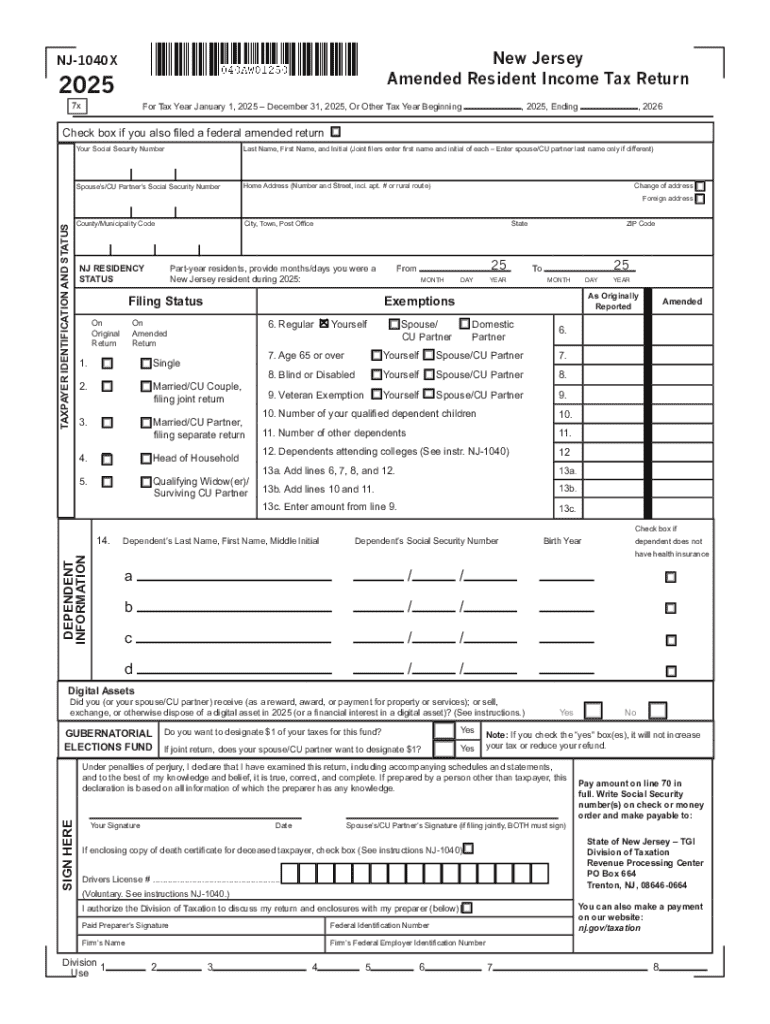

NJ DoT NJ-1040X 2025-2026 free printable template

Get, Create, Make and Sign NJ DoT NJ-1040X

Editing NJ DoT NJ-1040X online

Uncompromising security for your PDF editing and eSignature needs

NJ DoT NJ-1040X Form Versions

How to fill out NJ DoT NJ-1040X

How to fill out 2025 nj-1040x amended resident

Who needs 2025 nj-1040x amended resident?

2025 NJ-1040X Amended Resident Form: A Comprehensive Guide

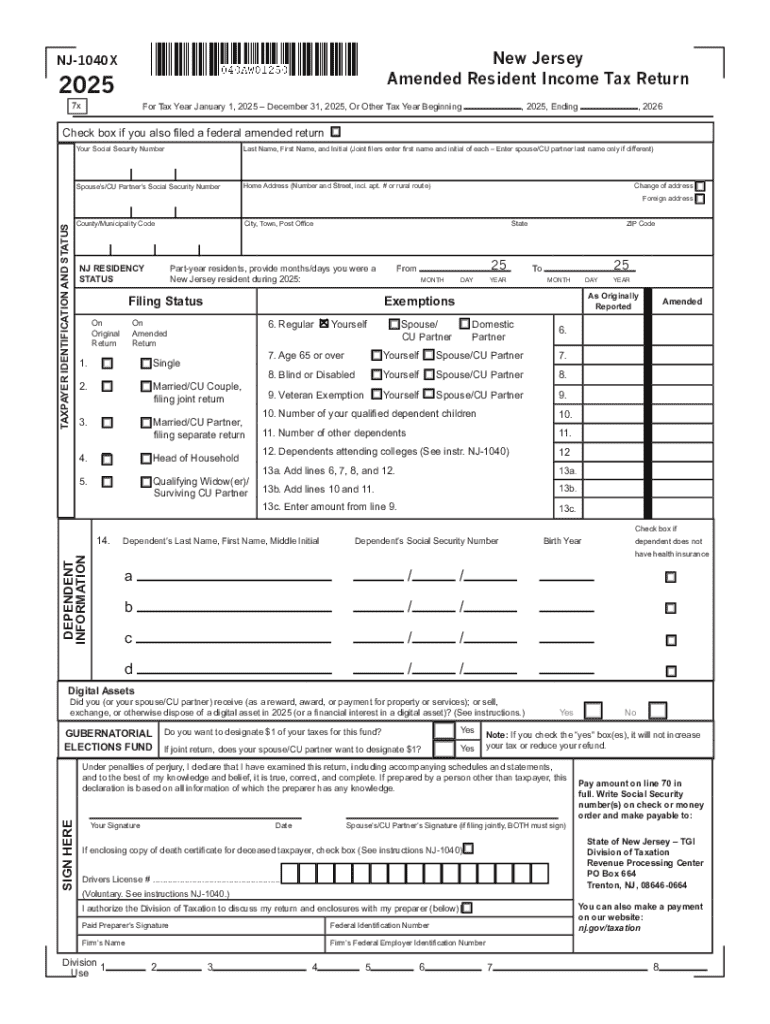

Understanding the NJ-1040X amended resident form

The 2025 NJ-1040X amended resident form is essential for New Jersey residents who need to correct their previously filed tax returns. This form allows taxpayers to amend income, credits, or deductions that may have been reported inaccurately in their original filing. Filing an amended return is crucial for compliance and ensuring that you are paying the correct amount of tax. The importance of rectifying errors cannot be overstated as it can lead to potential refunds or adjustments in tax liability.

Amending your return also serves to maintain transparency with the New Jersey Division of Taxation, which can improve your taxpayer standing. Common reasons for using the NJ-1040X include changes in your filing status, discovery of missed deductions or credits, and changes in income that were not accounted for in the original return.

Who should use the NJ-1040X form?

The NJ-1040X form is designed for individuals who filed a 2025 NJ-1040 but realized that information in their original return needs modification. Common situations prompting the use of this form include filing with an incorrect status, claiming omitted deductions and credits, and reporting new or corrected income. If you find errors post-filing or obtain new information that could impact your tax return, you qualify for utilizing the NJ-1040X.

How to obtain the 2025 NJ-1040X amended form

Acquiring the 2025 NJ-1040X form is straightforward. You can download it directly from pdfFiller, which provides a user-friendly interface and easy access to the necessary documents. After downloading, you can utilize pdfFiller's various tools to fill out, sign, and manage your amended form with ease.

PdfFiller also offers collaborative features that enable you to work with tax professionals or family members, ensuring your form is accurately completed before submission.

Step-by-step guide to filling out the NJ-1040X

Gathering necessary documents

Before you start filling out the NJ-1040X form, gather all relevant paperwork to ensure accuracy. Important documents include your original NJ-1040 form, W-2s, 1099s, any supporting documents for deductions or credits, and previous correspondence with the New Jersey Division of Taxation. Ensuring you have all these documents beforehand will streamline the amendment process.

Filling out the form

The NJ-1040X form consists of several sections that require detailed information. Start with your personal information, confirming your name, address, and Social Security number are correct. Next, reference the original tax details by providing figures from your NJ-1040, specifically noting amounts that have been adjusted.

Indicate your reason for the amendment in the designated section, providing clear and concise explanations for each change. If applicable, attach any supporting documentation that validates your claims.

Calculating your amended tax liability

After entering all relevant changes, you'll need to recalculate your tax liability based on the new figures. This may involve adjusting your taxable income, calculating new tax rates, and verifying any additional credits or deductions. It's crucial to double-check calculations to avoid further errors, which can complicate the amendment process. Utilize tax calculators or worksheets available through the New Jersey Division of Taxation to ensure accuracy.

Reviewing amended returns for accuracy

Before submitting your NJ-1040X, take the time to review your entire amended return for accuracy. Key points to verify include the correctness of entered figures, the inclusion of all necessary documents, and that the amendment provides a clear and valid reason for the changes. A thorough review reduces the risk of further complications, ensuring a smoother processing experience.

Submitting the NJ-1040X form

Once completed, you have two options for submitting the NJ-1040X form: e-filing or mailing it, depending on your preference. E-filing is typically the faster option and allows for quicker processing times, while mailing can take longer but is still a secure method if you prefer a paper trail. Be mindful of submission deadlines to avoid late penalties, ensuring your amended return is filed on time.

Tracking the status of your amended return

After submission, checking the status of your NJ-1040X is essential for peace of mind. New Jersey residents can track their amended return online through the state's Division of Taxation website. It's important to note that processing times for amended returns may vary, typically taking several weeks, so patience is key as you await confirmation.

Common mistakes to avoid when filing NJ-1040X

Filing the NJ-1040X can be straightforward, but errors can delay processing and lead to complications with your tax situation. Common mistakes include not signing the form, failing to include all necessary documentation, or miscalculating your new tax liability. It's advisable to take your time during the filling process and consider having a second pair of eyes review your work to catch potential oversights.

Potential outcomes after filing an amended return

Following the submission of your NJ-1040X, expect various potential outcomes depending on the nature of your amendments. You may receive an adjustment to your tax return resulting in a refund or, conversely, an indication of additional taxes owed. Regardless of the outcome, the New Jersey Division of Taxation will notify you of any adjustments made to your account, ensuring you remain informed about your tax standing.

Maximizing your tax refund: tips and strategies

Amending your return offers an excellent opportunity to revisit potential deductions you may have originally overlooked. Consider enhancing your refund by researching available deductions or credits specific to New Jersey residents. For instance, education-related credits, property tax rebates, and various healthcare-related deductions are worth exploring to maximize your total refund.

Using pdfFiller for your document needs

Choosing pdfFiller for preparing your 2025 NJ-1040X amended resident form streamlines the process with numerous features aimed at user efficiency. You can edit and sign forms directly online, collaborate with tax professionals in real time, and securely store your documents in the cloud. This cloud-based platform makes for an ideal solution for managing all your taxable documents for easy access anytime and from anywhere.

Whether you need to amend, complete, or file taxes, pdfFiller’s user-friendly interface ensures that your documentation is efficient and effective.

Additional support for filing tax amendments

If you find yourself overwhelmed or unsure about the amendment process, numerous resources can assist you with your NJ-1040X filing. From the New Jersey Division of Taxation's official website, which provides guidance and FAQs, to local tax assistance agencies and financial advisors, there are options available to help you navigate changes to your tax situation effectively.

Consulting with tax professionals can lead to enhanced accuracy in your filings and might uncover additional opportunities for tax savings. Investing in professional advice may be particularly beneficial for complex amendments.

People Also Ask about

Who is required to file a NJ tax return?

Who is exempt from NJ filing fee?

What is form NJ 600?

Who must file a NJ nonresident return?

Do I have to file a NJ return?

What is a NJ 165 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NJ DoT NJ-1040X for eSignature?

How do I edit NJ DoT NJ-1040X straight from my smartphone?

How do I complete NJ DoT NJ-1040X on an Android device?

What is 2025 nj-1040x amended resident?

Who is required to file 2025 nj-1040x amended resident?

How to fill out 2025 nj-1040x amended resident?

What is the purpose of 2025 nj-1040x amended resident?

What information must be reported on 2025 nj-1040x amended resident?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.