Get the free DR 0252

Show details

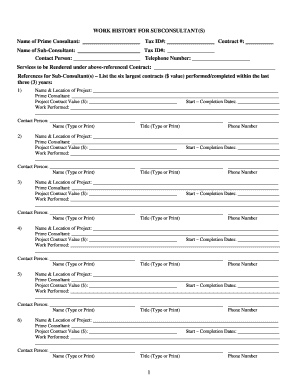

This document provides the guidelines for filing the Consumer Use Tax Return in Colorado, outlining the tax obligations for individuals and businesses regarding use tax on purchased items not subjected

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dr 0252

Edit your dr 0252 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dr 0252 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dr 0252 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dr 0252. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dr 0252

How to fill out DR 0252

01

Obtain the DR 0252 form from the appropriate state department website or office.

02

Begin by filling out your personal information, including your name, address, and contact details.

03

Provide the specific details regarding the purpose of the application as required on the form.

04

Include any necessary identification numbers, such as SSN or driver's license number, if applicable.

05

Double-check the information for accuracy and completeness.

06

Sign and date the form at the designated section.

07

Submit the completed form to the relevant authority either via mail or in person.

Who needs DR 0252?

01

Individuals who need to apply for a specific request or grant from the state.

02

People who require a formal application for licensing, registration, or certification purposes.

03

Organizations or businesses seeking certain state approvals or permits.

Fill

form

: Try Risk Free

People Also Ask about

What form must be filed report Colorado taxable sales?

Anyone in need of a paper version of the DR 0100 form can download a PDF version on the Colorado DOR forms page. Electronic filing/payment is required for businesses paying more than $75,000 per year in state sales tax.

What should I put for Colorado use tax?

Colorado use tax is calculated at the same 2.9% rate as the state sales tax.

How to calculate Colorado use tax?

The state consumer use tax rate is the same as the sales tax rate: 2.9%. With proof of payment, sales tax paid to another state may be credited against consumer use tax due in Colorado for a particular item.

Who pays rtd tax in Colorado?

RTD's chief source of revenue is through a 1.0% sales and use tax. Purchases made within the RTD boundary are subject to the tax. It should be noted that if residents from outside the District shop at establishments inside the RTD boundary, they pay the RTD tax for purchases.

How do I know if I owe Colorado use tax?

Check your invoice or receipt to see if sales tax was paid. Some online purchases will have sales or use tax included. Many online or out-of-state retailers do not collect sales or use tax from customers on purchases.

What should I put on my taxes?

You can deduct these expenses whether you take the standard deduction or itemize: Alimony payments. Business use of your car. Business use of your home. Money you put in an IRA. Money you put in health savings accounts. Penalties on early withdrawals from savings. Student loan interest. Teacher expenses.

What is an example of a use tax?

Example of Use Tax Let's say that a Californian bought clothing from an online retailer in Oregon. Under Oregon law, the retailer does not collect sales tax on the goods but the retail buyer must still pay a use tax on that clothing purchase to the California tax authority called the Board of Equalization.

What is subject to Colorado use tax?

This requirement applies to purchases made by both individual consumers and businesses in Colorado. Examples of taxable products (often referred to as "goods") are electronics, appliances, furniture, home accessories, jewelry/watches, clothing, shoes, sports equipment, or any other tangible personal property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DR 0252?

DR 0252 is a form used by businesses and individuals to report certain tax information to the relevant tax authority, particularly for items related to sales and use tax.

Who is required to file DR 0252?

Generally, businesses or individuals who engage in transactions that fall under the categories of sales or use tax are required to file DR 0252.

How to fill out DR 0252?

To fill out DR 0252, individuals or businesses must provide accurate information regarding their sales transactions, ensuring all required fields are completed as per the guidelines provided by the tax authority.

What is the purpose of DR 0252?

The purpose of DR 0252 is to ensure compliance with tax regulations by reporting sales and use tax information accurately and timely.

What information must be reported on DR 0252?

DR 0252 must report information including the total sales amount, any applicable tax deductions, the total tax collected, and necessary business identification details.

Fill out your dr 0252 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dr 0252 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.