Get the free I Total Living Coverage (TLC)

Show details

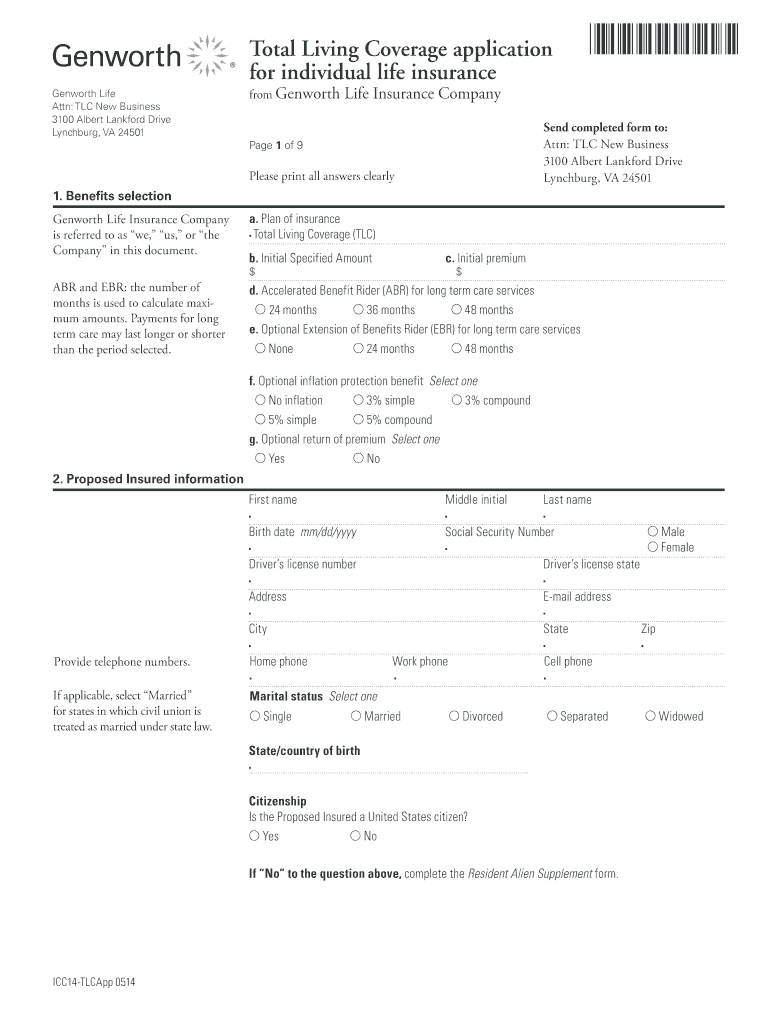

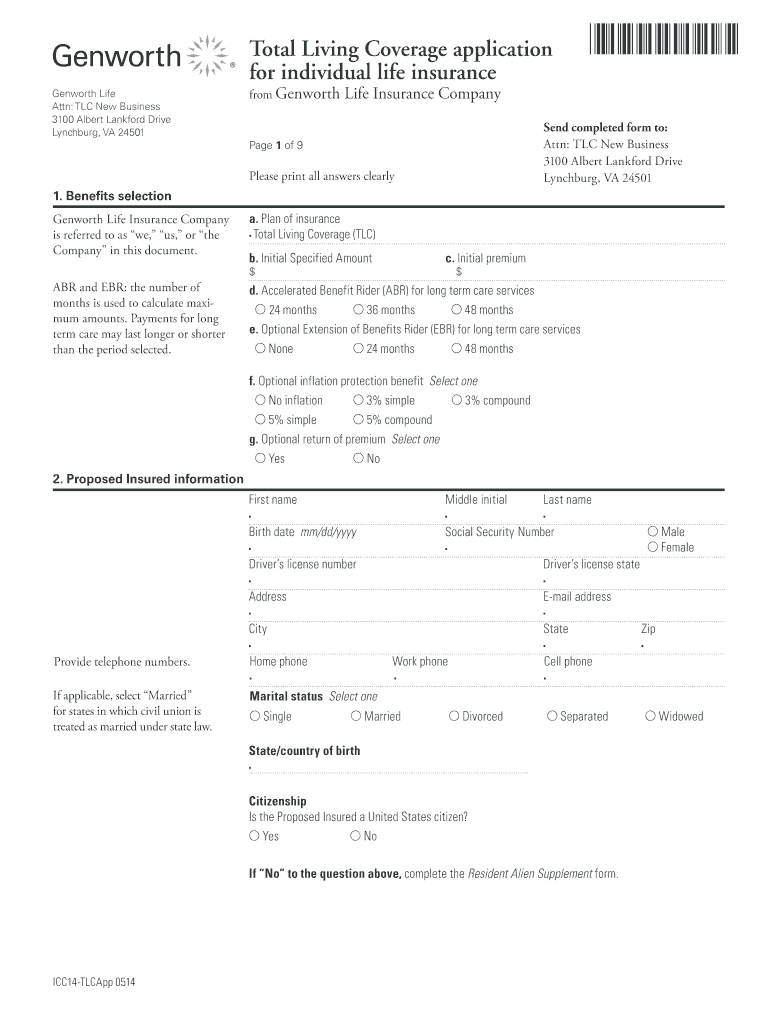

Illinois I Total Living Coverage (TLC) Application for Total Living Coverage Company Submission Materials Enclosed Complete and return the following forms to Gen worth: Part 1 Application Health Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign i total living coverage

Edit your i total living coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your i total living coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit i total living coverage online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit i total living coverage. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out i total living coverage

Point by point instructions for filling out i total living coverage:

01

Start by gathering all the necessary information. This includes personal details such as your name, address, and contact information. You may also need to provide information about your current living situation, such as whether you rent or own your home.

02

Familiarize yourself with the coverage options offered by i total living coverage. This will help you determine the type and level of coverage that best suits your needs. Review the policy terms and conditions to understand what is covered and what is excluded.

03

Consider your personal circumstances and assess the amount of coverage you require. This may include evaluating the value of your belongings, estimating potential liabilities, and considering any unique risks or circumstances that may necessitate additional coverage.

04

Fill out the application form carefully and accurately. Provide all the requested information, making sure to double-check for any errors or omissions. Be prepared to provide supporting documentation if required.

05

Review your completed application before submitting it. Ensure that all the information provided is correct and complete. Make a copy of the application for your records if desired.

Who needs i total living coverage?

01

Renters: If you are renting a home, i total living coverage can provide valuable protection for your personal belongings and liability. It can also offer financial assistance in case of temporary displacement due to covered events, such as a fire or flood.

02

Homeowners: Homeowners can benefit from i total living coverage by safeguarding their belongings, protecting their property against damage or theft, and having liability coverage in case of accidents or injuries that occur on their premises.

03

People with valuable assets: If you own valuable possessions such as jewelry, art, or collectibles, i total living coverage can provide specialized coverage to protect them adequately.

04

Those seeking greater peace of mind: Even if you don't have significant assets, having i total living coverage can provide peace of mind by offering financial protection against unexpected events and liabilities.

05

Individuals with unique risks: If you have specific risks associated with your living situation, such as operating a home-based business or having a swimming pool, i total living coverage can be customized to address these specific needs.

Overall, anyone who wants to protect their home, belongings, and liabilities should consider i total living coverage as it offers comprehensive protection and peace of mind.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit i total living coverage from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your i total living coverage into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I edit i total living coverage on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign i total living coverage right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete i total living coverage on an Android device?

On Android, use the pdfFiller mobile app to finish your i total living coverage. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is the total living coverage?

The total living coverage is the total amount of coverage provided for all living expenses in case of an emergency or unforeseen circumstance.

Who is required to file the total living coverage?

Anyone who owns or rents a property and wants to ensure their living expenses are covered in case of an emergency should file for total living coverage.

How to fill out the total living coverage?

To fill out the total living coverage, you will need to provide information about your living expenses, such as rent or mortgage payments, utilities, groceries, and other essential costs.

What is the purpose of the total living coverage?

The purpose of the total living coverage is to ensure that individuals have enough coverage to meet their living expenses in case of an emergency or unforeseen circumstance.

What information must be reported on the total living coverage?

The total living coverage requires information about your living expenses, such as rent or mortgage payments, utilities, groceries, and other essential costs.

Fill out your i total living coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

I Total Living Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.