ID DGT 2 2019 free printable template

Show details

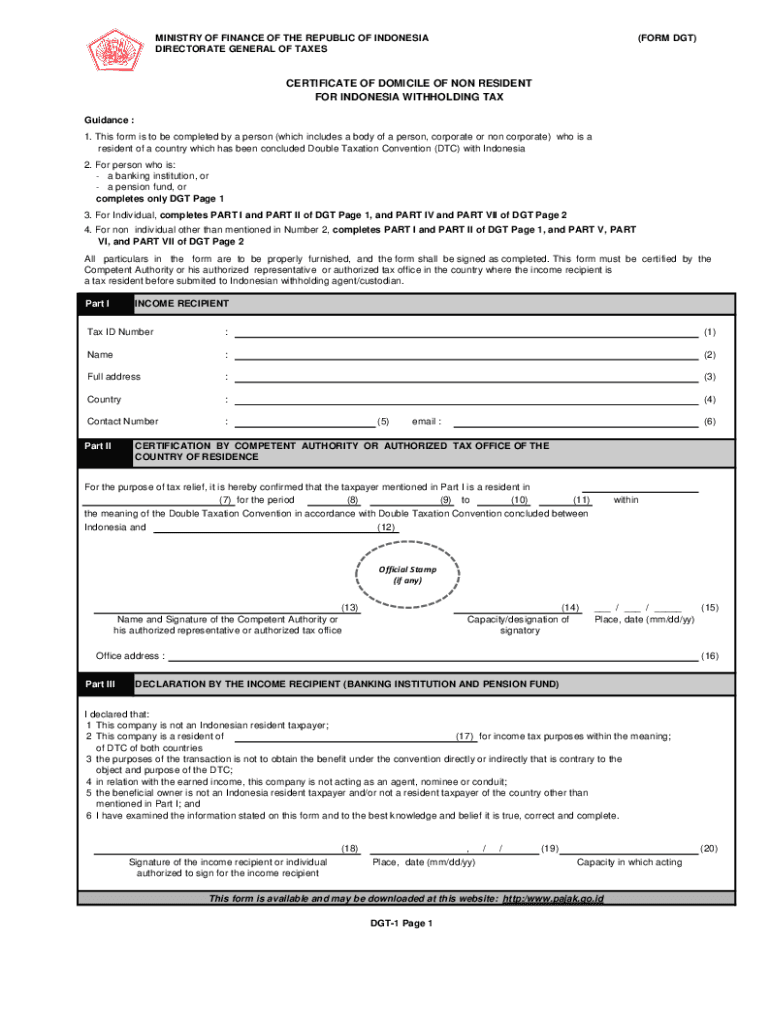

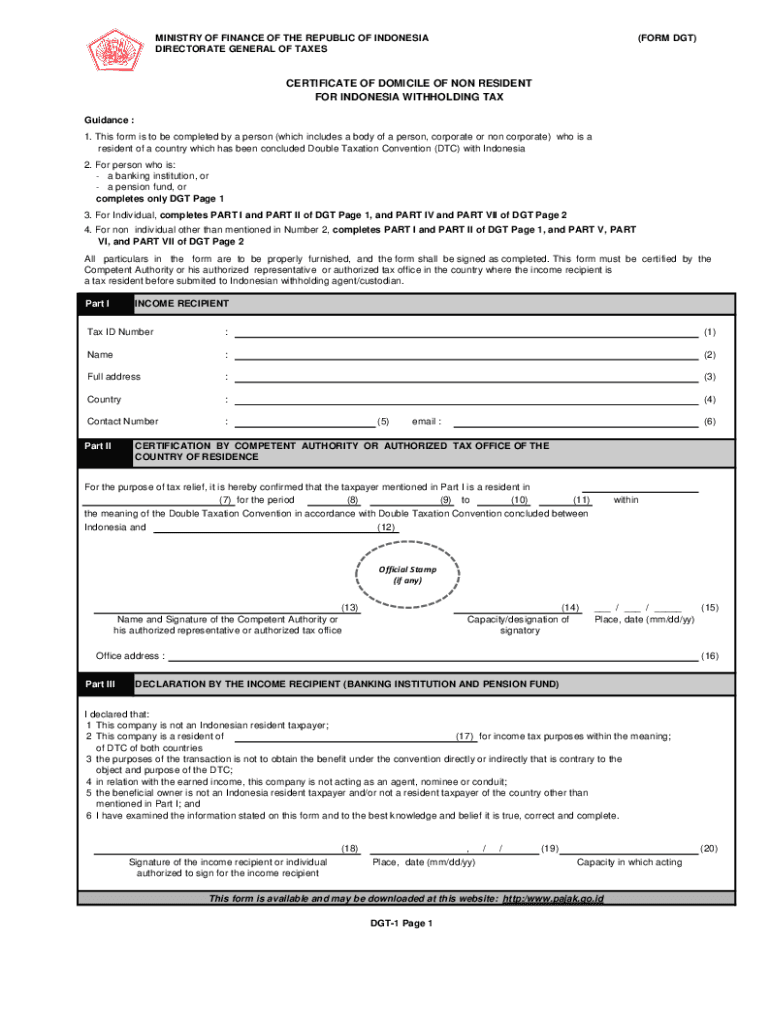

MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA DIRECTORATE GENERAL OF TAXES(FORM DGT)CERTIFICATE OF DOMICILE OF NON-RESIDENT FOR INDONESIA WITHHOLDING TAX Guidance : 1. This form is to be completed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ID DGT 2

Edit your ID DGT 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID DGT 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ID DGT 2 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ID DGT 2. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID DGT 2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID DGT 2

How to fill out ID DGT 2

01

Obtain the ID DGT 2 form from the relevant authority or their website.

02

Fill in your personal details, including full name, date of birth, and nationality.

03

Provide your address, ensuring it is accurate and up to date.

04

Enter your identification details, such as your passport number or national ID number.

05

Complete any additional sections required, such as emergency contact information.

06

Review the form for any errors or omissions.

07

Sign and date the form at the designated area.

08

Submit the form as instructed, either online or in person.

Who needs ID DGT 2?

01

Individuals who are applying for a driver's license or need to register a vehicle in the relevant jurisdiction.

02

New residents in the area who need to obtain local identification.

03

Foreign nationals residing in the country who require official identification.

Fill

form

: Try Risk Free

People Also Ask about

What are the visa requirements for Indonesia?

Multiple Visit Visa is issued in the Indonesian Embassy or Consulates, with mandatory requirements of Application/Guarantee Letter, passport with minimum 18 months validity, copy of bank accounts, return/through tickets and re-entry permit ( or stateless /non-nationality person).

Is PeduliLindungi app still needed?

Effective 5 April 2022, international travelers no longer need to fill International eHAC on PeduliLindungi app to enter Indonesia. Effective 5 April 2022, international travelers no longer need to fill International eHAC on PeduliLindungi app to enter Indonesia.

What are the requirements to enter Batam?

What are the requirements to enter Batam from Singapore? You will need a passport valid for 6 months and vaccination certificates where relevant. Click here to book tickets online!

What is SNI certificate Indonesia?

SNI is the Indonesian National Standard nationally applicable in Indonesia. The SNI standard was first drafted by the technical committee and defined by the National Standardisation Agency of Indonesia (BSN).

Does Indonesia give citizenship to foreigners?

Indonesian nationality is typically obtained either on the principle of jus soli, i.e. by birth in Indonesia; or under the rules of jus sanguinis, i.e. by birth abroad to at least one parent with Indonesian nationality.Indonesian nationality law. Indonesian Nationality ActEnactedAugust 1, 2006Status: Current legislation7 more rows

How can I change my citizenship to Indonesia?

You have resided in Indonesia for at least 5 consecutive years or 10 consecutive years by the time you apply for the Indonesian citizenship. You are at least 18 years old, or if you are under 18 years old, you have to be married. You are mentally and physically healthy.

What citizenship if a child is born in Indonesia?

ing to art. 4 of Law No. 12/2006 on Citizenship, children born to an Indonesian parent are automatically Indonesian citizens. In addition, children born or found on Indonesian territory to unknown or stateless parents or to parents whose citizenship is undetermined, acquire citizenship.

What is proof of citizenship Indonesia?

in) 印尼華人國籍問題,泛指在印尼獨立後,由於排華政策,以及中华人民共和国国籍法的改變,造成的國籍不明現象,這現象令各地印尼華人,都面臨各種不同的法律問題。 ( zh) A Republic of Indonesia Certificate of Citizenship (Indonesian: Surat Bukti Kewarganegaraan Republik Indonesia, abbreviated SBKRI) was an identity card establishing citizenship in the Republic of Indonesia.

Does Indonesia give citizenship to foreigners?

Foreigners are only eligible to apply for Indonesian citizenship, provided that they are willing to renounce their current citizenship.

What is SNI certification Indonesia?

The Indonesian National Standard (SNI) is the only nationally applicable standard in Indonesia and is mandatory for various products.

Do I need PeduliLindungi to enter Indonesia?

The requirements for entering Indonesia for international travelers (foreign citizen) are as follows: Take possession of Proof of Vaccination or Vaccination Certificate (physical or digital). Download and make use of app of PeduliLindungi.

What are valid proofs of citizenship?

Proof of U.S. citizenship: You must either provide your most recently issued passport, an original U.S. birth certificate, a Consular Report of Birth Abroad (FS-240), a naturalization certificate, or a certificate of citizenship.

What is SNI on TYRE?

This means the tires meet European specifications, which vary slightly from US standards. Other codes include NOM for Mexico, CCC for China, SNI for Indonesia and N superimposed over an I for Brazil.

What is the easiest country to get dual citizenship?

Here are the countries where the process to get dual citizenship is relatively easy compared to other countries. Ireland – Can I Get Irish Citizenship? Italy – Get an Affordable Italian Passport or Dual Citizenship. Israel – Israeli Dual Citizenship. Paraguay Citizenship. Guatemala – Become a Resident in Guatemala.

Can you hold dual citizenship in Indonesia?

Based on Law No. 12/2006, the State of the Republic of Indonesia does not recognize dual citizenship (bipatride) or statelessness (apatride).

Who can visit Indonesia without visa?

Indonesia Visa Free Countries AlbaniaAlgeriaAndorraKenyaKiribatiKuwaitKyrgyzstanLaosLatviaLebanonLesothoLiechtensteinLithuaniaLuxembourgMacau SAR52 more rows

How to obtain Indonesian citizenship?

Foreigners who are legally married to Indonesian citizens and have lived in the territory of the Republic of Indonesia for at least 5 consecutive years or 10 consecutive years, can also obtain Indonesian Citizenship by submitting a statement to become citizens before the authorized official.

Will Indonesia allow dual citizenship?

Dual nationality is not typically allowed in Indonesia. However, after lobbying from women's rights groups, in 2006, the nationality law was revised to allow children to retain dual nationality until they reach legal majority of seventeen.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ID DGT 2 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your ID DGT 2 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete ID DGT 2 online?

Filling out and eSigning ID DGT 2 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I complete ID DGT 2 on an Android device?

Use the pdfFiller Android app to finish your ID DGT 2 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is ID DGT 2?

ID DGT 2 is a tax declaration form used in certain jurisdictions to report income and tax obligations.

Who is required to file ID DGT 2?

Individuals and businesses that meet specific income or tax thresholds as defined by tax authorities are required to file ID DGT 2.

How to fill out ID DGT 2?

To fill out ID DGT 2, gather all necessary financial documents, follow the instructions provided on the form, and ensure all relevant income and deductions are accurately reported.

What is the purpose of ID DGT 2?

The purpose of ID DGT 2 is to ensure accurate reporting of income and facilitate proper tax assessment by the authorities.

What information must be reported on ID DGT 2?

ID DGT 2 must report information such as total income, deductions, tax credits, and other relevant financial data.

Fill out your ID DGT 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID DGT 2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.