MO DoR 2643 2021 free printable template

Show details

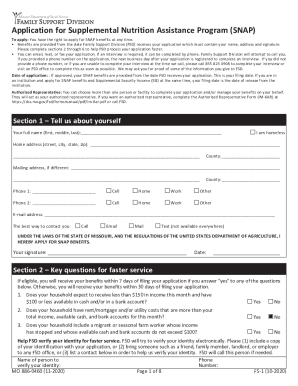

Missouri Tax Registration Application

You can also complete your registration online by visiting our website at

for.mo.gov/register business/

For sales, use and withholding tax facts, sales tax rates,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR 2643

Edit your MO DoR 2643 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR 2643 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MO DoR 2643 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MO DoR 2643. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 2643 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DoR 2643

How to fill out MO DoR 2643

01

Gather all necessary financial documents and information.

02

Obtain the MO DoR 2643 form from the official Missouri Department of Revenue website or a local office.

03

Fill in your personal details, such as name, address, and social security number, at the top of the form.

04

Provide relevant financial information in the appropriate sections, ensuring accuracy and completeness.

05

Review the form thoroughly to check for any errors or missing information.

06

Sign and date the form where indicated.

07

Submit the completed form to the Missouri Department of Revenue, either by mail or online, if applicable.

Who needs MO DoR 2643?

01

Individuals or businesses in Missouri who need to report certain financial information.

02

Taxpayers who are filing for specific tax credits or refunds.

03

Anyone required to provide information for state tax compliance.

Fill

form

: Try Risk Free

People Also Ask about

What Missouri tax form do I use?

Missouri Form Mo-1040 Instructions.

Can I download and print tax forms?

You can e-file directly to the IRS and download or print a copy of your tax return.

What is form 2643A?

Form 2643A - Missouri Tax Registration Application.

What Missouri tax forms do I need?

Obtaining Tax Forms Form MO-1040 Missouri Individual Income Tax Long Form. Form MO-1040A Missouri Individual Income Tax Short Form. Form MO-PTC Property Tax Credit Claim.

What form do I use to pay Missouri state taxes?

Form MO-1040V ensures that your payment will be processed more efficiently and accurately. Form MO-1040V allows you to file your completed income tax return and send your payment at a later date. Your income tax return and payment are due no later than April 18, 2023.

Is a Missouri tax ID and an EIN the same thing?

A Missouri tax ID number, also referred to as an EIN or Employer Identification Number, is given to a business entity from the IRS. It's also called a Tax ID Number or Federal Tax ID Number (TIN). To a business, the EIN serves the same purpose as a social security number serves for an individual.

Who is required to file a Missouri tax return?

Just like the federal level, Missouri imposes income taxes on your earnings if you have a sufficient connection to the state if you work or earn an income within state borders. You may not have to file a Missouri return if: You are a resident and have less than $1,200 of Missouri adjusted gross income.

How do I get a Missouri state tax ID number?

If you need to get a Missouri state tax ID number, you'll need a federal tax ID number first. Applying online can help you obtain this number in less than an hour. Once you have it, you can use it on your state-level tax ID number application.

How do I get a Missouri state tax ID number?

Missouri Tax ID Application: Overview. When applying for a tax ID number in Missouri, the process is easy when you have the necessary business information available. You can apply for an EIN by fax, by mail, or by filling out the application on the IRS website.

Do I need a Missouri tax ID number?

Employer Withholding Tax - Every employer maintaining an office or transacting any business within the state of Missouri and making payment of wages to a resident or nonresident individual must obtain a Missouri Employer Tax Identification Number.

Do I have to pay Missouri state income tax?

If you or your spouse earned Missouri source income of $600 or more (other than military pay), you must file a Missouri income tax return by completing Form MO-1040 and Form MO-NRI. Be sure to include a copy of your federal return.

How much should I withhold for Missouri state taxes?

Withholding Formula (Effective Pay Period 06, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $1,1211.5%Over $1,121 but not over $2,242$16.82 plus 2.0% of excess over $1,121Over $2,242 but not over $3,363$39.24 plus 2.5% of excess over $2,2426 more rows • 30 Mar 2022

How do I pay Missouri state income tax?

The Missouri Department of Revenue accepts online payments — including extension and estimated tax payments — using a credit card or eCheck. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.

How do I pay taxes to the state of Missouri?

Paying Online The Missouri Department of Revenue accepts online payments — including extension and estimated tax payments — using a credit card or eCheck. An eCheck is an easy and secure method to pay your individual income taxes by electronic bank draft.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MO DoR 2643 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including MO DoR 2643. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in MO DoR 2643?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your MO DoR 2643 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out the MO DoR 2643 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign MO DoR 2643 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is MO DoR 2643?

MO DoR 2643 is a tax form used by businesses operating in the state of Missouri to report certain tax-related information to the Missouri Department of Revenue.

Who is required to file MO DoR 2643?

Businesses in Missouri that meet specific criteria for tax reporting obligations are required to file MO DoR 2643.

How to fill out MO DoR 2643?

To fill out MO DoR 2643, businesses must gather required financial information and complete the form by providing accurate data in the designated fields, following any instructions provided by the Missouri Department of Revenue.

What is the purpose of MO DoR 2643?

The purpose of MO DoR 2643 is to ensure compliance with state tax laws by collecting relevant tax information from businesses operating in Missouri.

What information must be reported on MO DoR 2643?

MO DoR 2643 requires businesses to report information such as gross receipts, deductions, and other tax-related data as specified by the Missouri Department of Revenue.

Fill out your MO DoR 2643 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR 2643 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.