IRS 1120-W 2013 free printable template

Show details

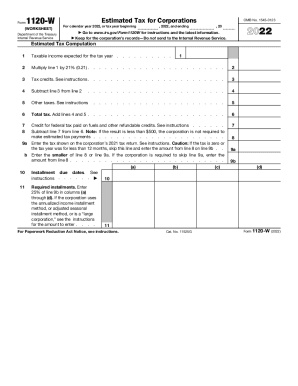

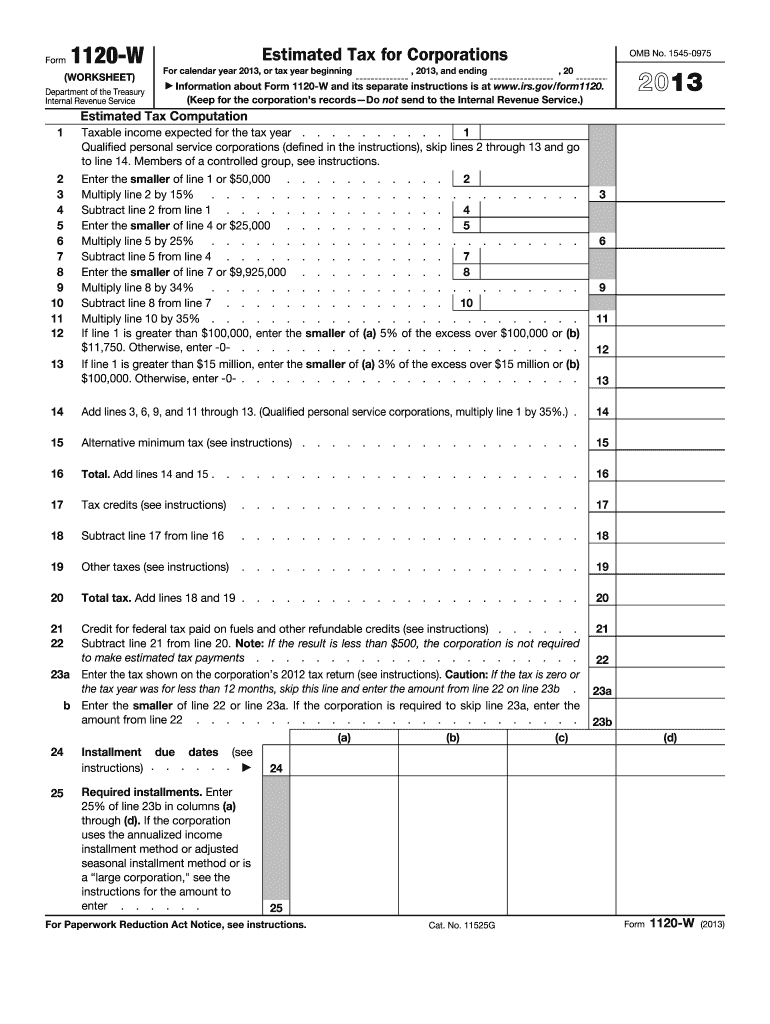

Form 1120-W (WORKSHEET) Department of the Treasury Internal Revenue Service Estimated Tax for Corporations For calendar year 2013, or tax year beginning OMB No. 1545-0975, 2013, and ending, 20 Information

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-W

How to edit IRS 1120-W

How to fill out IRS 1120-W

Instructions and Help about IRS 1120-W

How to edit IRS 1120-W

To edit IRS Form 1120-W, you can use forms editing tools that allow you to input or change your financial information accurately. Using tools from pdfFiller, you can easily fill out the form online by entering your details in the designated fields. Ensure that all information you provide is correct to avoid penalties or processing delays.

How to fill out IRS 1120-W

Filling out IRS Form 1120-W involves several steps. First, gather necessary financial documents including profit and loss statements, balance sheets, and previous tax returns. Next, use the following step-by-step instructions to complete the form:

01

Start with the corporation’s name and address.

02

Enter your Employer Identification Number (EIN).

03

Provide the taxable year for which you are estimating tax payments.

04

Calculate the estimated income and deductions for the year.

05

Complete the tax computation sections accurately.

Make sure to review the completed form for accuracy before submission. Using pdfFiller makes it easier since you can correct errors on-the-go.

About IRS 1120-W 2013 previous version

What is IRS 1120-W?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-W 2013 previous version

What is IRS 1120-W?

IRS Form 1120-W is the Estimated Tax for Corporations. It is used by corporations to calculate and estimate their tax liability for the current tax year, ensuring they make timely payments toward their taxes. The form allows corporations to avoid penalties by estimating their tax payments accurately.

What is the purpose of this form?

The purpose of IRS Form 1120-W is to ensure corporations meet their federal tax obligations through estimated tax payments. By estimating their expected income for the year, corporations can make payments that are spread throughout the year, minimizing the burden at year-end. This form is particularly important for corporations with significant income or tax liabilities to avoid underpayment penalties.

Who needs the form?

Corporations with a tax liability expected to be $500 or more for the tax year must file Form 1120-W. This includes C corporations and S corporations that opt to pay corporate taxes. If your corporation expects to owe less than this threshold, you are exempt from filing the form.

When am I exempt from filling out this form?

You are exempt from filing IRS Form 1120-W if your corporation expects to owe less than $500 in tax for the year. Additionally, if your corporation had no tax liability in the previous year and was not under the jurisdiction of U.S. tax requirements, you may also be exempt.

Components of the form

The components of IRS Form 1120-W include sections for entering estimated taxable income, taxes owed, and payments made. The form typically requires detailed reporting on the corporation's anticipated financial activities and tax-related computations. The clear sections help guide filers from estimating income to computing their federal tax liability accurately.

What are the penalties for not issuing the form?

Failing to file IRS Form 1120-W when required can result in a penalty of 5% of the unpaid tax per month, up to a maximum of 25%. Additionally, if insufficient estimated tax payments are made during the tax year, the corporation may be subject to underpayment penalties, which could further increase the overall tax obligation.

What information do you need when you file the form?

When filing IRS Form 1120-W, you will need data such as your corporation's taxable income, deductions, credits, and expected changes in tax liability. You should have recent financial statements and detailed projections available to ensure accurate estimations. This preparation helps in completing the form more efficiently and correctly.

Is the form accompanied by other forms?

IRS Form 1120-W is typically filed alone unless there are specific circumstances requiring additional forms. However, corporations may need to complete other related forms at the end of the tax year, such as Form 1120, to report final figures. It's crucial to check for any requirements based on your specific tax situation.

Where do I send the form?

The completed IRS Form 1120-W should be sent to the appropriate address listed in the form's instructions, which can vary based on your corporation's location and type. Filing electronically through approved software can also simplify this process, providing instant submission and confirmation options.

See what our users say