Get the free BIR TH BIR TH MAR R IAGE MAR R IAGE DEA TH DEA TH

Show details

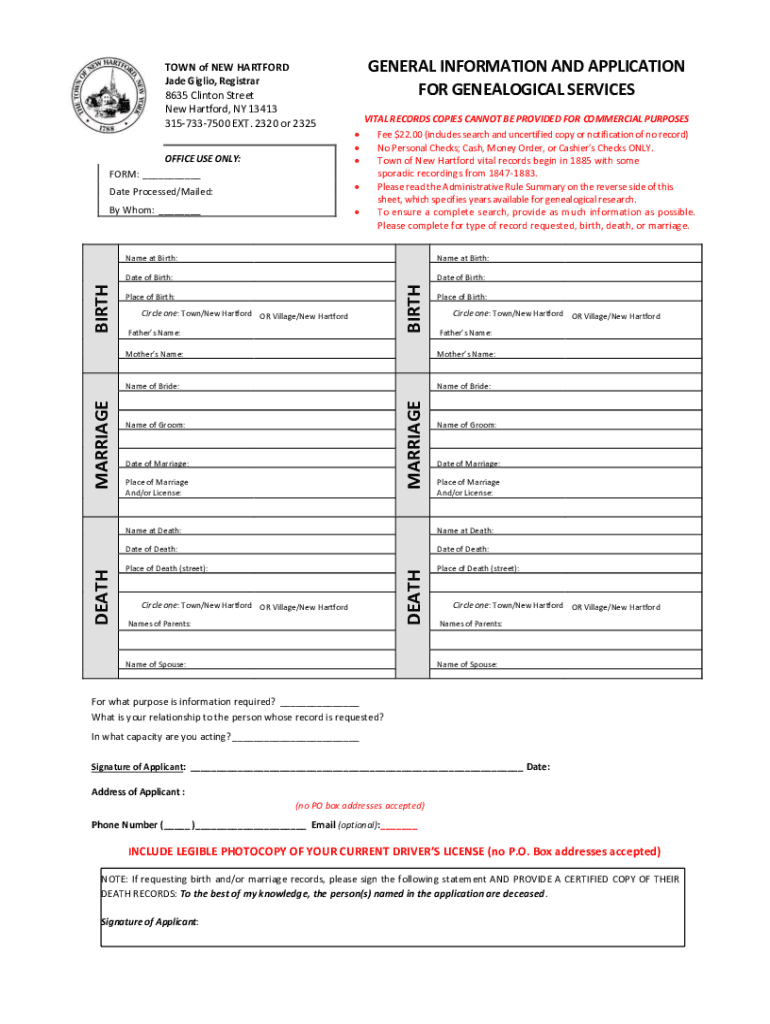

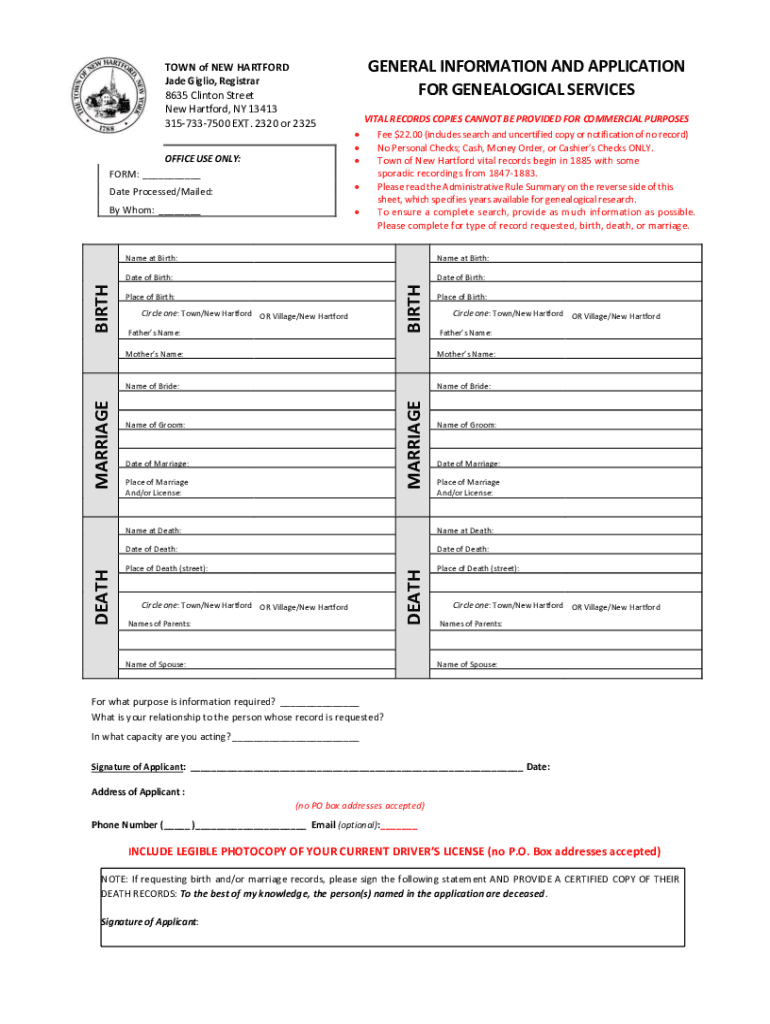

GENERAL INFORMATION AND APPLICATION FOR GENEALOGICAL ServiceNow of NEW HARTFORD Jade Giulio, Registrar8635 Clinton Street New Hartford, NY 13413 3157337500 EXT. 2320 or 2325 OFFICE USE ONLY: FORM:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bir th bir th

Edit your bir th bir th form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir th bir th form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bir th bir th online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bir th bir th. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bir th bir th

How to fill out bir th bir th

01

To fill out Form BIR TH BIR TH, follow these steps:

02

Start by providing the necessary information on the top portion of the form, such as the taxpayer's name, address, and taxpayer identification number (TIN).

03

Indicate the applicable tax year or quarter being filed.

04

Specify the type of tax being paid or filed for.

05

Enter the gross sales/receipts or revenue for the applicable tax period.

06

Compute and enter the tax due based on the prescribed tax rate.

07

Deduct any available tax credits or allowances.

08

Determine the net tax payable.

09

Indicate the mode of payment and the amount paid.

10

Sign and date the form.

11

File the completed form with the Bureau of Internal Revenue (BIR) or its authorized agent banks.

12

Please note that these steps are general guidelines, and it is recommended to consult the official instructions or seek professional assistance for accurate and up-to-date information.

Who needs bir th bir th?

01

Various individuals and entities may need to fill out BIR TH BIR TH, including:

02

- Self-employed individuals, such as freelancers, consultants, or sole proprietors, who are liable to file and pay certain taxes

03

- Professionals, such as doctors, lawyers, accountants, or engineers, who are engaged in business or practice their profession independently

04

- Corporations or partnerships engaged in trade or business

05

- Withholding agents who are required to deduct and remit taxes on behalf of their employees or suppliers

06

- Non-resident aliens or foreign corporations deriving income from sources within the Philippines

07

- Individuals or organizations required to secure a Tax Clearance Certificate (TCC)

08

The specific circumstances and tax obligations of each individual or entity may vary, so it is advisable to consult the regulations and requirements of the Bureau of Internal Revenue (BIR) or seek professional advice for accurate and personalized information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete bir th bir th online?

Easy online bir th bir th completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit bir th bir th in Chrome?

Install the pdfFiller Google Chrome Extension to edit bir th bir th and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the bir th bir th in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is bir th bir th?

Bir th bir th refers to reporting the birth of a child to the authorities.

Who is required to file bir th bir th?

Parents or legal guardians are required to file bir th bir th for their child.

How to fill out bir th bir th?

Bir th bir th can be filled out by providing the required information about the child's birth, such as date, time, and place.

What is the purpose of bir th bir th?

The purpose of bir th bir th is to officially register the birth of a child and obtain a birth certificate.

What information must be reported on bir th bir th?

Information such as the child's full name, date of birth, place of birth, parents' names, and other details must be reported on bir th bir th.

Fill out your bir th bir th online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Th Bir Th is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.