Get the free FE-085 Statement of Income (SOI) Bilingual. FE-085 Statement of Income (SOI) Bilingual

Show details

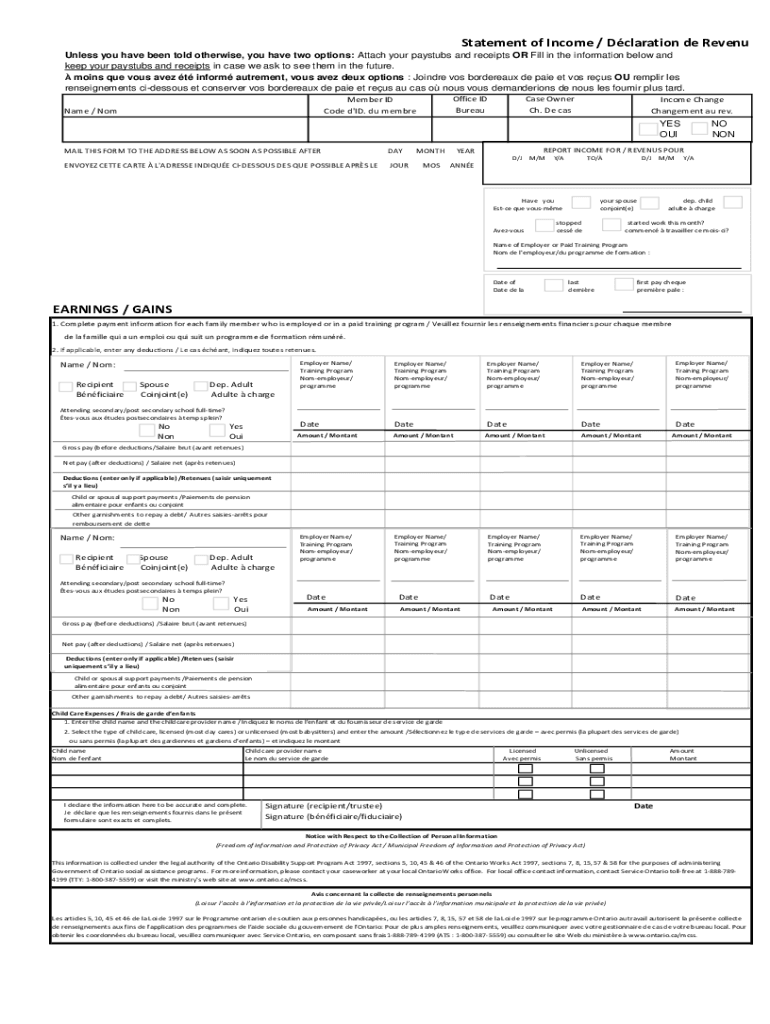

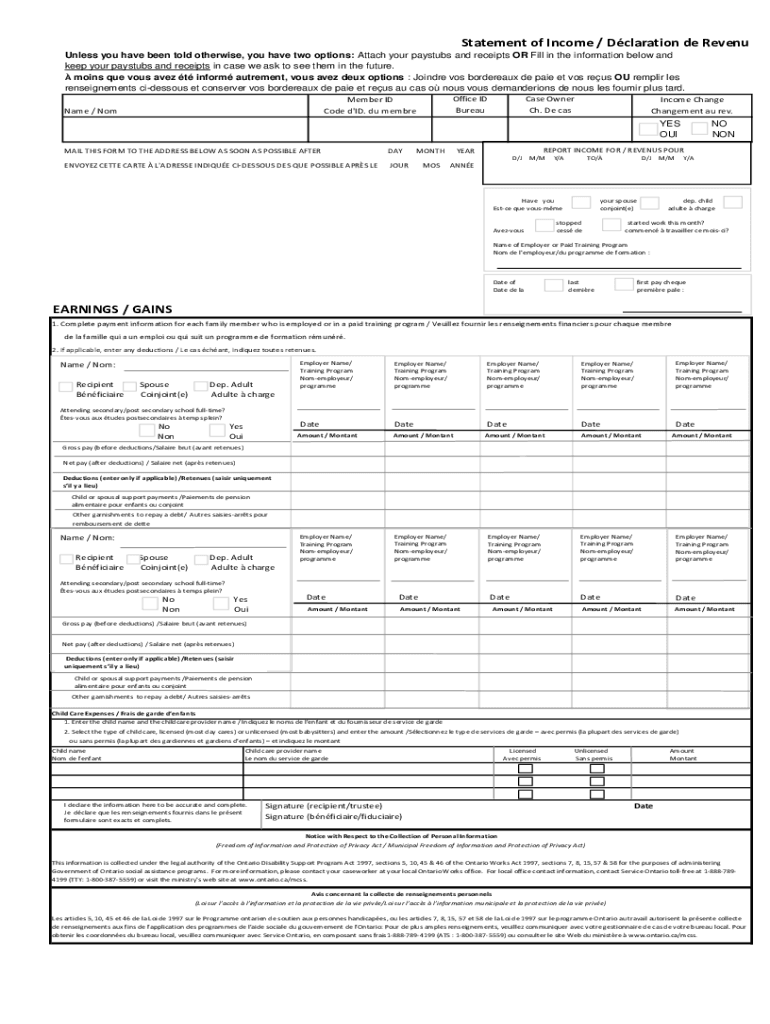

Statement of Income / Declaration de Revenu Unless you have been told otherwise, you have two options: Attach your pay stubs and receipts OR Fill in the information below and keep your pay stubs and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fe-085 statement of income

Edit your fe-085 statement of income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fe-085 statement of income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fe-085 statement of income online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fe-085 statement of income. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fe-085 statement of income

How to fill out fe-085 statement of income

01

To fill out the fe-085 statement of income, follow these steps:

02

Start by gathering all the necessary financial documents, including income statements, bank statements, and tax returns.

03

Read the instructions provided on the form to understand the specific requirements and guidelines for filling it out.

04

Begin by providing your personal information, such as your name, address, and social security number.

05

Fill in the relevant sections regarding your income sources, including employment income, self-employment income, rental income, and any other sources of income.

06

Provide details about your deductible expenses, such as business expenses, rental expenses, and any other applicable deductions.

07

Calculate your total income and total expenses, and determine your net income by subtracting the expenses from the income.

08

Review the form for any errors or missing information before submitting it.

09

Sign and date the statement of income to certify its accuracy.

10

Keep a copy of the completed form for your records.

11

Submit the fe-085 statement of income according to the instructions provided, whether it is through mail, electronically, or in person.

Who needs fe-085 statement of income?

01

The fe-085 statement of income is typically needed by individuals or organizations in certain situations:

02

- Self-employed individuals who need to report their income and expenses for tax purposes.

03

- Individuals or businesses applying for loans or credit, as the statement provides financial information and supports their ability to repay the borrowed funds.

04

- Landlords or property owners who need to demonstrate their rental income and expenses for accounting or legal purposes.

05

- Contractors or freelancers who need to document their income and expenses for contract requirements or client invoices.

06

- Government agencies or social service organizations who require proof of income for determining eligibility for assistance programs.

07

- Individuals involved in legal matters, such as divorce or child custody cases, where the statement of income may be requested as part of the financial disclosure process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fe-085 statement of income?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific fe-085 statement of income and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit fe-085 statement of income on an iOS device?

Use the pdfFiller mobile app to create, edit, and share fe-085 statement of income from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete fe-085 statement of income on an Android device?

Use the pdfFiller Android app to finish your fe-085 statement of income and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is fe-085 statement of income?

The fe-085 statement of income is a financial statement that shows the revenue, expenses, and profits of a business or individual for a specific period of time.

Who is required to file fe-085 statement of income?

Businesses and individuals who meet certain criteria such as revenue thresholds are required to file fe-085 statement of income.

How to fill out fe-085 statement of income?

To fill out fe-085 statement of income, you need to gather information about your revenue, expenses, and other financial transactions for the period you are reporting.

What is the purpose of fe-085 statement of income?

The purpose of fe-085 statement of income is to provide an overview of the financial performance of a business or individual.

What information must be reported on fe-085 statement of income?

Information such as revenue, expenses, net income, and other financial data must be reported on the fe-085 statement of income.

Fill out your fe-085 statement of income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fe-085 Statement Of Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.