regarding inaccurate tax filings or suspect improper use of their personal information should also consider filing this form.

05

Filing Form 14039 helps the IRS in verifying the identity of the taxpayer and takes necessary actions to protect their tax accounts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit wwwirsgovpubirs-pdfform 14039 identity formft on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing wwwirsgovpubirs-pdfform 14039 identity formft, you need to install and log in to the app.

Can I edit wwwirsgovpubirs-pdfform 14039 identity formft on an iOS device?

You certainly can. You can quickly edit, distribute, and sign wwwirsgovpubirs-pdfform 14039 identity formft on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit wwwirsgovpubirs-pdfform 14039 identity formft on an Android device?

You can edit, sign, and distribute wwwirsgovpubirs-pdfform 14039 identity formft on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is wwwirsgovpubirs-pdfform 14039 identity formft?

The IRS Form 14039 is an Identity Theft Affidavit that is used by individuals to report that they have been a victim of identity theft and may need to resolve issues related to the tax implications of this theft.

Who is required to file wwwirsgovpubirs-pdfform 14039 identity formft?

Individuals who believe they have been a victim of identity theft and whose personal information has been compromised, typically when they encounter issues like receiving an IRS notice about a tax return they did not file, are required to file Form 14039.

How to fill out wwwirsgovpubirs-pdfform 14039 identity formft?

To fill out Form 14039, you need to provide personal information such as your name, address, Social Security number, details of the identity theft incident, and any relevant IRS documentation before submitting it to the IRS.

What is the purpose of wwwirsgovpubirs-pdfform 14039 identity formft?

The purpose of the Form 14039 is to inform the IRS of identity theft incidents, allowing affected individuals to protect themselves and facilitate the resolution of tax-related issues caused by the misuse of their personal information.

What information must be reported on wwwirsgovpubirs-pdfform 14039 identity formft?

The form requires reporting of your personal details, a description of the identity theft, any fraudulent tax returns that may have been filed, and evidence that supports your claim of identity theft.

Fill out your wwwirsgovpubirs-pdfform 14039 identity formft online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wwwirsgovpubirs-Pdfform 14039 Identity Formft is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.