KS RF-9 2019 free printable template

Show details

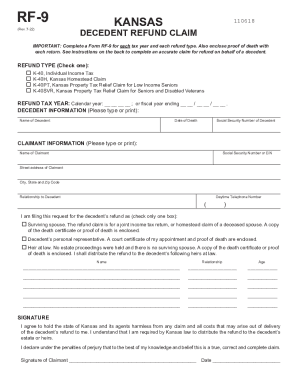

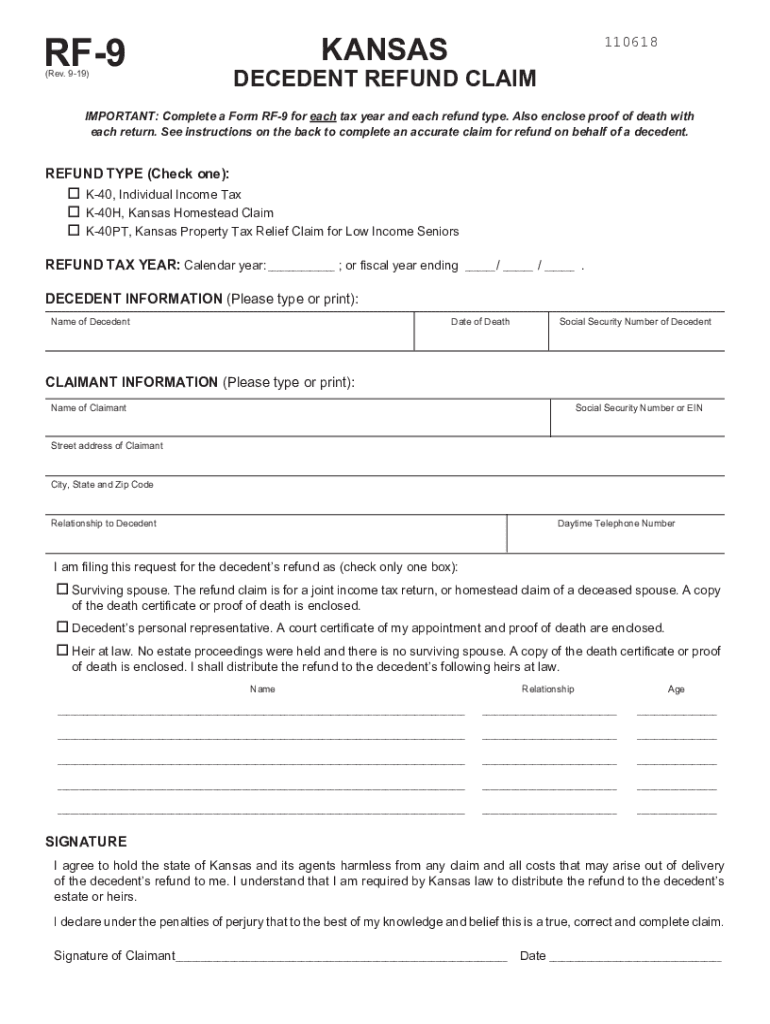

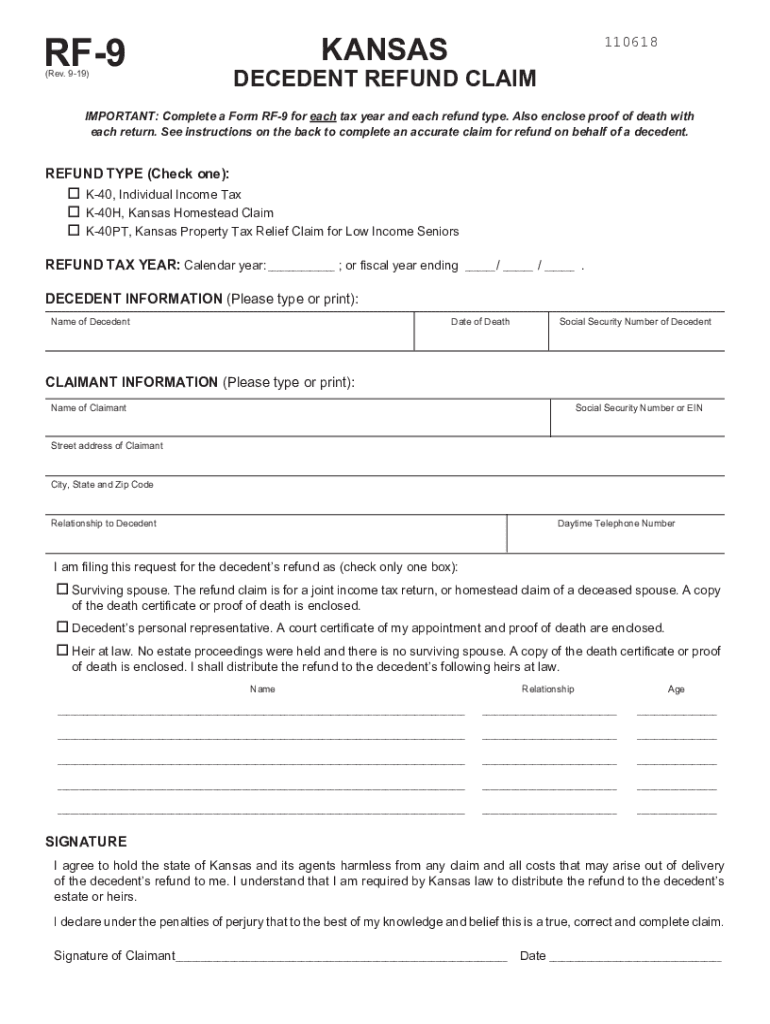

RF-9 KANSAS Decedent Refund Claim Rev. 7/13 IMPORTANT Complete a Form RF-9 for each tax year and each refund type. I understand that I am required by Kansas law to distribute the refund to the decedent s estate or heirs. I declare under the penalties of perjury that to the best of my knowledge and belief this is a true correct and complete claim. Signature of Claimant Date INSTRUCTIONS FOR FORM RF-9 GENERAL INFORMATION This form is used to claim a refund on behalf of a deceased taxpayer. If...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KS RF-9

Edit your KS RF-9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS RF-9 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS RF-9 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KS RF-9. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS RF-9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS RF-9

How to fill out KS RF-9

01

Obtain the KS RF-9 form from the appropriate agency or download it from their website.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Enter the date of the application in the designated field.

04

Provide detailed information regarding the purpose of the application in the specified section.

05

If required, include supporting documentation that verifies the details provided on the form.

06

Review your filled-out form for accuracy and completeness.

07

Sign and date the form at the bottom to certify that the information is true and correct.

08

Submit the completed form to the designated office either in person or via mail as instructed.

Who needs KS RF-9?

01

Individuals or businesses applying for a specific permit or registration within the Kansas jurisdiction.

02

Anyone needing to document or formalize a request related to Kansas state regulations.

03

Organizations that require compliance with regulatory requirements in their operations.

Fill

form

: Try Risk Free

People Also Ask about

Does Kansas have state income tax?

Kansas has a graduated individual income tax, with rates ranging from 3.10 percent to 5.70 percent. There are also jurisdictions that collect local income taxes. Kansas has a 4.00 percent to 7.00 percent corporate income tax rate.

What is Kansas Department of Revenue homestead refund?

The Homestead Refund is a rebate program for the property taxes paid by homeowners. The refund is based on a portion of the property tax paid on a Kansas resident's home. The maximum refund is $700. To qualify you must be a Kansas resident, living in Kansas the entire year.

What is property tax relief for seniors in Kansas?

The SAFESR property tax relief claim (K-40PT) allows a refund of property tax for low income senior citizens that own their home. The refund is 75% of the property taxes actually and timely paid on real or personal property used as their principal residence.

Who is required to file Kansas state tax return?

Kansas residents and nonresidents of Kansas earning income from Kansas sources are required to annually file an income tax return, K-40. Kansas income tax conforms to many provisions of the Internal Revenue Service.

Do I need to file a state tax return in Kansas?

Kansas residents and nonresidents of Kansas earning income from Kansas sources are required to annually file an income tax return, K-40. Kansas income tax conforms to many provisions of the Internal Revenue Service.

What is a RF 9 form?

INSTRUCTIONS FOR FORM RF-9 GENERAL INFORMATION. This form is used to claim a refund on behalf of a deceased taxpayer. You MUST complete a separate Form RF-9 for each type of tax refund claimed.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in KS RF-9?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your KS RF-9 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit KS RF-9 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your KS RF-9, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit KS RF-9 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute KS RF-9 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is KS RF-9?

KS RF-9 is a form used by employers in Kansas to report information about their employees and wages for state tax purposes.

Who is required to file KS RF-9?

Employers who have employees working in Kansas and are liable for Kansas income tax withholding are required to file KS RF-9.

How to fill out KS RF-9?

To fill out KS RF-9, employers must provide accurate employee information including names, social security numbers, and the amount of wages paid, along with any applicable withholding amounts.

What is the purpose of KS RF-9?

The purpose of KS RF-9 is to document employee wages and withholding information for Kansas income tax purposes, ensuring compliance with state tax laws.

What information must be reported on KS RF-9?

Information that must be reported on KS RF-9 includes employee names, social security numbers, total wages paid, and Kansas state tax withheld.

Fill out your KS RF-9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS RF-9 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.