IRS W-4P 2022 free printable template

Show details

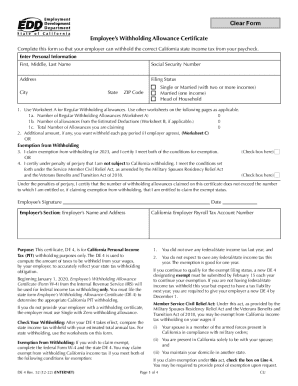

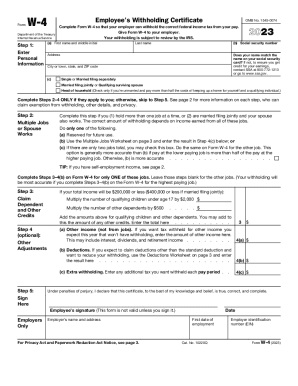

Form W-4P Withholding Certificate for Periodic Pension or Annuity Payments Department of the Treasury Internal Revenue Service Step 1 Enter Personal Information OMB No. 1545-0074 Give Form W-4P to the payer of your pension or annuity payments. For Privacy Act and Paperwork Reduction Act Notice see page 3. Cat. No. 10225T Date Form W-4P 2022 Page 2 General Instructions Section references are to the Internal Revenue Code. Future developments. For the latest information about any enacted after it...was published go to www.irs.gov/FormW4P. Purpose of form. Complete Form W-4P to have payers withhold the correct amount of federal income tax from your periodic pension annuity including commercial annuities profit-sharing and stock bonus plan or IRA payments. If too much tax is withheld you will generally be due a refund when you file your tax return. If your tax situation changes or you chose not to have federal income tax withheld and you now want withholding you should submit a new Form...W-4P. Self-employment. Generally you will owe both income and you and your spouse receive. If you do not have a job and want to pay these taxes through withholding from your payments you should enter the self-employment income in Step 4 a. Then compute your self-employment tax divide that tax by the number of payments remaining in the year and include that resulting amount per payment in Step 4 c. Caution If you have too little tax withheld you will generally owe tax when you file your tax...return and may owe a penalty unless you make timely payments of estimated tax. If too much tax is withheld you will generally be due a refund when you file your tax return. If your tax situation changes or you chose not to have federal income tax withheld and you now want withholding you should submit a new Form W-4P. Self-employment. Generally you will owe both income and you and your spouse receive. If you do not have a job and want to pay these taxes through withholding from your payments you...should enter the self-employment income in Step 4 a. Then complete Steps 1a 1b and 5. Generally if you are a U.S. citizen or a resident alien you are not permitted to elect not to have federal income tax withheld on payments to be delivered outside the United States and its possessions. Caution If you have too little tax withheld you will generally owe tax when you file your tax return and may owe a penalty unless you make timely payments of estimated tax. If too much tax is withheld you will...generally be due a refund when you file your tax return. If your tax situation changes or you chose not to have federal income tax withheld and you now want withholding you should submit a new Form W-4P. 505 Tax Withholding and Estimated Tax. Choosing not to have income tax withheld. You can choose not to have federal income tax withheld from your payments by writing No Withholding on Form W-4P in the space below Step 4 c. Then complete Steps 1a 1b and 5. Generally if you are a U.S. citizen or a...resident alien you are not permitted to elect not to have federal income tax withheld on payments to be delivered outside the United States and its possessions. Caution If you have too little tax withheld you will generally owe tax when you file your tax return and may owe a penalty unless you make timely payments of estimated tax. Instead use Form W-4R Withholding Certificate for these payments/distributions. For more information on withholding see Pub. 505 Tax Withholding and Estimated Tax....Choosing not to have income tax withheld. You can choose not to have federal income tax withheld from your payments by writing No Withholding on Form W-4P in the space below Step 4 c. Then complete Steps 1a 1b and 5. Generally if you are a U.S. citizen or a resident alien you are not permitted to elect not to have federal income tax withheld on payments to be delivered outside the United States and its possessions. Don t use Form W-4P for a nonperiodic payment note that distributions from an IRA...that are payable on demand are treated as nonperiodic payments or an eligible rollover distribution including a lump-sum pension payment. Instead use Form W-4R Withholding Certificate for these payments/distributions. For more information on withholding see Pub. 505 Tax Withholding and Estimated Tax. Choosing not to have income tax withheld. You can choose not to have federal income tax withheld from your payments by writing No Withholding on Form W-4P in the space below Step 4 c.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-4P

How to edit IRS W-4P

How to fill out IRS W-4P

Instructions and Help about IRS W-4P

How to edit IRS W-4P

To edit the IRS W-4P form, you can use pdfFiller’s editing tools. Start by uploading the form to the platform, which allows for easy modifications. You can add or remove information as necessary, ensuring that your details reflect current income and withholding preferences. Once your edits are completed, be sure to save your changes before proceeding to submission.

How to fill out IRS W-4P

Filling out the IRS W-4P form involves a few clear steps:

01

Download the form from the IRS website or access it through pdfFiller.

02

Complete your personal information, including your name, address, and Social Security number.

03

Indicate the amount of tax withholding you desire from your periodic payments.

04

Sign and date the form to verify the information is accurate.

Consult the form's instructions for specific guidelines based on your tax situation, ensuring all entries are accurate to avoid delays in processing.

About IRS W-4P 2022 previous version

What is IRS W-4P?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-4P 2022 previous version

What is IRS W-4P?

IRS W-4P is the Withholding Certificate for Pension or Annuity Payments. This form allows you to instruct the payer regarding the amount of federal income tax to withhold from your pension or annuity payments. Proper completion helps ensure that the correct amount is withheld, reducing potential tax liabilities at the end of the year.

What is the purpose of this form?

The purpose of the W-4P form is to provide the IRS with your tax withholding preferences for income received from pensions or annuities. By submitting this form, you can elect how much federal income tax will be deducted from your payments, helping you manage your tax obligations effectively.

Who needs the form?

Individuals receiving pensions, annuities, or certain retirement benefits need to complete the IRS W-4P form. Particularly, this is relevant for those wanting to adjust their withholding based on their projected tax obligations for the year. Failure to submit this form could result in higher withholding than necessary.

When am I exempt from filling out this form?

You may be exempt from submitting the W-4P if you have had no tax liability for the prior year and expect none for the current year. Additionally, if your pension or annuity payment is below a certain threshold, you might not need to fill out the form.

Components of the form

The IRS W-4P consists of several key sections, including personal information, tax withholding instructions, and signature lines. Each section guides users on providing the necessary information to ensure that withholding aligns with their tax situation.

What are the penalties for not issuing the form?

Not issuing the W-4P when required may result in improper withholding of federal income tax. This could lead to underpayment and potential penalties or interest on unpaid taxes. It’s vital to submit the form to avoid any complications with the IRS.

What information do you need when you file the form?

When filing the IRS W-4P, you need to provide personal identification information, including your name, address, and Social Security number. Additionally, details about your pension or annuity income and the desired withholding amount are necessary for accurate processing.

Is the form accompanied by other forms?

The IRS W-4P may not need to be submitted alongside other forms for most situations. However, if you are making adjustments that affect other tax forms, ensure that you check for any supplemental documentation your payer might require.

Where do I send the form?

Once you have completed the IRS W-4P form, submit it directly to the payer of your pension or annuity. It is essential to follow their specific submission guidelines, which may include mailing, faxing, or electronic submission options.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It takes a few minutes to sort things out, but overall it's very helpful

I have just started using the service, but so far, so good.

See what our users say