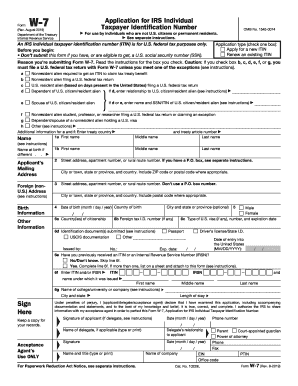

IRS W-7 (COA) 2019 free printable template

Get, Create, Make and Sign irs w 7 coa form

How to edit w7 coa taxpayer online

Uncompromising security for your PDF editing and eSignature needs

IRS W-7 (COA) Form Versions

How to fill out irs w 7coa form

How to fill out IRS W-7 (COA)

Who needs IRS W-7 (COA)?

Video instructions and help with filling out and completing irs form w 7

Instructions and Help about form w 7

What you see here is the form w7 the application for an i10 as you see it's a pretty simple one-page document we're going to go through the w7 align at a time the good news is that when you prepare these using our tax software once you check the appropriate box the software does most of the work for you of course you'll want to double-check it to make sure all the details are correct, so that's why we're going to go into some detail through the form the first section about a quarter of the way down the page is the reason you're submitting w7 in the tax centers we only use three reason codes C D and E you will never ever, ever check any reason code other than one of these three some volunteers get confused by reason code B because they think our clients are non-resident aliens, but they're not they are resident aliens for tax purposes, and we'll be talking about this in just a little just remember only C D or e and all is good reason code C is for the primary taxpayer on the return reason code D is for a dependent and reason code e is for a spouse see the dotted line out there to the side if the w7 is for a dependent or a spouse the name of the primary taxpayer will be printed on this dotted line and if the primary already has a Social Security or an i10 his or her number will also show up there if the primary is also applying for an i10 then that will just be blank it will only their name will be printed on that line next is the name box their name is going to be entered on the w7 just as it is on the tax return and I want to mention a few words here about names so an ITIN applicant can have their name any way they want to have it configured so for example if they want to have two last names they may want to you know only use one last name they may want to have a hyphenated last name maybe they want two names with no — really they can have it configured however they choose they just need to understand that their name configuration is how all of their future tracks records will be registered so once they choose the form of their name they must be consistent year-to-year when they file their taxes line 1b is for the name entry only if it's different from their name online 1a some applicants will have their birth certificates with them when they're sitting at your desk and if the name is different you can go ahead and enter that in line 1b but if you're not sure about that or if they don't have their birth certificate with them, you can just leave that blank the next box is the applicants mailing address and this is the address here in the US if the applicant is a spouse or dependent who lives out of the country this mailing address still will be the US address of the primary taxpayer this also is the address that's on the tax return it's really important to make sure this address is correct because this is where the iTunes will be mailed after they are assigned so double-check with your client and make sure a correct and complete address is...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS W-7 COA directly from Gmail?

How can I modify IRS W-7 COA without leaving Google Drive?

How do I edit IRS W-7 COA on an iOS device?

What is IRS W-7 (COA)?

Who is required to file IRS W-7 (COA)?

How to fill out IRS W-7 (COA)?

What is the purpose of IRS W-7 (COA)?

What information must be reported on IRS W-7 (COA)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.