Get the free Eoi Life Insurance

Show details

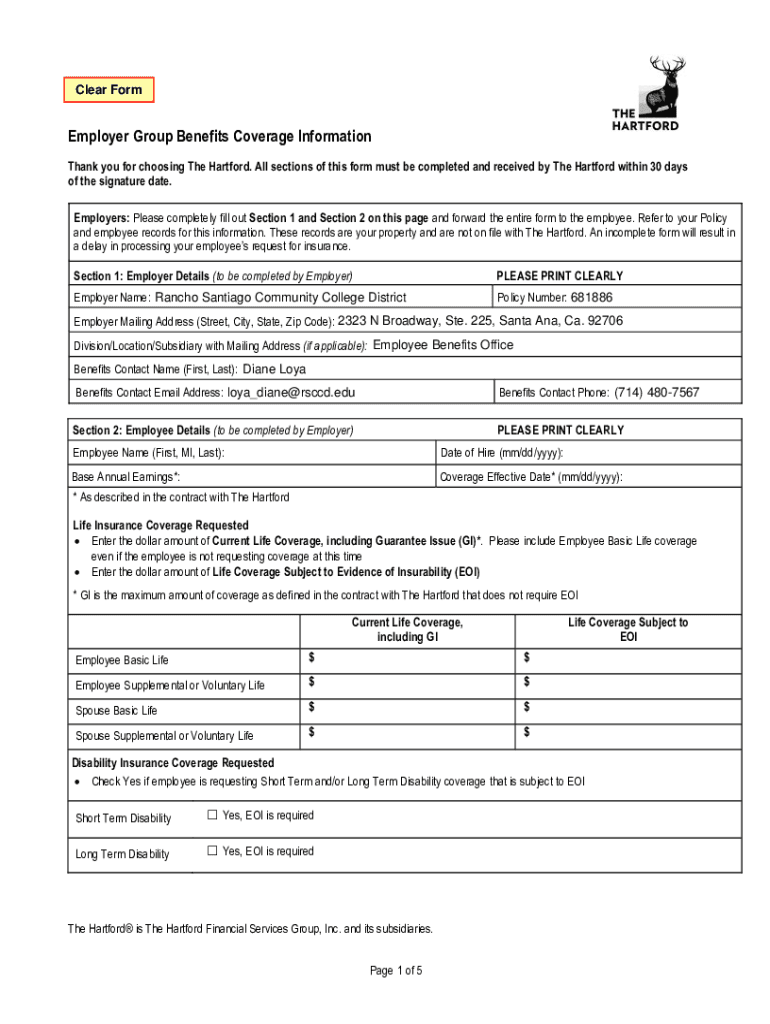

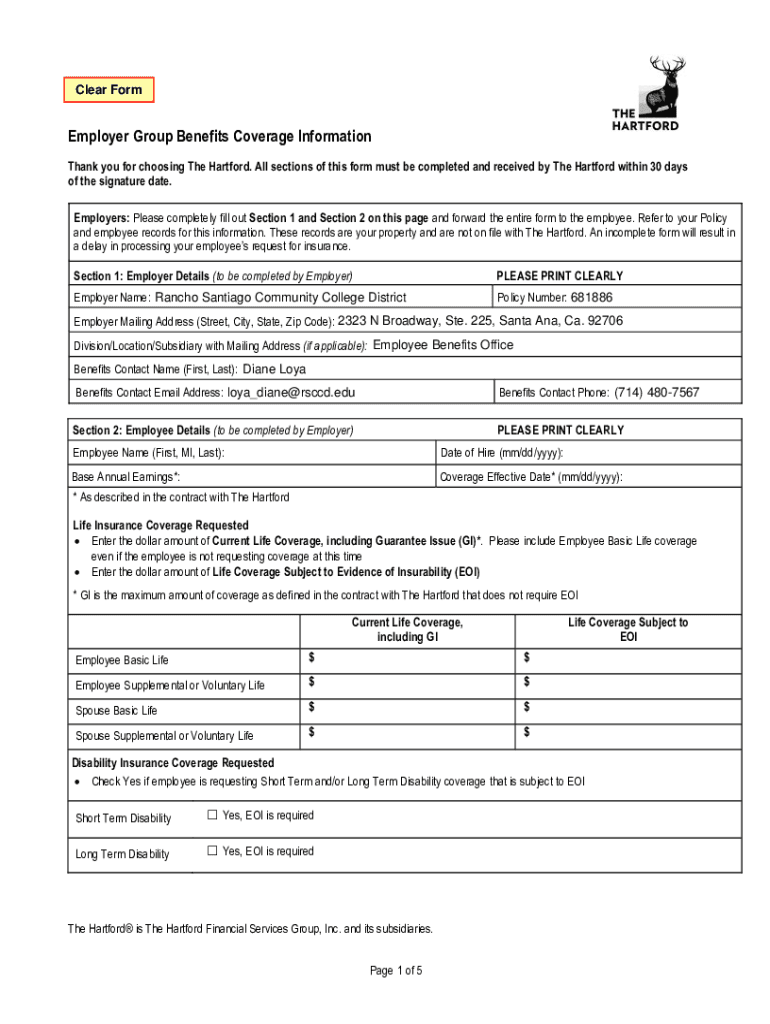

Clear FormEmployer Group Benefits Coverage Information Thank you for choosing The Hartford. All sections of this form must be completed and received by The Hartford within 30 days of the signature

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign eoi life insurance

Edit your eoi life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eoi life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit eoi life insurance online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit eoi life insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out eoi life insurance

How to fill out eoi life insurance

01

To fill out an EOI (Evidence of Insurability) for life insurance, follow these steps:

02

Obtain the EOI form: Contact your insurance provider or visit their website to request the EOI form.

03

Gather necessary information: Before filling out the form, gather all the required information such as your personal details, medical history, lifestyle habits, and any existing insurance coverages.

04

Read the instructions: Carefully read the instructions provided with the form to understand the requirements and additional documents, if any.

05

Fill out the form: Provide accurate and complete information on the form, including your name, address, contact details, social security number, date of birth, and relevant medical details. Fill in all the applicable sections and answer all the questions truthfully.

06

Attach supporting documents: If required, attach any supporting documents as mentioned in the instructions. This may include medical records, medical examination results, or previous insurance policies.

07

Review and sign: Before submitting, carefully review the filled-out form to ensure accuracy. Then, sign and date the form as indicated.

08

Submit the EOI form: Send the completed EOI form to the designated address provided by your insurance provider. Follow any specific submission instructions mentioned in the form or accompanying documents.

09

Follow up: Inquire with your insurance provider about the status of your EOI submission. They may require additional information or clarification before making a final decision.

10

Note: It's important to be truthful and provide accurate information on the EOI form. Providing false or misleading information can lead to coverage denial or cancellation of the insurance policy.

Who needs eoi life insurance?

01

EOI life insurance is typically needed by individuals who:

02

- Are applying for a life insurance policy that requires underwriting

03

- Have a pre-existing medical condition or a history of serious illnesses

04

- Are older or have reached a certain age where insurance companies may require additional proof of insurability

05

- Are looking to increase their existing life insurance coverage beyond a certain threshold set by the insurance provider

06

- Have recently engaged in high-risk activities or occupations, which may raise concerns for the insurance provider

07

By providing additional evidence of insurability through an EOI, individuals in the above situations can demonstrate that they are still insurable and qualify for the desired life insurance coverage. It allows the insurance company to assess any potential risks associated with the applicant and make an informed decision.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify eoi life insurance without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your eoi life insurance into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete eoi life insurance online?

pdfFiller has made it easy to fill out and sign eoi life insurance. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an eSignature for the eoi life insurance in Gmail?

Create your eSignature using pdfFiller and then eSign your eoi life insurance immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is eoi life insurance?

EOI life insurance is Evidence of Insurability, which is a form that applicants may need to fill out to provide additional information about their health to the insurance company before being approved for coverage.

Who is required to file eoi life insurance?

Applicants who are applying for life insurance coverage may be required to file EOI life insurance if requested by the insurance company.

How to fill out eoi life insurance?

To fill out EOI life insurance, applicants usually need to complete a form provided by the insurance company with information about their health history and any pre-existing conditions.

What is the purpose of eoi life insurance?

The purpose of EOI life insurance is for the insurance company to assess the risk of providing coverage to an applicant based on their health status and medical history.

What information must be reported on eoi life insurance?

Applicants may need to report information about their medical history, current health status, and any pre-existing conditions on EOI life insurance.

Fill out your eoi life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Eoi Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.