CA ACR 521 2022 free printable template

Show details

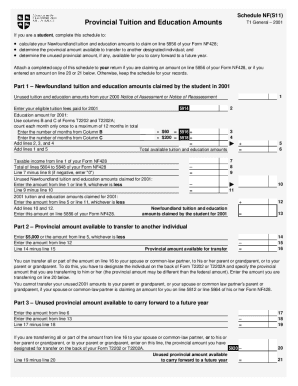

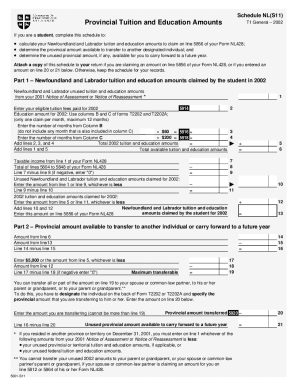

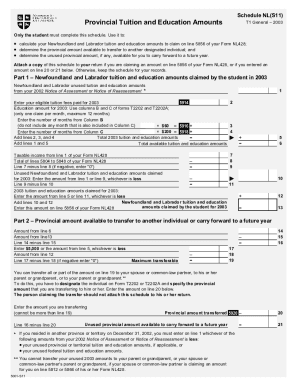

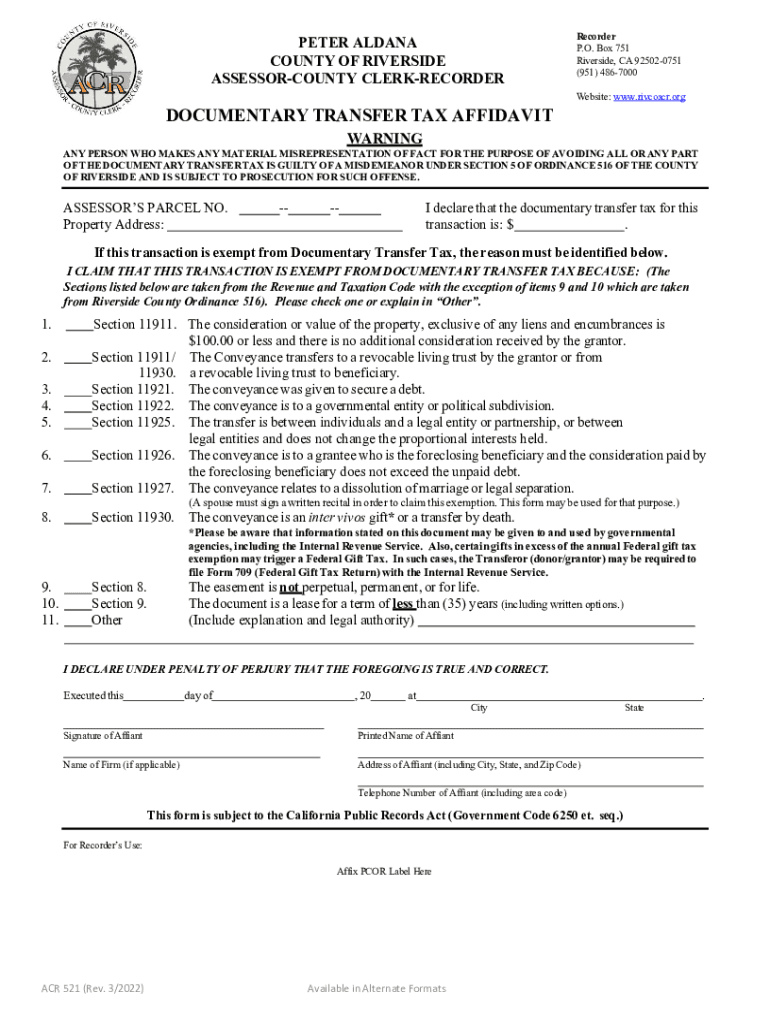

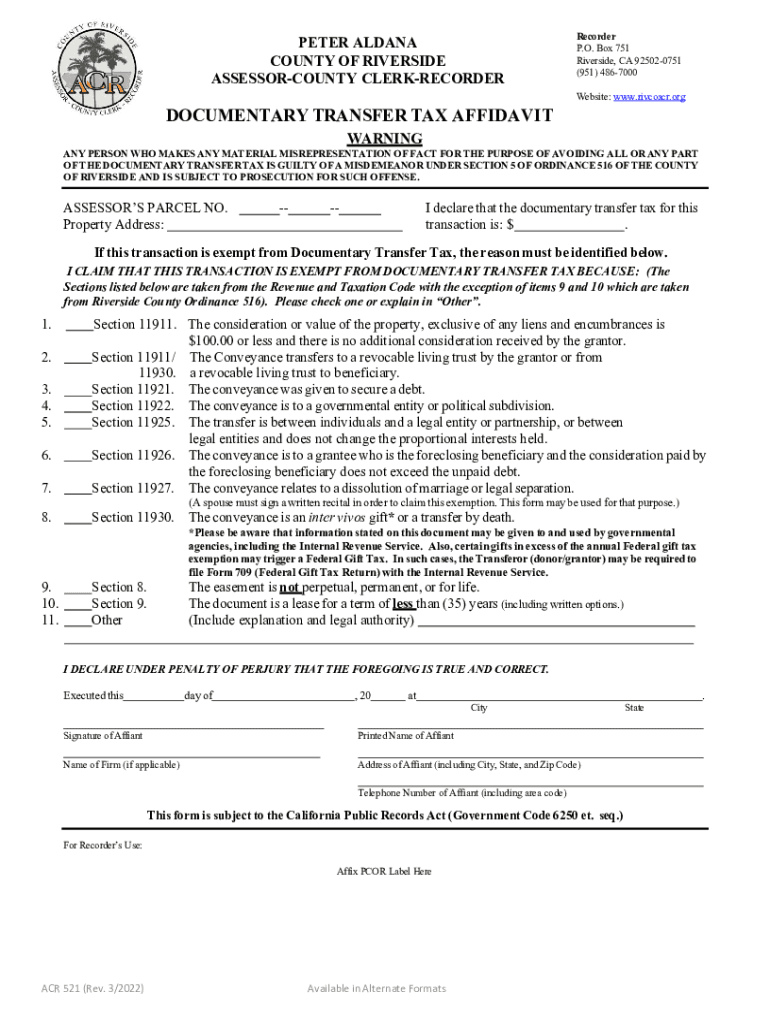

O. Box 751 Riverside CA 92502-0751 951 486-7000 Website www. rivcoacr. org WARNING ANY PERSON WHO MAKES ANY MATERIAL MISREPRESENTATION OF FACT FOR THE PURPOSE OF AVOIDING ALL OR ANY PART OF THE DOCUMENTARY TRANSFER TAX IS GUILTY OF A MISDEMEANOR UNDER SECTION 5 OF ORDINANCE 516 OF THE COUNTY OF RIVERSIDE AND IS SUBJECT TO PROSECUTION FOR SUCH OFFENSE. ASSESSOR S PARCEL NO. PETER ALDANA COUNTY OF RIVERSIDE ASSESSOR-COUNTY CLERK-RECORDER DOCUMENTARY TRANSFER TAX AFFIDAVIT Recorder P. Property...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA ACR 521

Edit your CA ACR 521 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA ACR 521 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA ACR 521 online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA ACR 521. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA ACR 521 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA ACR 521

How to fill out CA ACR 521

01

Obtain a copy of the CA ACR 521 form from the appropriate website or office.

02

Fill in the personal information section, including name, address, and social security number.

03

Provide details about your employment history over the past year.

04

Indicate any relevant deductions or exemptions you are claiming.

05

Review the instructions for any specific requirements applicable to your situation.

06

Double-check all the information for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the completed form to the relevant tax authority by the deadline.

Who needs CA ACR 521?

01

Anyone who is required to report income or claim deductions on their taxes in California.

02

Individuals who have had significant changes in their financial situation.

03

Taxpayers who receive income from sources that require reporting via CA ACR 521.

Fill

form

: Try Risk Free

People Also Ask about

Is Pomona CA a good place to live?

Pomona has some quality schools and excellent colleges to its credit. Proud to be from here. Great area and the beach, amusement parks, and other fun activities are all within a 30 mile vicinity. What I like about Pomona is that there friendly neighbors.

What kind of people live in Pomona?

Pomona Demographics White: 40.03% Other race: 32.49% Asian: 10.56% Two or more races: 8.24% Black or African American: 6.02% Native American: 2.6% Native Hawaiian or Pacific Islander: 0.07%

Is Pomona a low income city?

The poverty rate in Pomona, California is 28.12% higher than the US average. In Pomona, California, an estimated 16.4% of 147,902 people live in poverty.

What percentage of Pomona is black?

Table PopulationFemale persons, percent 50.9%Race and Hispanic OriginWhite alone, percent 33.7%Black or African American alone, percent(a) 5.9%57 more rows

What is the racial makeup of Pomona California?

Table PopulationBlack or African American alone, percent(a) 5.9%American Indian and Alaska Native alone, percent(a) 2.5%Asian alone, percent(a) 10.8%Native Hawaiian and Other Pacific Islander alone, percent(a) 0.1%57 more rows

Is Pomona California expensive to live?

Pomona, California's cost of living is 44% higher than the national average.

Is Pomona California nice place to live?

Pomona has some quality schools and excellent colleges to its credit. Proud to be from here. Great area and the beach, amusement parks, and other fun activities are all within a 30 mile vicinity. What I like about Pomona is that there friendly neighbors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA ACR 521 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your CA ACR 521 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit CA ACR 521 on an iOS device?

Create, edit, and share CA ACR 521 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete CA ACR 521 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your CA ACR 521 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is CA ACR 521?

CA ACR 521 is a form used in California for the annual certification of an exempt organization, which provides information about the organization’s activities and finances.

Who is required to file CA ACR 521?

Organizations that are exempt from federal income tax under Section 501(c)(3) of the Internal Revenue Code and have gross receipts of $50,000 or more are required to file CA ACR 521.

How to fill out CA ACR 521?

To fill out CA ACR 521, organizations need to provide their legal name, address, federal employer identification number (EIN), gross receipts, and specific activities conducted during the year. Detailed instructions are provided with the form.

What is the purpose of CA ACR 521?

The purpose of CA ACR 521 is to ensure compliance with state tax laws by collecting information about non-profit organizations, their activities, and their financial status to maintain transparency and accountability.

What information must be reported on CA ACR 521?

Information required on CA ACR 521 includes the organization's name, address, EIN, gross receipts, a description of the organization's activities, and any changes in the organization's structure or operations.

Fill out your CA ACR 521 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA ACR 521 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.