Get the free Tax PublicationsBoyar Wealth Management, Inc.

Show details

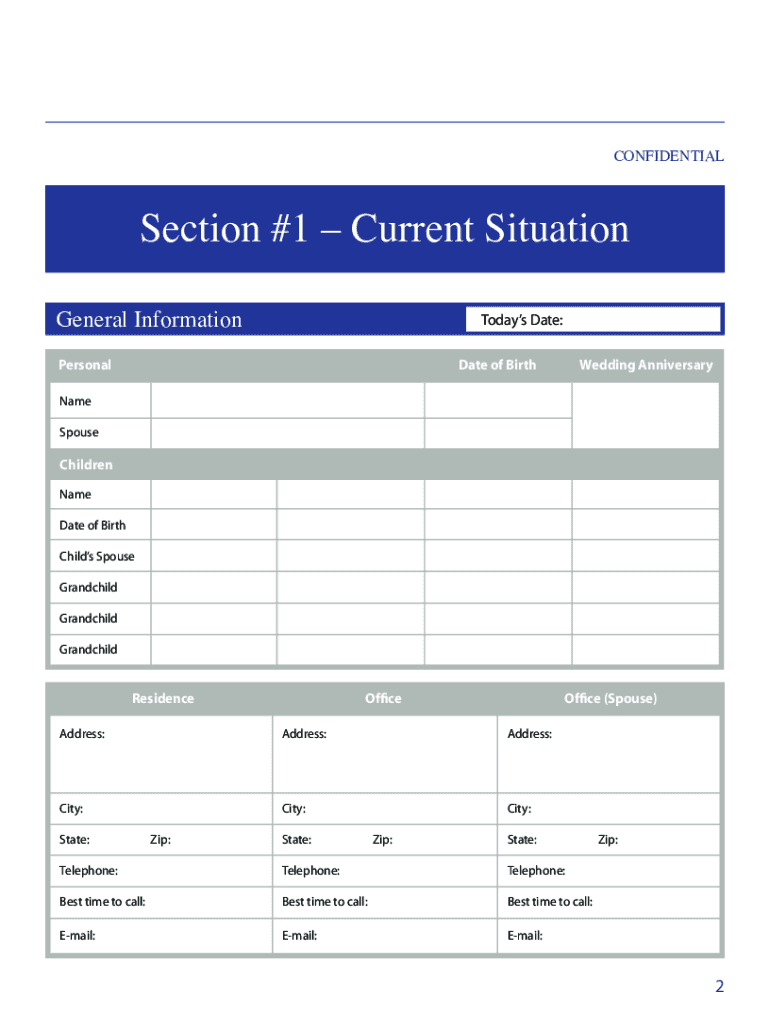

3837 NW Boca Raton blvd., suite 100 Boca Raton, fl 33431 tells 561.314.1840 fax 561.989.0078 damon.boyar@lpl.comConfidential Financial Discovery Form Thank you for the opportunity to assist you with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax publicationsboyar wealth management

Edit your tax publicationsboyar wealth management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax publicationsboyar wealth management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax publicationsboyar wealth management online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax publicationsboyar wealth management. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax publicationsboyar wealth management

How to fill out tax publicationsboyar wealth management

01

To fill out tax publications for Boyar Wealth Management, follow these steps:

02

Start by gathering all necessary financial documents, including income statements, investment statements, and expense records.

03

Review and understand the specific tax publications required by Boyar Wealth Management. These may include forms such as 1040, Schedule A, Schedule B, and Schedule D.

04

Organize your financial information according to the categories specified in each tax publication. This can include categorizing income, deductions, investments, and capital gains/losses.

05

Carefully fill out each section of the tax publications, ensuring accuracy and attention to detail.

06

Double-check all calculations and information before submitting the completed tax publications.

07

If you have any questions or concerns during the process, consult with a tax professional or contact Boyar Wealth Management for guidance.

08

Submit the filled-out tax publications to the designated entity as per Boyar Wealth Management's instructions.

09

Keep copies of all submitted tax publications for future reference and recordkeeping.

Who needs tax publicationsboyar wealth management?

01

Tax publications from Boyar Wealth Management are needed by individuals or entities who are clients of Boyar Wealth Management and require assistance with tax filing and compliance.

02

These tax publications are specifically designed to meet the unique requirements and guidelines set forth by Boyar Wealth Management and may not be applicable to individuals or entities not associated with this financial institution.

03

It is recommended to consult with Boyar Wealth Management directly to determine if their tax publications are appropriate for your specific financial situation and needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax publicationsboyar wealth management to be eSigned by others?

When you're ready to share your tax publicationsboyar wealth management, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete tax publicationsboyar wealth management online?

pdfFiller has made it simple to fill out and eSign tax publicationsboyar wealth management. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I complete tax publicationsboyar wealth management on an Android device?

Use the pdfFiller Android app to finish your tax publicationsboyar wealth management and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is tax publicationsboyar wealth management?

Tax Publicationsboyar Wealth Management refers to a comprehensive suite of services and resources aimed at assisting individuals and businesses with their tax obligations and wealth management strategies, including guidance on tax filings and asset management.

Who is required to file tax publicationsboyar wealth management?

Individuals and businesses with taxable income, investments, or assets that may trigger tax liabilities are typically required to file Tax Publicationsboyar Wealth Management.

How to fill out tax publicationsboyar wealth management?

To fill out Tax Publicationsboyar Wealth Management, gather all necessary financial documents, accurately complete the required forms, and provide detailed information about income, deductions, and assets, ensuring compliance with tax regulations.

What is the purpose of tax publicationsboyar wealth management?

The purpose of Tax Publicationsboyar Wealth Management is to facilitate effective tax planning and compliance, optimize tax liabilities, and enhance overall financial wellbeing through informed wealth management strategies.

What information must be reported on tax publicationsboyar wealth management?

Information that must be reported includes personal identification details, sources of income, deductions, credits, assets and investments, and any other data relevant to establishing tax liabilities.

Fill out your tax publicationsboyar wealth management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Publicationsboyar Wealth Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.