Get the free New Long-Term Care Insurance Benefit Plans May Offer

Show details

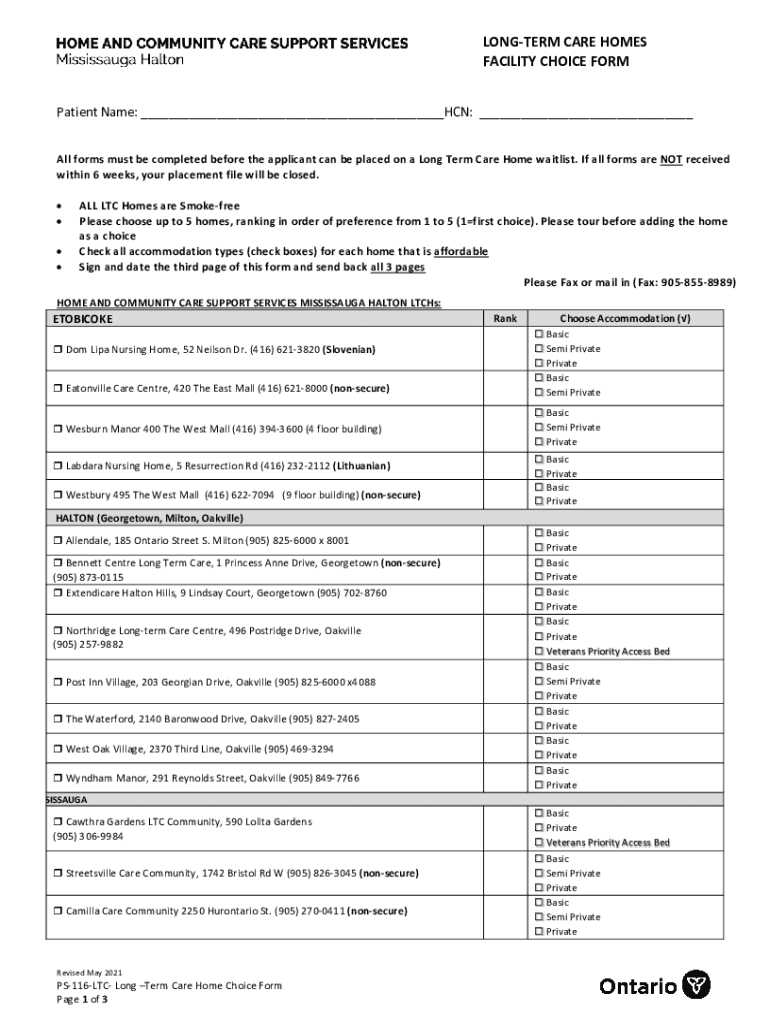

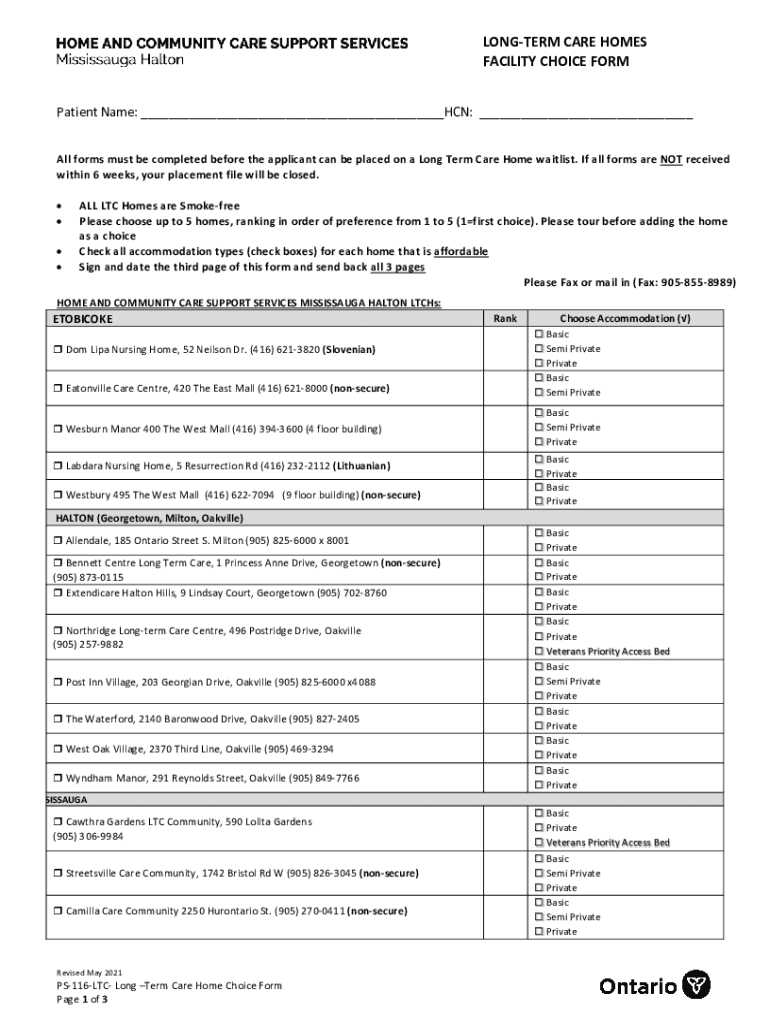

LongTermCare Package May2021TABLEOFCONTENTS PlanningforLongTermCare...3 LongTermCareHomesFacilityChoiceForm......10 LongTermCarePatientChecklist

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new long-term care insurance

Edit your new long-term care insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new long-term care insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new long-term care insurance online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new long-term care insurance. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new long-term care insurance

How to fill out new long-term care insurance

01

Step 1: Gather all necessary documents and information related to your health and financial situation.

02

Step 2: Research different long-term care insurance policies and compare their coverage, benefits, and costs.

03

Step 3: Choose the insurance provider that best suits your needs and budget.

04

Step 4: Review the policy thoroughly, paying attention to the coverage limits, waiting periods, exclusions, and any optional riders or additional benefits.

05

Step 5: Fill out the application form accurately and completely, providing all required information about yourself, your health history, and your financial resources.

06

Step 6: Consult with an insurance agent, if needed, to clarify any doubts or to seek guidance.

07

Step 7: Submit the completed application along with any required supporting documents, such as medical records or financial statements.

08

Step 8: Wait for the insurance company to review your application and make a decision. This process may take several weeks.

09

Step 9: If approved, carefully review the policy documents and make sure you understand all the terms and conditions.

10

Step 10: Pay the premium as specified in the policy to activate the insurance coverage.

11

Step 11: Keep a copy of all the documents related to your long-term care insurance policy in a safe place for future reference.

Who needs new long-term care insurance?

01

Anyone who wants to ensure financial protection against the high costs of long-term care services may consider getting new long-term care insurance.

02

Individuals who do not have sufficient savings or assets to cover potential long-term care expenses may find this insurance beneficial.

03

Those who want to have more control and freedom in choosing the type and location of their long-term care services might opt for this insurance.

04

People who want to preserve their assets and avoid depleting their savings or burdening their family members with caregiving costs could benefit from this insurance.

05

Individuals who have a family history of chronic illnesses or disabilities that require long-term care may also consider getting this insurance to be prepared.

06

It is advisable to assess your personal and financial situation and consider your current health status before deciding whether you need new long-term care insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my new long-term care insurance directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your new long-term care insurance as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send new long-term care insurance for eSignature?

When your new long-term care insurance is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit new long-term care insurance on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share new long-term care insurance on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is new long-term care insurance?

New long-term care insurance is a type of insurance policy that provides coverage for long-term care services.

Who is required to file new long-term care insurance?

Individuals who are looking to secure coverage for long-term care services are required to file for new long-term care insurance.

How to fill out new long-term care insurance?

To fill out new long-term care insurance, you will need to provide personal information, medical history, and desired coverage options.

What is the purpose of new long-term care insurance?

The purpose of new long-term care insurance is to help individuals cover the costs of long-term care services that may not be covered by other insurance policies.

What information must be reported on new long-term care insurance?

You must report personal information, medical history, and desired coverage options on new long-term care insurance.

Fill out your new long-term care insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Long-Term Care Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.