Get the free FIXED DEPOSIT

Show details

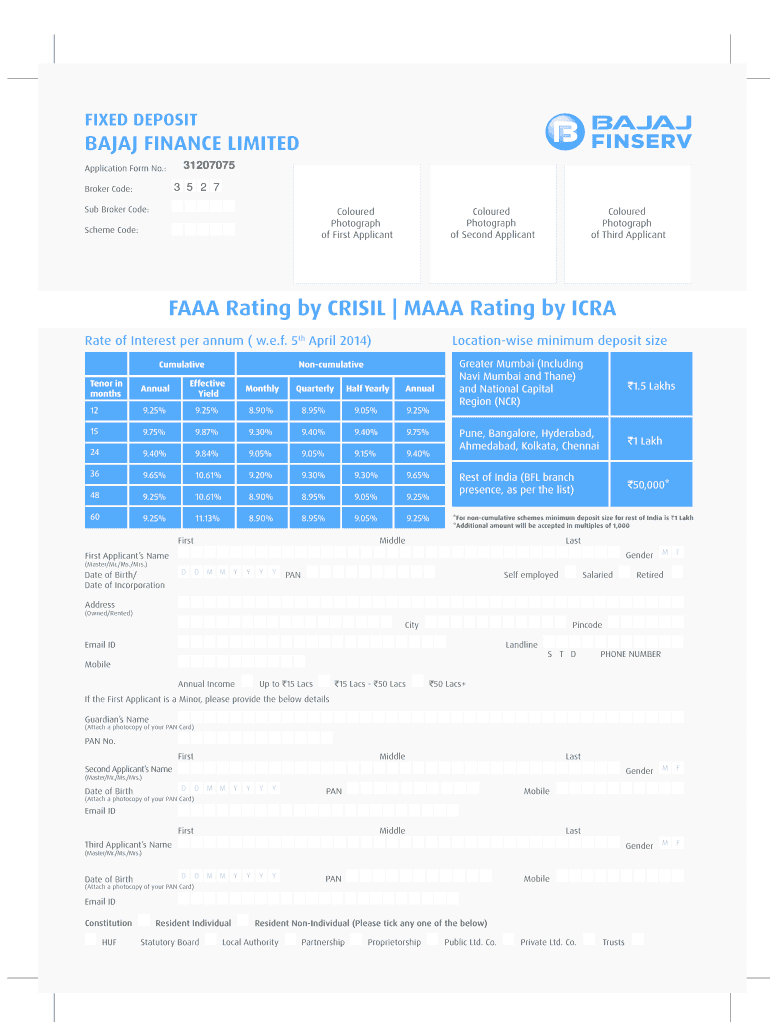

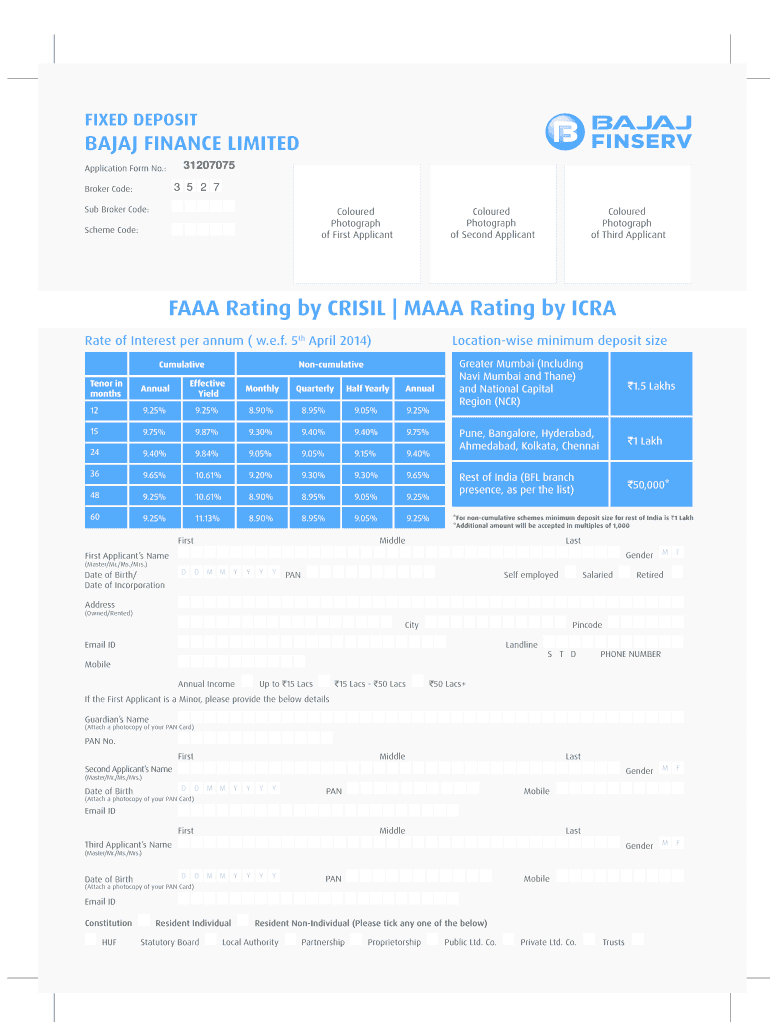

FIXED DEPOSIT BAJAJ FINANCE LIMITED 31205484 Application Form No.: 3 5 2 7 Broker Code: Sub Broker Code: Colored Photograph of Second Applicant Colored Photograph of First Applicant Scheme Code: Colored

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed deposit

Edit your fixed deposit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed deposit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fixed deposit online

To use the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fixed deposit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed deposit

How to fill out a fixed deposit:

01

Gather the necessary documents: You will typically need your identification proof, address proof, and PAN card. Make sure to have these documents handy before proceeding with the fixed deposit application process.

02

Choose the right financial institution: Research different banks or financial institutions to find the one that offers the best interest rates and terms for fixed deposits. Consider factors such as reputation, customer service, and convenience.

03

Visit the bank or financial institution: Go to the branch of the chosen institution in person or access their website to start the fixed deposit application process.

04

Fill out the application form: Request the fixed deposit application form from the bank staff or download it from their website. Fill in all the required details accurately, ensuring there are no mistakes or omissions.

05

Provide the necessary information: Along with your personal details, you will need to specify the deposit amount, tenure (duration of the fixed deposit), and the type of fixed deposit (e.g., cumulative or non-cumulative).

06

Review and sign the form: Carefully review the filled-out application form, ensuring all the information provided is correct. Once you are satisfied, sign the form and ensure that all other required signatures are obtained, if applicable.

07

Submit the application: Hand over the completed and signed application form to the bank staff. If you are applying online, follow the provided instructions to submit the form electronically.

08

Provide the deposit amount: Transfer the required deposit amount to the bank through a crossed cheque, demand draft, or online transfer. Confirm with the bank about the accepted modes of payment.

09

Receive the fixed deposit receipt: After the bank verifies the application and the deposit amount, they will issue a fixed deposit receipt or certificate. This document serves as proof of your fixed deposit and includes all relevant details such as the deposit amount, tenure, maturity date, and applicable interest rate.

Who needs a fixed deposit:

01

Individuals looking for a safe and secure investment: A fixed deposit is an ideal option for individuals seeking a secure investment avenue. As it is backed by a reputable financial institution, it offers a guaranteed return on investment.

02

Investors seeking regular income: Fixed deposits can be structured to provide periodic interest payments, which makes them suitable for individuals who rely on regular income. This can be beneficial for retirees or those who want to supplement their monthly earnings.

03

People with a low-risk tolerance: Fixed deposits are considered low-risk investments since they offer a fixed rate of return. The capital invested is not subject to market fluctuations, making it an attractive option for individuals who prefer stability and certainty over higher-risk investments.

04

Long-term savers: Fixed deposits are an excellent choice for individuals who want to save for a specific financial goal or accumulate wealth over time. The predetermined tenure of the fixed deposit ensures the investment remains intact for a specified period.

05

Individuals seeking liquidity: While fixed deposits are known for their fixed tenure, some banks offer a premature withdrawal option. This allows individuals to access their funds before maturity in case of emergencies or unexpected financial needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fixed deposit directly from Gmail?

fixed deposit and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find fixed deposit?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the fixed deposit in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I fill out fixed deposit on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your fixed deposit by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is fixed deposit?

Fixed deposit is a financial investment where a sum of money is deposited with a bank or financial institution for a fixed period of time at a fixed interest rate.

Who is required to file fixed deposit?

Individuals or organizations looking to invest their money in a safe and secure manner are required to file fixed deposit.

How to fill out fixed deposit?

To fill out fixed deposit, one must visit a bank or financial institution, provide the required information and deposit the desired amount of money.

What is the purpose of fixed deposit?

The purpose of fixed deposit is to provide a safe and secure investment option with a guaranteed return.

What information must be reported on fixed deposit?

The information that must be reported on fixed deposit includes the deposit amount, term of the deposit, interest rate, and account holder details.

Fill out your fixed deposit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Deposit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.