VA 760C 2021 free printable template

Show details

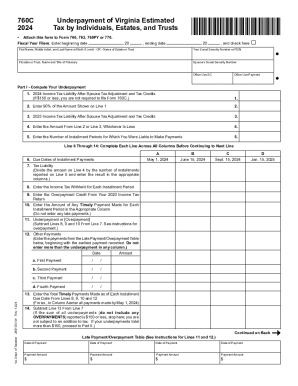

760C 2021Underpayment of Virginia Estimated by Individuals, Estates and Trusts Enclose this form with Form 760, 763, 760PY or 770. Fiscal Year Filers: Enter beginning date20, ending date×VA760C121888*

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA 760C

Edit your VA 760C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA 760C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VA 760C online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit VA 760C. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA 760C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA 760C

How to fill out VA 760C

01

Gather your personal information, including your Social Security number and income details.

02

Obtain the VA 760C form from the Virginia Department of Taxation website or local tax office.

03

Fill out the top section of the form with your personal information.

04

Report your income in the appropriate sections, following the instructions provided with the form.

05

Include any deductions and credits you are eligible for.

06

Double-check your calculations and ensure all required fields are completed.

07

Sign and date the form once you have filled it out.

08

Submit the VA 760C form via mail or electronically, as per the provided guidelines.

Who needs VA 760C?

01

Individuals who are residents of Virginia and need to file their state income tax return.

02

Taxpayers who are claiming a refund or need to fulfill their tax obligations in Virginia.

03

Residents who meet the income thresholds set by the state for filing an income tax return.

Fill

form

: Try Risk Free

People Also Ask about

What is Virginia spouse tax adjustment?

If a couple elects to use the Spouse Tax Adjustment, they calculate their income tax separately using the Spouse Tax Adjustment worksheet. As a result, the first $17,000 of each of their incomes will be taxed at the lower rates. Consequently, using the Spouse Tax Adjustment can result in a tax savings of up to $259.

What is Virginia tax Form 760C?

2021 Form 760C - Underpayment of Virginia Estimated Tax by Individuals, Estates and Trusts.

What is VA Form 760cg?

Full-year residents of Virginia must include income earned in other states to compute total Adjusted Gross Income for the appropriate tax year. Credit for taxes paid to another state may be claimed by filing Virginia Schedule OSC. Solution Id.

What does Form 760C mean?

Purpose of Form 760C Virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments of estimated tax. If you do not pay at least 90% of your tax in this manner, you may be charged an addition to tax.

Is 760C the same as 760CG?

"Form 760C: Line 3: Prior year tax liability must be entered." I have VA760CG. What line(s) are the same on VA760CG as line 3 on 760C? Form 760 and 760CG are the same form - the "CG" means "computer generated". Form 760C is a different form that is trying to calculate an underpayment penalty, if any.

How do I pay Virginia estimated taxes?

We offer multiple options to pay estimated taxes. Individual online services account. If you don't have an account, enroll here. 760ES eForm. No login or password is required. ACH credit. Pay by ACH credit and initiate sending payments from your bank account to Virginia Tax's bank account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit VA 760C from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your VA 760C into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for signing my VA 760C in Gmail?

Create your eSignature using pdfFiller and then eSign your VA 760C immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out the VA 760C form on my smartphone?

Use the pdfFiller mobile app to complete and sign VA 760C on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is VA 760C?

VA 760C is the Virginia Individual Income Tax Return form, specifically designed for individuals who need to file an amended return.

Who is required to file VA 760C?

Individuals who need to correct or amend their original Virginia Individual Income Tax Return (VA 760) are required to file VA 760C.

How to fill out VA 760C?

To fill out VA 760C, you need to complete the form by providing your personal information, the details of the original return, and the changes necessary. Ensure you explain the reasons for the amendments and attach any required documentation.

What is the purpose of VA 760C?

The purpose of VA 760C is to allow taxpayers to amend their initial Virginia tax returns in order to correct errors or update information.

What information must be reported on VA 760C?

The information that must be reported on VA 760C includes your name, Social Security Number, details of the original return, adjustments being made, and the reasons for the amendments.

Fill out your VA 760C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA 760c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.