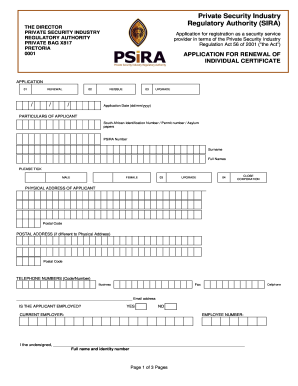

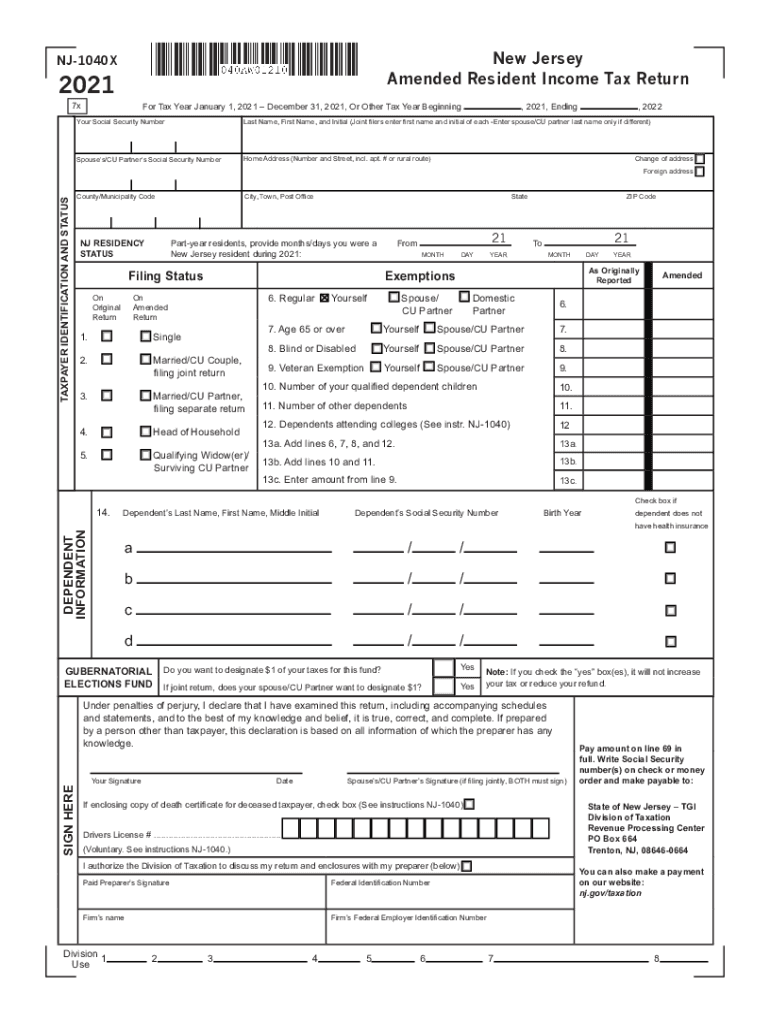

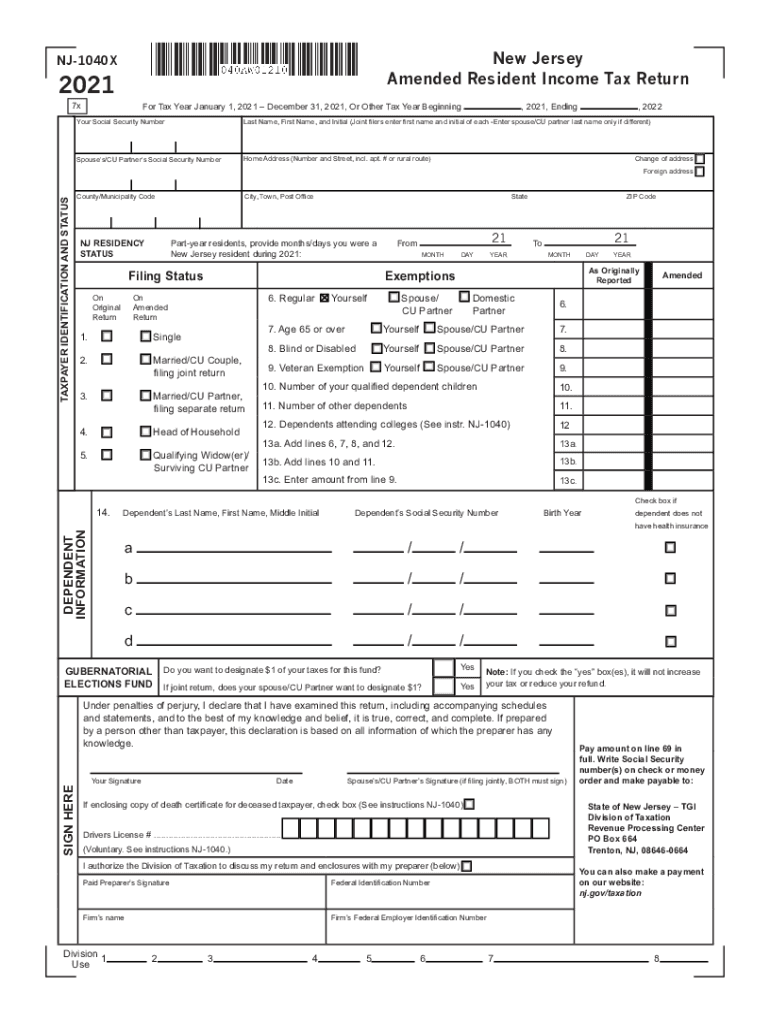

NJ DoT NJ-1040X 2021 free printable template

Show details

New Jersey Amended Resident Income Tax ReturnNJ1040X2021 7xFor Tax Year January 1, 2022, December 31, 2021, Or Other Tax Year Beginning, 2021, Ending, 2022Your Social Security Numberless Name, First

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT NJ-1040X

Edit your NJ DoT NJ-1040X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT NJ-1040X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ DoT NJ-1040X online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NJ DoT NJ-1040X. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT NJ-1040X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ DoT NJ-1040X

How to fill out NJ DoT NJ-1040X

01

Obtain the NJ-1040X form from the New Jersey Division of Taxation website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year you are amending in the designated section.

04

Provide the original amounts from your filed NJ-1040 form in the appropriate columns.

05

Enter the corrected amounts in the corresponding sections of the NJ-1040X form.

06

Explain the reasons for the changes in the 'Explanation' section.

07

Calculate any additional refunds or taxes owed.

08

Sign and date the form before submission.

09

Mail the completed NJ-1040X form to the appropriate address listed in the instructions.

Who needs NJ DoT NJ-1040X?

01

Individuals who made an error on their original NJ-1040 tax return.

02

Taxpayers who wish to claim additional deductions or credits not included in the original filing.

03

Residents needing to report changes in income or filing status that affect their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

Why is my NJ tax refund taking so long 2022?

A number of things could cause a delay in your New Jersey refund, including the following: If the department needs to verify information reported on your return or request additional information, the process will take longer. Math errors in your return or other adjustments.

When can I expect a refund date?

When to Expect Your Refund. Refunds are generally issued within 21 days of when you electronically filed your tax return or 42 days of when you filed paper returns. If it's been longer, find out why your refund may be delayed or may not be the amount you expected.

Who is subject to NJ income tax?

Who has to file New Jersey state taxes? Any resident with a New Jersey income source above the taxable amount minimum is subject to income tax. The same applies to part-year residents (those who spend less than 180 days in the state during the year) and non-residents earning an income in New Jersey.

Will the tax deadline be extended again 2022?

Yes, the tax deadline for people who filed extensions is coming in October. You have until Oct. 17, 2022, to file your 2021 income tax return if you requested an extension. The IRS encourages taxpayers to file electronically ASAP.

Is NJ income tax deadline extended?

If you owe NJ income taxes, you will either have to submit a NJ tax return or extension by the April 18, 2023 tax deadline in order to avoid late filing penalties. The extension will only avoid late filing penalties until Oct. 16, 2023. Note: Unless you pay all your Taxes or eFile your tax return by Oct.

Who must file a NJ non resident tax return?

A nonresident serviceperson who has income from New Jersey sources such as a civilian job in off-duty hours, income or gain from property located in New Jersey or income from a business, trade or profession carried on in this State must file a New Jersey nonresident return, Form NJ-1040NR.

Do I need to file a NJ state return?

If you were a resident of New Jersey for only part of the year and your income from all sources for the entire year was more than $20,000 ($10,000 if filing status is single or married/CU partner, filing separate return), you must file a New Jersey resident Income Tax return and report any income you received while you

What happens if you file NJ taxes late?

The Late Filing Penalty is 5% of the tax due for each month (or part of a month) the return is late. The maximum penalty for late filing is 25% of the balance due. We also may charge $100 for each month the return is late. In addition to interest, we may also charge a Late Payment Penalty of 5% of the tax due.

Is New Jersey getting a $500 stimulus check?

Eligible residents can expect one-time financial support of up to $500 for each household member who has an ITIN and is listed on the resident's tax return.

When can I expect NJ tax refund?

4 weeks or more after you file electronically; At least 12 weeks after you mail your return; 15 weeks or more for additional processing requirements or paper returns sent by certified mail.

Is New Jersey getting rebate checks in 2022?

New Jersey Homeowners making up to $150,000 will receive $1,500 rebates on their property taxes, while those earning between $150,000 and $250,000 will receive $1,000. Renters who earn up to $150,000 will receive $450 checks.

Are NJ state taxes delayed this year?

NJ Taxation There is no extension of time to pay your taxes; You must pay at least 80% of any owed taxes no later than April 18, 2022, to avoid a late filing penalty; You will have until October 15, 2022, to file your New Jersey return.

Who has to file a NJ tax return?

NJ Income Tax – Who Must File your filing status is:and your gross income from everywhere for the entire year was more than the filing threshold:Single Married/CU partner, filing separate return$10,000Married/CU couple, filing joint return head of household, Qualifying widow(er)/surviving CU partner$20,000 May 12, 2021

Do you have to file NJ state taxes if you don't owe?

For Tax Year 2022, if you expect a refund or you don't owe taxes, you do not have to file a tax extension.

When can I expect my NJ rebate check?

Before checking on your refund, wait four weeks from the day you filed an electronic (online) return. Wait 12 weeks to check your refund if you filed a paper return.

Who gets the $500 rebate in New Jersey?

The state will send checks to eligible individuals at the address they used to file their 2021 taxes. To receive a check, a person must have filed a New Jersey income tax return in 2021 using an ITIN and have a household income below 200% of the federal poverty level.

Is NJ getting a rebate check 2022?

Distributing Middle Class Tax Relief: In FY2022, over 760,000 New Jersey families will receive an up to $500 tax rebate due to the millionaires tax enacted by the Governor and the Legislature last fall.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NJ DoT NJ-1040X for eSignature?

Once your NJ DoT NJ-1040X is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit NJ DoT NJ-1040X on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign NJ DoT NJ-1040X on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out NJ DoT NJ-1040X on an Android device?

Use the pdfFiller mobile app to complete your NJ DoT NJ-1040X on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NJ DoT NJ-1040X?

NJ DoT NJ-1040X is a form used to amend a previously filed New Jersey income tax return.

Who is required to file NJ DoT NJ-1040X?

Any taxpayer who needs to correct errors or report changes to their New Jersey income tax return from a previous year is required to file NJ DoT NJ-1040X.

How to fill out NJ DoT NJ-1040X?

To fill out NJ DoT NJ-1040X, you need to provide your personal information, details of the changes being made, and attach any supporting documentation as required.

What is the purpose of NJ DoT NJ-1040X?

The purpose of NJ DoT NJ-1040X is to allow taxpayers to correct or amend their New Jersey income tax returns to reflect accurate information.

What information must be reported on NJ DoT NJ-1040X?

The information that must be reported on NJ DoT NJ-1040X includes the taxpayer's identification details, the tax year being amended, the original amounts, and the corrected amounts.

Fill out your NJ DoT NJ-1040X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT NJ-1040x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.