AZ Form 140X 2021 free printable template

Show details

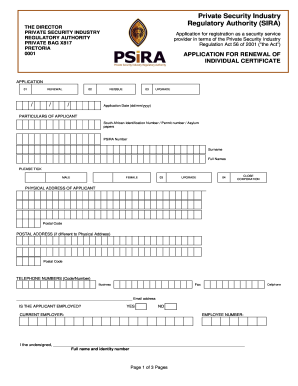

Individual Amended Income Tax Return For Forms 140, 140A, 140EZ, 140NR and 140PY OR FISCAL YEAR BEGINNING M D 2 0 2 1 AND ENDING M D D Y Y Y Y140X1 1Your First Name and Middle Initially Espouses First

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ Form 140X

How to edit AZ Form 140X

How to fill out AZ Form 140X

Instructions and Help about AZ Form 140X

How to edit AZ Form 140X

Edit AZ Form 140X using a PDF editor, like pdfFiller, to ensure all information is accurate. You can upload your existing form or create a new one if needed. Utilize tools within pdfFiller to make changes easily, ensuring compliance with Arizona tax regulations.

How to fill out AZ Form 140X

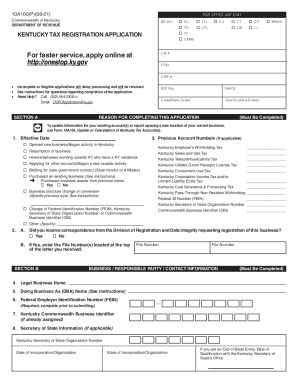

To fill out AZ Form 140X, start by gathering all relevant financial documents, including prior tax returns and any supporting schedules. Complete each section of the form by providing the required information about your income, deductions, and any adjustments needed. Be clear and precise to avoid delays in processing.

About AZ Form 140X 2021 previous version

What is AZ Form 140X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ Form 140X 2021 previous version

What is AZ Form 140X?

AZ Form 140X is the Arizona Tax Amendment form, designed for individuals wishing to amend their previously filed Arizona income tax returns. This form allows taxpayers to correct errors or make adjustments resulting from additional information that may affect tax liabilities.

What is the purpose of this form?

The primary purpose of AZ Form 140X is to enable taxpayers to correct mistakes found after their original return has been filed. This includes changes to income, deductions, or credits that were reported inaccurately. Submitting this form ensures that your tax records reflect the correct information, which may lead to a tax refund or additional payment obligations.

Who needs the form?

Taxpayers who have previously filed an Arizona income tax return and need to make corrections should use AZ Form 140X. This includes individuals who may have received additional information affecting their tax liability, such as W-2 corrections, or those who realized they overlooked deductions or credits.

When am I exempt from filling out this form?

You are exempt from filing AZ Form 140X if there are no errors in your original tax return, or if the adjustments do not affect your tax liability. Additionally, if your changes only relate to federal adjustments that do not apply to Arizona tax calculations, the form is not necessary.

Components of the form

AZ Form 140X consists of several sections where you report your previous filing and the specific changes being made. It generally includes the taxpayer’s identification information, details of the original return, and a section to outline the reasons for amendments. Each component is crucial for the Arizona Department of Revenue to process your changes accurately.

What are the penalties for not issuing the form?

Failure to submit AZ Form 140X when required may result in penalties, including additional taxes owed, interest on unpaid taxes, or a potential audit. It's essential to amend your return if errors are discovered to avoid these consequences.

What information do you need when you file the form?

When filing AZ Form 140X, you should have your original tax return, copies of any related documents, any new W-2s or 1099s, and specific details relating to the corrections being made. Accurate information is vital to ensure proper processing and compliance with Arizona tax laws.

Is the form accompanied by other forms?

AZ Form 140X can be accompanied by other forms, particularly if the changes impact deductions or credit calculations requiring additional documentation. Attach relevant schedules and forms that support your amendments to provide a complete picture to the Arizona Department of Revenue.

Where do I send the form?

Completed AZ Form 140X should be mailed to the Arizona Department of Revenue, typically the same address used for your original return. Ensure you check the latest guidelines to confirm the appropriate mailing address based on your specific situation.

See what our users say