Get the free T Change in Accounting Period 990-PF Return of Private ...

Show details

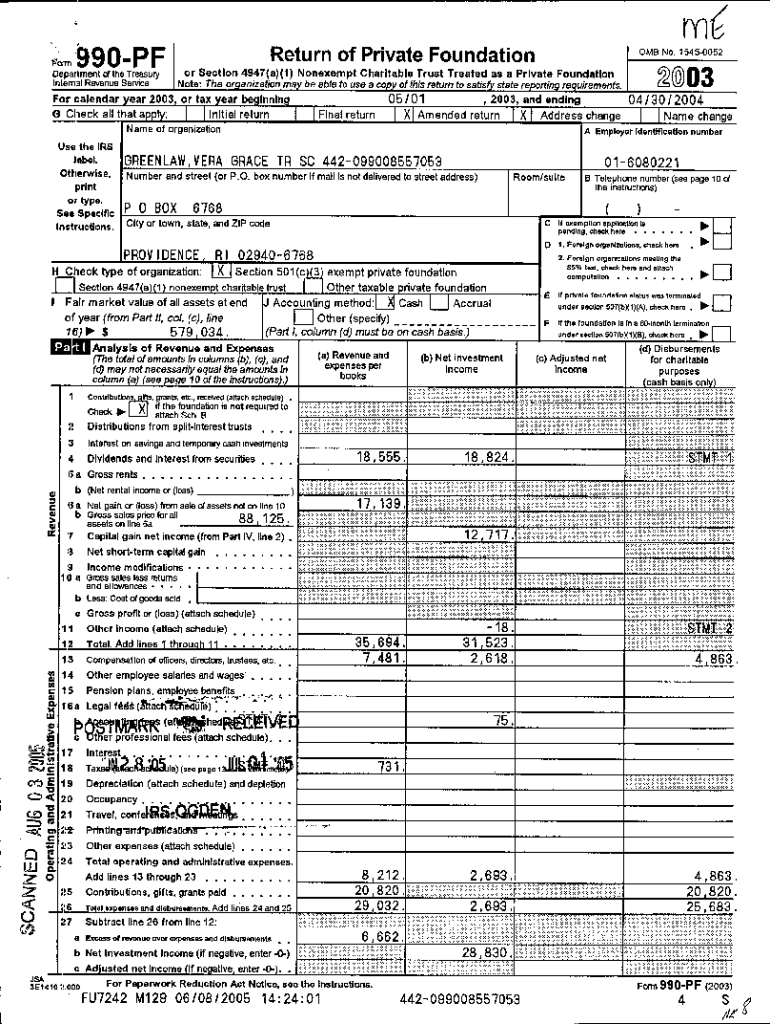

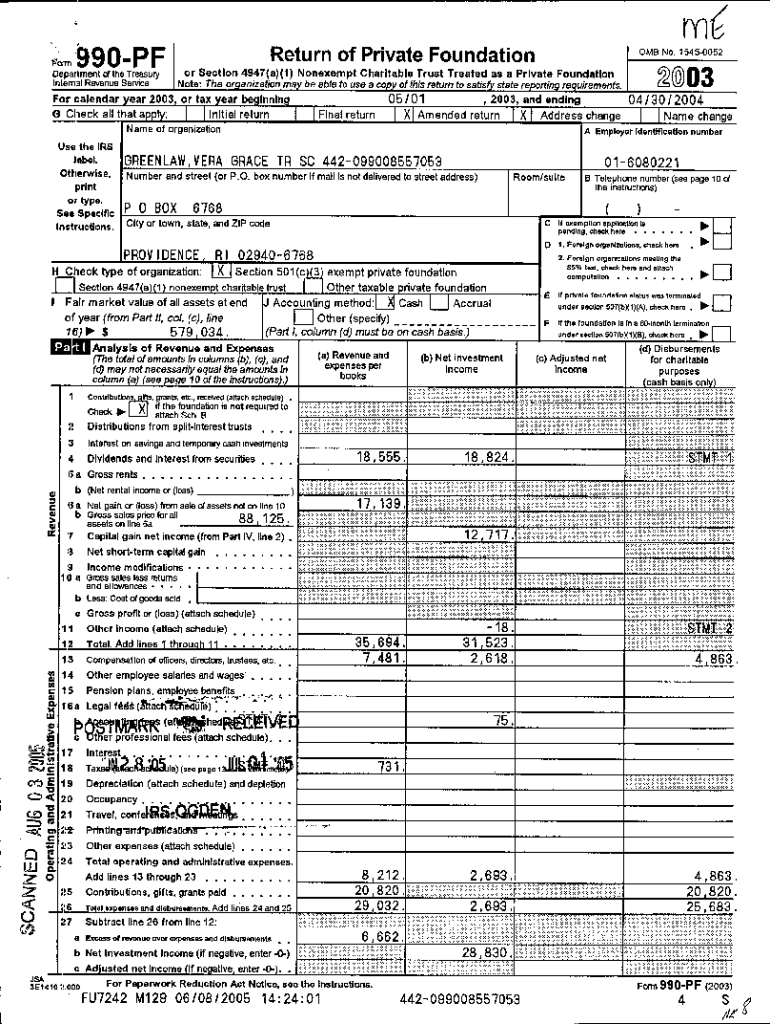

P011M\'9 90PFI 1OMB No. 15450052Return of Private Foundation2003a)(1) Nonexempt Charitable Trust Treated as a Private Foundation on may be able to use a copy of this return to satisfy state reporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t change in accounting

Edit your t change in accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t change in accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t change in accounting online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit t change in accounting. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t change in accounting

How to fill out t change in accounting

01

To fill out a change in accounting, follow these steps:

02

Gather all necessary information and documents related to the change.

03

Determine the reason for the change and the impact it will have on the financial statements.

04

Identify the affected accounts and make the necessary adjustments.

05

Review and update the chart of accounts if needed.

06

Record the change in the general ledger by creating appropriate journal entries.

07

Ensure that all transactions and balances are correctly reflected in the new accounting system or software.

08

Reconcile the financial statements to ensure accuracy.

09

Communicate the change to relevant parties such as auditors, stakeholders, and regulatory authorities.

10

Monitor and analyze the impact of the change on the company's performance and financial results.

Who needs t change in accounting?

01

T change in accounting may be needed by:

02

Companies that are restructuring or undergoing mergers and acquisitions.

03

Businesses that have identified errors or inconsistencies in their previous accounting methods.

04

Organizations that need to comply with changes in accounting standards or regulations.

05

Entities that are transitioning from manual or outdated accounting systems to modern software solutions.

06

Startups or new businesses that are setting up their accounting systems for the first time.

07

Companies that are expanding globally and need to adapt their accounting practices to international standards.

08

Businesses seeking to improve financial reporting accuracy and transparency.

09

Organizations that have experienced significant growth or changes in the nature of their operations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send t change in accounting for eSignature?

When you're ready to share your t change in accounting, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in t change in accounting without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your t change in accounting, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out t change in accounting using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign t change in accounting. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is the change in accounting?

The change in accounting refers to any modification or adjustment made to an organization's accounting methods or practices.

Who is required to file the change in accounting?

Any organization or individual that makes a change in accounting must file the necessary documentation.

How to fill out the change in accounting?

To fill out the change in accounting, one must provide details about the old accounting method, the new accounting method, and the reasons for the change.

What is the purpose of the change in accounting?

The purpose of the change in accounting is to ensure accuracy and consistency in financial reporting.

What information must be reported on the change in accounting?

The information reported on the change in accounting includes details about the old and new accounting methods, reasons for the change, and any potential impact on financial statements.

Fill out your t change in accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T Change In Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.