Get the free ESTATE OF CLAIR W - dcba-pa

Show details

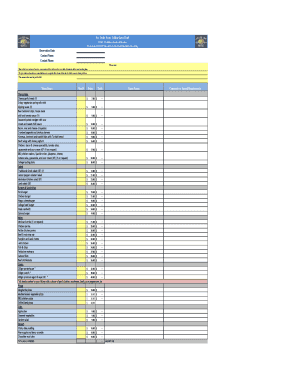

ADVANCE SHEET THE Pages 484487 Dauphin County Reporter (USPS 810200) A WEEKLY JOURNAL CONTAINING THE DECISIONS RENDERED IN THE 12th JUDICIAL DISTRICT No. 5653, Vol. 123 April 11, 2008, No. 106 Entered

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate of clair w

Edit your estate of clair w form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate of clair w form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate of clair w online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit estate of clair w. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate of clair w

To fill out the estate of Clair W, follow the steps below:

01

Gather all relevant documents: Collect all the necessary documents related to Clair W's assets, including bank statements, deeds to properties, insurance policies, investment records, and any other financial documents.

02

Determine the beneficiaries: Identify the beneficiaries of Clair W's estate. This could include family members, friends, or charitable organizations mentioned in the will or designated as beneficiaries of specific assets.

03

Appoint an executor: Find out who Clair W appointed as the executor of their estate. If there is no designated executor, consult with a legal professional to appoint an executor or administrator to handle the estate's administration.

04

Obtain Letters Testamentary/Letters of Administration: If you are the executor or administrator, obtain the necessary legal documents from the probate court, such as Letters Testamentary or Letters of Administration, which provide you with the authority to handle the estate.

05

Notify relevant parties: Inform the necessary parties about Clair W's passing, such as financial institutions, government agencies, and relevant service providers. This will ensure a smooth transition of assets and avoid any unauthorized access or use of accounts.

06

Locate and value assets: Identify all the assets owned by Clair W, including real estate, vehicles, bank accounts, investments, retirement accounts, and personal belongings. It is essential to obtain proper valuations for each asset.

07

Settle outstanding debts: Determine the outstanding debts or liabilities of Clair W's estate, including mortgages, loans, credit card debts, and any other obligations. Work with creditors to settle these debts and resolve any outstanding issues.

08

Pay taxes: Determine if any estate or inheritance taxes are owed to the state or federal government. Consult with a tax professional to ensure proper filing and payment of these taxes.

09

Distribute assets according to the will: Follow Clair W's stated wishes in their will regarding the distribution of assets. If there is no will, follow the laws of intestacy in your jurisdiction to distribute the assets among the beneficiaries.

10

Keep records and file necessary paperwork: Maintain detailed records of all estate-related activities, including receipts, correspondence, and distribution of assets. Complete and file all required legal paperwork with the appropriate probate court or government agencies.

Who needs the estate of Clair W?

Clair W's estate is typically needed by:

01

Beneficiaries: The individuals or organizations named in Clair W's will or designated as beneficiaries of specific assets are entitled to receive the assets mentioned.

02

Executor or Personal Representative: The person appointed by Clair W or the court to handle the administration of the estate, including gathering assets, paying debts, and distributing assets to the beneficiaries.

03

Creditors: If Clair W owed any debts or liabilities, the estate may be needed to settle those outstanding obligations.

04

Legal professionals: Lawyers, accountants, or other professionals may need access to the estate to assist with the legal and financial aspects of estate administration.

It is important to consult with a qualified legal professional or consult the specific laws in your jurisdiction for accurate guidance on the process of filling out the estate of Clair W.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is estate of clair w?

Estate of clair w refers to the process of settling the assets and debts of a deceased individual named Clair W.

Who is required to file estate of clair w?

The executor or administrator of Clair W's estate is required to file the estate of Clair W.

How to fill out estate of clair w?

To fill out estate of Clair W, the executor or administrator must gather all relevant financial information, assets, debts, and taxes related to the estate and submit them to the appropriate authorities.

What is the purpose of estate of clair w?

The purpose of estate of Clair W is to ensure that the assets and debts of the deceased individual are properly accounted for and distributed according to their will or state laws.

What information must be reported on estate of clair w?

The estate of Clair W must report all assets, debts, taxes, and any other financial information related to the deceased individual's estate.

How can I modify estate of clair w without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including estate of clair w, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete estate of clair w online?

pdfFiller has made filling out and eSigning estate of clair w easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete estate of clair w on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your estate of clair w. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your estate of clair w online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Of Clair W is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.