Get the free Partage du patrimoine familial et liquidation du rgime ...

Show details

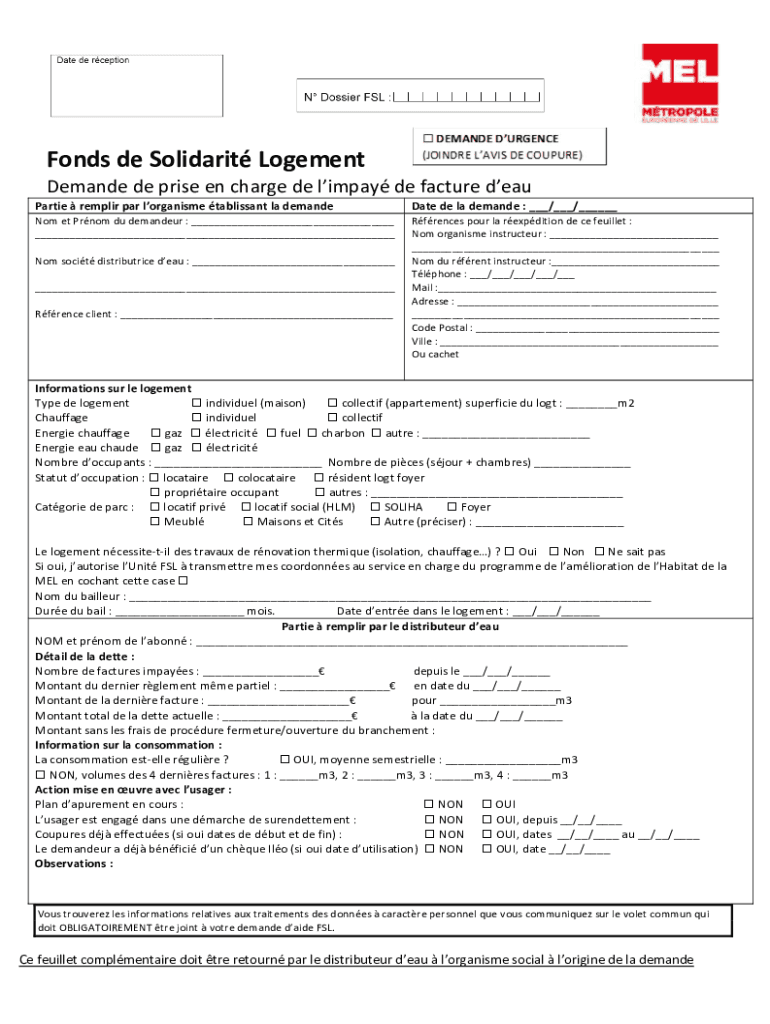

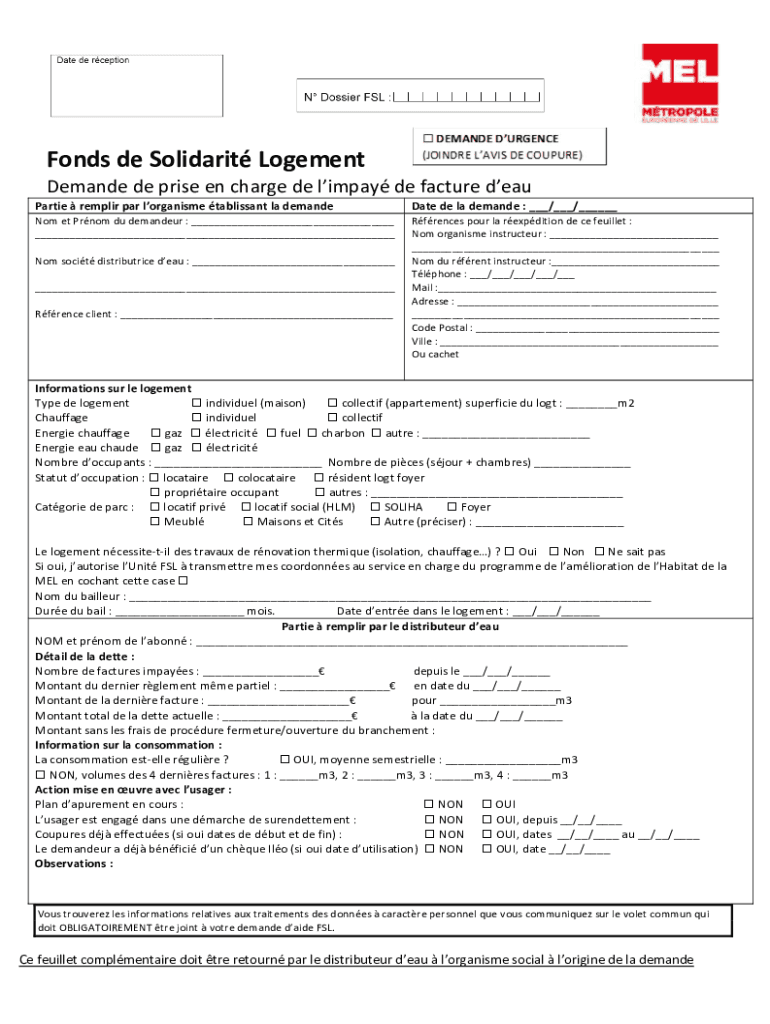

Finds de Solidarit Movement Demand DE price en charge DE limply DE facture deal Parties repair par organism talisman la demanded DE la demand : ___/___/___No met Prom Du demander : ___ ___References

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partage du patrimoine familial

Edit your partage du patrimoine familial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partage du patrimoine familial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit partage du patrimoine familial online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit partage du patrimoine familial. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partage du patrimoine familial

How to fill out partage du patrimoine familial

01

Begin by gathering all necessary documents related to the family assets.

02

Determine the value of each asset, including real estate, financial accounts, investments, and personal belongings.

03

Consult with a legal professional or notary to understand the legal requirements and specific steps involved in the process.

04

Clearly identify and list the heirs who are entitled to a share of the family wealth.

05

Distribute the assets among the heirs according to the legal provisions and the specific wishes of the deceased, if applicable.

06

Prepare a detailed inventory of the assets and their respective values, and provide copies to all involved parties.

07

Obtain any necessary approvals or signatures from the heirs, as well as the legal authority overseeing the process.

08

Document the distribution of assets in a written agreement or legal document, ensuring that all parties involved understand and accept the terms.

09

Keep copies of all relevant documents and agreements for future reference and legal purposes.

10

If needed, consult with a tax professional to understand any tax implications or obligations related to the distribution of the family wealth.

Who needs partage du patrimoine familial?

01

Partage du patrimoine familial is needed by individuals or families who need to divide and distribute their shared assets among heirs after the death of a family member.

02

This legal process ensures a fair and equitable distribution of the family wealth according to the applicable laws and the specific wishes of the deceased, if indicated.

03

It is important for those involved to properly follow the process to avoid disputes or legal complications in the future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send partage du patrimoine familial for eSignature?

Once your partage du patrimoine familial is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I execute partage du patrimoine familial online?

Completing and signing partage du patrimoine familial online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit partage du patrimoine familial on an Android device?

With the pdfFiller Android app, you can edit, sign, and share partage du patrimoine familial on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is partage du patrimoine familial?

Partage du patrimoine familial is a legal process of dividing family assets and property among family members.

Who is required to file partage du patrimoine familial?

All family members involved in the inheritance process are required to file partage du patrimoine familial.

How to fill out partage du patrimoine familial?

Partage du patrimoine familial can be filled out with the assistance of a notary or legal professional to ensure accurate completion.

What is the purpose of partage du patrimoine familial?

The purpose of partage du patrimoine familial is to ensure fair distribution of family assets and property according to legal guidelines.

What information must be reported on partage du patrimoine familial?

Partage du patrimoine familial must include details of all family assets, property, and individuals involved in the inheritance process.

Fill out your partage du patrimoine familial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partage Du Patrimoine Familial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.