CA FTB 3537 2021 free printable template

Show details

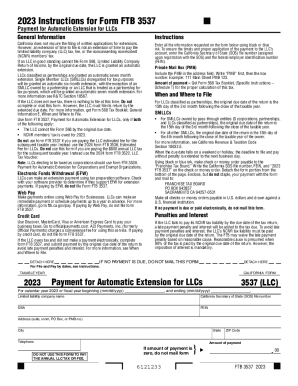

2021 Instructions for Form FT 3537 Payment for Automatic Extension for LCS General InformationInstructionsCalifornia does not require the filing of written applications for extensions. However, an

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 3537

Edit your CA FTB 3537 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 3537 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 3537 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA FTB 3537. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 3537 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 3537

How to fill out CA FTB 3537

01

Obtain the CA FTB 3537 form from the California Franchise Tax Board website.

02

Enter your name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) at the top of the form.

03

Provide your business information, including the name and address of your business.

04

Complete Part I to indicate the type of entity you are filing for (e.g., partnership, LLC, corporation).

05

Fill out Part II with the reason for the return and any related income or tax information.

06

Indicate any applicable tax credits in Part III.

07

Review the form for accuracy and completeness.

08

Sign and date the form.

09

Submit the form to the address provided in the instructions, typically along with any payment if applicable.

Who needs CA FTB 3537?

01

Businesses that are subject to California tax and have a tax liability.

02

Partnerships, Limited Liability Companies (LLCs), and corporations operating in California.

03

Taxpayers making estimated tax payments to the state of California.

Fill

form

: Try Risk Free

People Also Ask about

What is the form 3537 payment?

Use form FTB 3537, Payment for Automatic Extension for LLCs, only if both of the following apply: The LLC cannot file Form 568 by the original due date. NCNR members' tax is owed for 2022. Do not use form FTB 3537 if you are paying the LLC estimated fee for the subsequent taxable year.

Do you have to pay the $800 California Corp fee the first year?

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

Do I have to pay taxes on an LLC that made no money California?

LLC Corporations It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income.

How do I pay a $800 LLC fee in California?

If you start to operate an LLC business in California, you need to pay the first $800 fee in the 4th month after the approval of your LLC. After that, you will also need to pay another $800 in annual tax due date on April 15th every year. To pay that, you need to file Form 3522, called the annual LLC Tax Voucher.

What is California Form 3537?

Use form FTB 3537, Payment for Automatic Extension for LLCs, only if both of the following apply: The LLC cannot file Form 568 by the original due date. NCNR members' tax is owed for 2022. Do not use form FTB 3537 if you are paying the LLC estimated fee for the subsequent taxable year.

How do I file an extension for an LLC in California?

Use form FTB 3537, Payment for Automatic Extension for LLCs, only if both of the following apply: The LLC cannot file Form 568 by the original due date. NCNR members' tax is owed for 2022. Do not use form FTB 3537 if you are paying the LLC estimated fee for the subsequent taxable year.

What is California form 3519?

The CA 3519, Payment for Automatic Extension for Individuals, is both an extension and a payment. It is labeled 3519-V in View. File it only if the taxpayer's return cannot be filed by the original due date and tax is owed. Form 3519 need not be filed if tax is not owed - a six-month extension is automatically granted.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CA FTB 3537 online?

The editing procedure is simple with pdfFiller. Open your CA FTB 3537 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit CA FTB 3537 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing CA FTB 3537.

How do I edit CA FTB 3537 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as CA FTB 3537. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is CA FTB 3537?

CA FTB 3537 is a form used by the California Franchise Tax Board (FTB) for making an estimated tax payment for individuals and entities that expect to owe tax of $500 or more when they file their return.

Who is required to file CA FTB 3537?

Taxpayers who expect to owe $500 or more in California state taxes are required to file CA FTB 3537, including individuals, estates, and trusts.

How to fill out CA FTB 3537?

To fill out CA FTB 3537, taxpayers need to provide their personal information, such as name, Social Security number, and address, along with the estimated tax payment amount for the current tax year, and then submit the form along with the payment, either electronically or by mail.

What is the purpose of CA FTB 3537?

The purpose of CA FTB 3537 is to allow taxpayers to make advance payments towards their California state taxes, ensuring they meet their tax obligations and minimize interest and penalties for underpayment.

What information must be reported on CA FTB 3537?

Information required on CA FTB 3537 includes the taxpayer's name, Social Security number or taxpayer identification number, address, the tax year for which the estimated payment is being made, and the amount of the estimated tax payment.

Fill out your CA FTB 3537 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 3537 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.