Get the free Companies Insolvency Act (Canada) BIA Trustee MMA ...

Show details

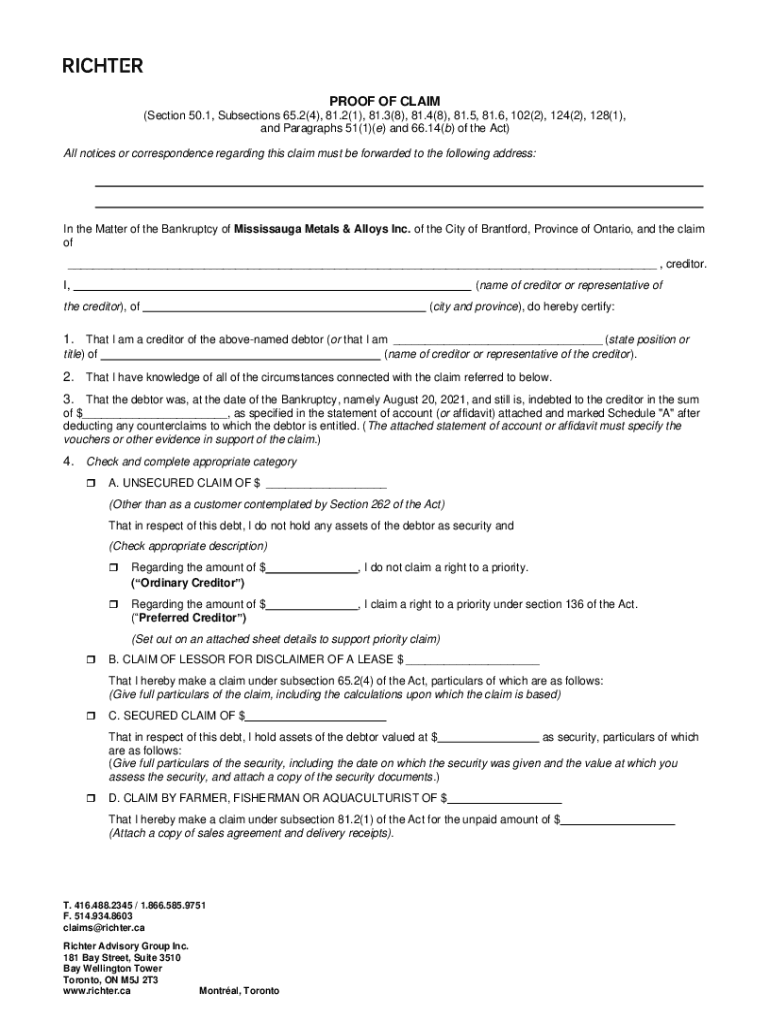

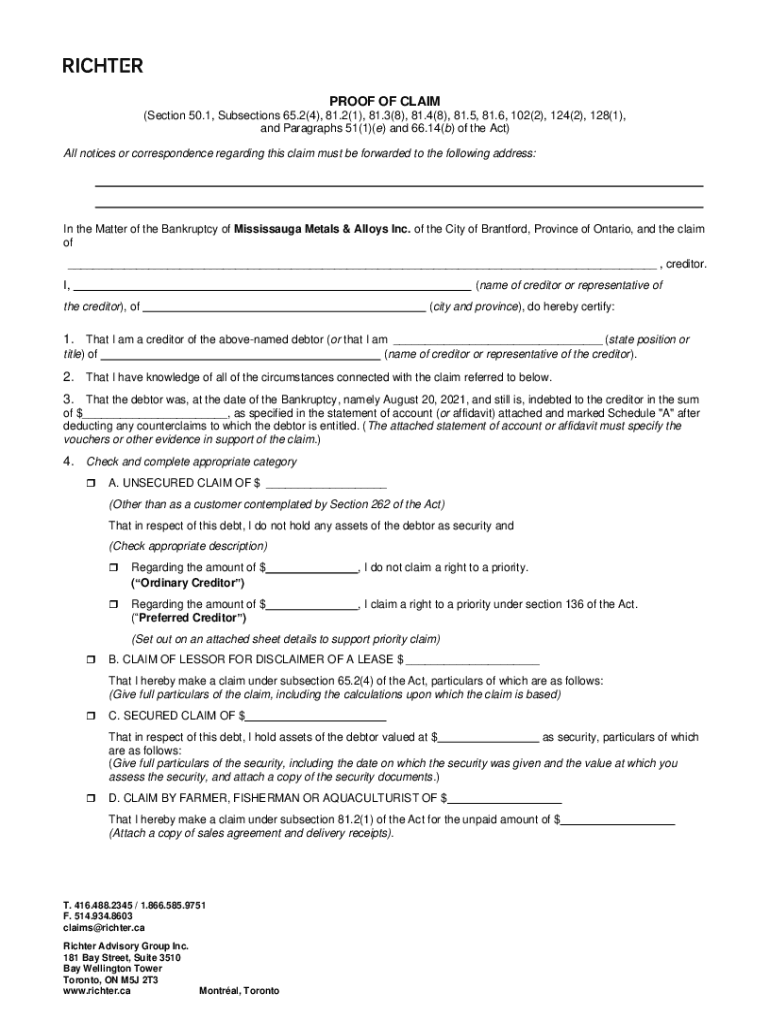

Estate Nos. 32159247 / 32159246 Notice of Bankruptcy, First Meeting of Creditors (Subsection 102(1) of the Act) In the Matter of the Bankruptcy of Mississauga Metals & Alloys Inc. and 1420561 Ontario

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign companies insolvency act canada

Edit your companies insolvency act canada form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your companies insolvency act canada form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit companies insolvency act canada online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit companies insolvency act canada. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out companies insolvency act canada

How to fill out companies insolvency act canada

01

To fill out the Companies Insolvency Act Canada, follow these steps:

02

Begin by gathering all the necessary information about the company, including its financial statements, assets, liabilities, and any pending legal actions.

03

Identify the type of insolvency proceedings the company may qualify for, such as bankruptcy or a proposal under the Bankruptcy and Insolvency Act.

04

Determine if the company meets the eligibility criteria for the chosen insolvency proceedings.

05

Prepare the necessary documentation, including the appropriate forms and supporting documents specified by the Companies Insolvency Act Canada.

06

Fill out the forms accurately and completely, providing all the required information.

07

Ensure that all financial statements and other relevant documents are properly attached or referenced in the forms.

08

Review the filled-out forms for any errors or missing information.

09

If necessary, seek professional advice from a licensed insolvency professional or legal counsel to navigate through the complexities of the Companies Insolvency Act Canada.

10

Once the forms are complete and reviewed, submit them to the designated authority or court, as specified in the Companies Insolvency Act Canada.

11

Follow any additional instructions or procedures outlined by the authority or court throughout the insolvency proceedings.

12

Keep a copy of all the filled-out forms and supporting documents for record-keeping purposes.

13

Cooperate fully with the appointed trustee or administrator throughout the insolvency proceedings.

14

Stay informed about the progress of the insolvency proceedings and comply with any obligations or requests made by the trustee or administrator.

15

Be prepared for the potential outcomes of the insolvency proceedings, such as restructuring, liquidation, or debt repayment plans.

16

Seek legal advice or guidance for any concerns or issues that may arise during the application or throughout the Companies Insolvency Act Canada process.

Who needs companies insolvency act canada?

01

Various parties may need to reference or use the Companies Insolvency Act Canada, including:

02

- Company directors and officers who are exploring debt relief options or facing insolvency

03

- Creditors and lenders seeking to recover outstanding debts from an insolvent company

04

- Employees who may be affected by company insolvency

05

- Shareholders or investors in an insolvent company

06

- Insolvency professionals, such as trustees or administrators, who handle the insolvency proceedings

07

- Legal professionals who provide advice or representation in matters related to company insolvency

08

- Government authorities responsible for regulating and overseeing insolvency proceedings

09

- Anyone involved or interested in the restructuring, liquidation, or debt resolution processes of companies under insolvency

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find companies insolvency act canada?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific companies insolvency act canada and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I edit companies insolvency act canada on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing companies insolvency act canada.

How do I complete companies insolvency act canada on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your companies insolvency act canada. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is companies insolvency act canada?

The Companies' Creditors Arrangement Act (CCAA) is a federal law in Canada that allows insolvent corporations to restructure their affairs and debts.

Who is required to file companies insolvency act canada?

Any corporation in Canada that is insolvent and wishes to restructure its debts can file under the Companies' Creditors Arrangement Act (CCAA).

How to fill out companies insolvency act canada?

To fill out the Companies' Creditors Arrangement Act (CCAA), a corporation must file a formal application in court, provide relevant financial information, and propose a plan for restructuring its debts.

What is the purpose of companies insolvency act canada?

The purpose of the Companies' Creditors Arrangement Act (CCAA) is to provide a framework for insolvent corporations to restructure their debts and continue operating, rather than resorting to bankruptcy and liquidation.

What information must be reported on companies insolvency act canada?

Information such as financial statements, debts owed, assets owned, proposed restructuring plan, and other relevant financial details must be reported when filing under the Companies' Creditors Arrangement Act (CCAA).

Fill out your companies insolvency act canada online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Companies Insolvency Act Canada is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.