Get the free Financial reporting in Australia - Austrade

Show details

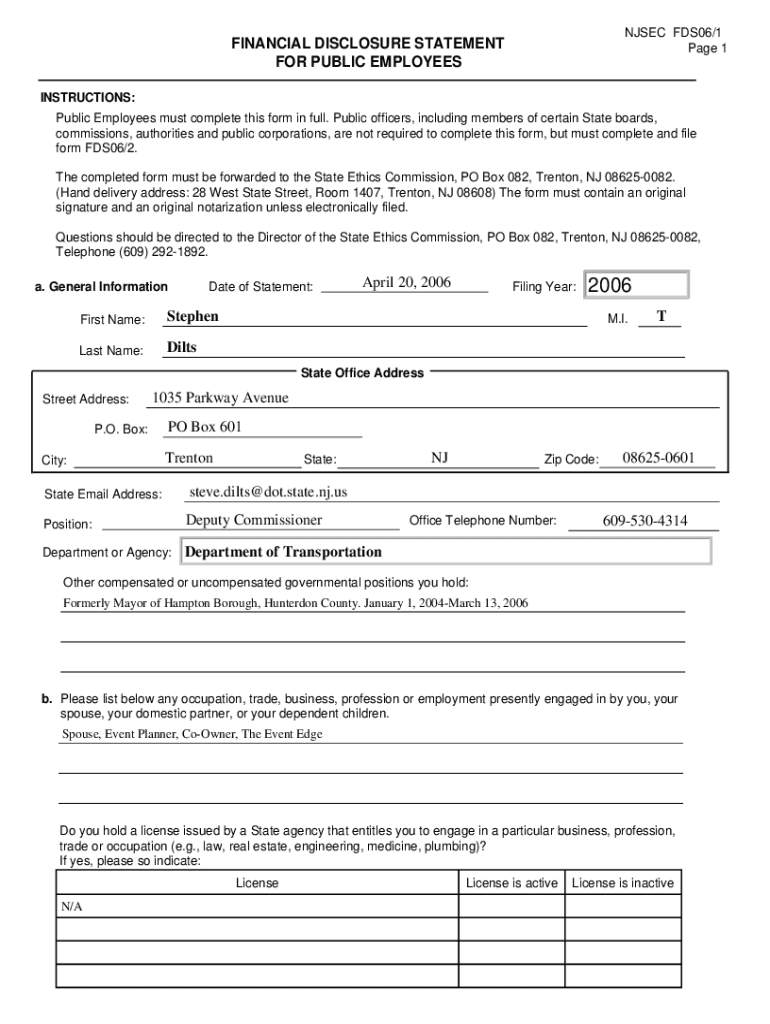

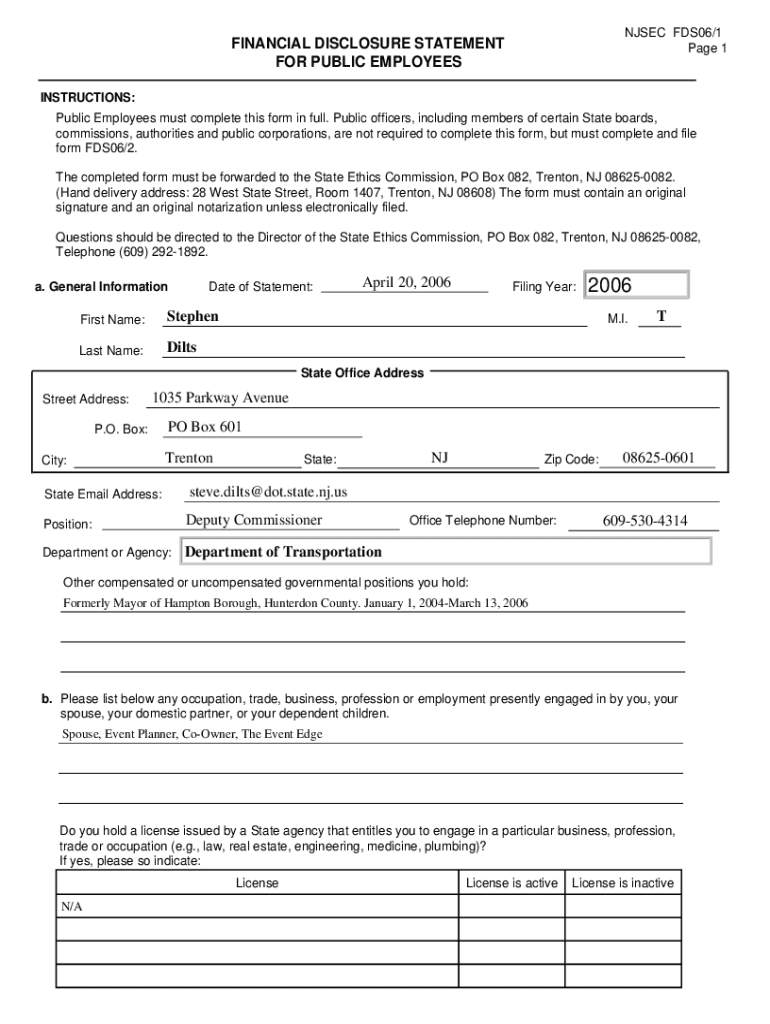

NJ SEC FDS06/1 Page 1FINANCIAL DISCLOSURE STATEMENT FOR PUBLIC EMPLOYEES INSTRUCTIONS:Public Employees must complete this form in full. Public officers, including members of certain State boards,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial reporting in australia

Edit your financial reporting in australia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial reporting in australia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial reporting in australia online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit financial reporting in australia. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial reporting in australia

How to fill out financial reporting in australia

01

To fill out financial reporting in Australia, follow these steps:

02

Determine the reporting requirements: Identify whether you need to prepare financial reports for the purpose of tax obligations, regulatory compliance, or other specific reasons.

03

Gather necessary information: Collect all relevant financial data, including income statements, balance sheets, cash flow statements, and supporting documentation like invoices, receipts, and bank statements.

04

Understand the accounting standards: Familiarize yourself with the applicable accounting standards in Australia, such as the Australian Accounting Standards (AAS) or International Financial Reporting Standards (IFRS).

05

Organize and record financial data: Input the collected financial information into the appropriate accounting software or spreadsheets.

06

Prepare financial statements: Generate financial statements, including profit and loss statements, balance sheets, and cash flow statements.

07

Review and reconcile: Carefully review the financial reports to ensure accuracy and reconcile any discrepancies.

08

Seek professional assistance if needed: If you are unsure about any aspect of financial reporting, consult an accountant or financial advisor for guidance.

09

Submit the reports: Submit the completed financial reports to the relevant authorities or stakeholders within the designated timeframe.

10

Maintain records: Keep copies of the financial reports and supporting documents for future reference and auditing purposes.

11

Note: The exact process may vary depending on the specific reporting requirements and the size and nature of your business.

Who needs financial reporting in australia?

01

Various entities and individuals in Australia require financial reporting, including:

02

- Businesses: Companies, partnerships, and sole traders need financial reporting to comply with tax obligations, meet regulatory requirements, and assess their financial performance.

03

- Not-for-profit organizations: Charities, community and sporting clubs, and other non-profit entities need financial reporting to demonstrate transparency, accountability, and compliance with funding regulations.

04

- Government bodies: Government agencies at various levels require financial reporting to ensure proper use of public funds and effective management of resources.

05

- Investors and shareholders: Individuals or organizations investing in Australian businesses or holding shares in publicly listed companies rely on financial reporting to make informed investment decisions.

06

- Lenders and creditors: Banks, financial institutions, and other lenders assess the financial health and creditworthiness of borrowers through financial reports.

07

- Auditors and regulatory bodies: Independent auditors and government regulatory bodies rely on financial reporting to evaluate compliance with accounting standards, laws, and regulations.

08

- Individuals for personal financial management: Some individuals may utilize financial reporting to track their personal income, expenses, and assets for budgeting and financial planning purposes.

09

Financial reporting in Australia serves the purpose of transparency, accountability, decision-making, and regulatory compliance in various sectors of the economy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my financial reporting in australia directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your financial reporting in australia as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit financial reporting in australia online?

The editing procedure is simple with pdfFiller. Open your financial reporting in australia in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in financial reporting in australia without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your financial reporting in australia, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is financial reporting in australia?

Financial reporting in Australia is the disclosure of financial information to stakeholders and the public, typically including financial statements, management commentary, and other relevant information.

Who is required to file financial reporting in australia?

All companies registered in Australia, including small businesses, are required to file financial reporting.

How to fill out financial reporting in australia?

Financial reporting in Australia can be filled out using accounting software or with the help of a professional accountant.

What is the purpose of financial reporting in australia?

The purpose of financial reporting in Australia is to provide stakeholders with information about a company's financial health and performance.

What information must be reported on financial reporting in australia?

Financial reporting in Australia typically includes balance sheets, income statements, cash flow statements, and notes to the financial statements.

Fill out your financial reporting in australia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Reporting In Australia is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.