Get the free First Nations Tax Commission - fntc.ca

Show details

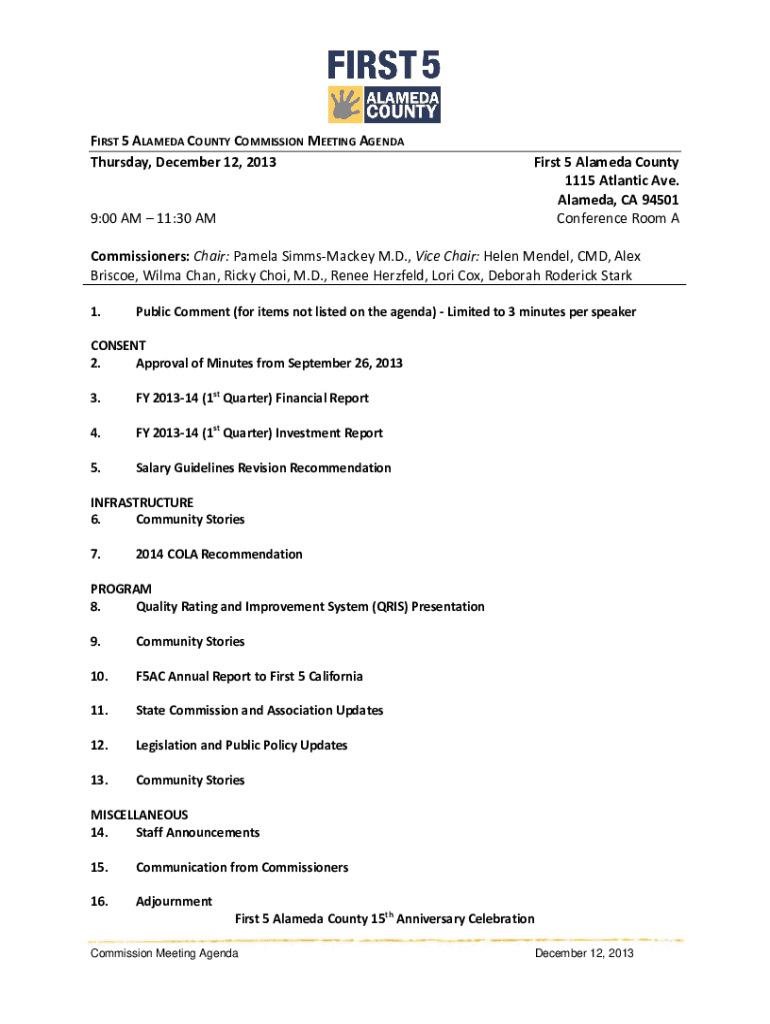

FIRST5ALAMEDACOUNTYCOMMISSIONMEETINGAGENDA Thursday,December12,2013 First5AlamedaCounty 1115AtlanticAve. Alameda,CA94501 ConferenceRoomA9:00AM11:30AM Commissioners:Chair:PamelaSimmsMackeyM. D., Timeshare:Helen

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign first nations tax commission

Edit your first nations tax commission form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first nations tax commission form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing first nations tax commission online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit first nations tax commission. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out first nations tax commission

How to fill out first nations tax commission

01

To fill out the First Nations Tax Commission form, follow these steps:

02

Start by downloading the official form from the First Nations Tax Commission website or obtain a physical copy from the designated authority.

03

Read the instructions carefully to understand the requirements and supporting documents needed to complete the form.

04

Provide accurate information in each section of the form, such as personal details, contact information, and financial data.

05

Attach all necessary supporting documents, such as income statements, tax returns, and any other relevant paperwork.

06

Double-check your form for any errors or missing information before submitting it.

07

Once your form is complete, submit it to the designated authority or follow the specified submission process provided by the First Nations Tax Commission.

08

Keep a copy of the filled-out form and supporting documents for your records.

09

Await confirmation or further communication regarding your submission from the First Nations Tax Commission.

10

If needed, follow up with the authority for any additional steps or clarifications.

11

Remember to comply with any deadlines or requirements set by the First Nations Tax Commission throughout the process.

Who needs first nations tax commission?

01

The First Nations Tax Commission is needed by indigenous communities or First Nations that seek to exercise tax-levying powers and enact their own tax laws and systems.

02

First Nations that want to establish a governance framework for managing taxation within their communities can benefit from the services and guidance offered by the First Nations Tax Commission.

03

The Commission provides support in developing tax laws, implementing taxation systems, and ensuring transparency and accountability in the management of tax revenues.

04

Additionally, First Nations businesses, individuals, and organizations within the jurisdiction of a participating First Nation can also benefit from the First Nations Tax Commission when it comes to tax-related matters.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in first nations tax commission?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your first nations tax commission to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in first nations tax commission without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your first nations tax commission, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out first nations tax commission on an Android device?

Complete first nations tax commission and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is first nations tax commission?

The First Nations Tax Commission is a federal institution in Canada that works with First Nations to establish and enforce property tax regimes on First Nations reserves.

Who is required to file first nations tax commission?

First Nations governments are required to file the First Nations Tax Commission.

How to fill out first nations tax commission?

To fill out the First Nations Tax Commission, First Nations governments must provide information on property values, tax rates, and other relevant tax data.

What is the purpose of first nations tax commission?

The purpose of the First Nations Tax Commission is to help First Nations generate revenue for local community development through property taxation.

What information must be reported on first nations tax commission?

Information such as property values, tax rates, tax exemptions, and revenue projections must be reported on the First Nations Tax Commission.

Fill out your first nations tax commission online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

First Nations Tax Commission is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.