IRS W-4P 2022 free printable template

Instructions and Help about IRS W-4P

How to edit IRS W-4P

How to fill out IRS W-4P

About IRS W-4P 2022 previous version

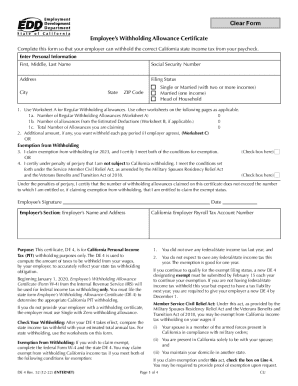

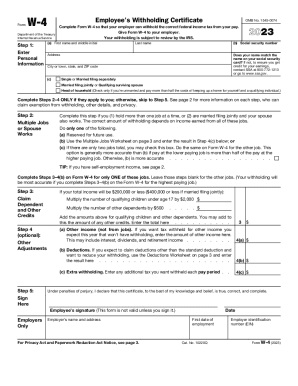

What is IRS W-4P?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-4P

What should I do if I realize there are mistakes on my submitted IRS W-4P?

If you spot mistakes on your IRS W-4P after submission, you should submit a corrected form as soon as possible to ensure accurate withholding. Check with your payer or financial institution on their specific process for corrections to avoid delays and ensure compliance.

How can I verify if the IRS has received my W-4P electronically?

You can verify the submission status of your IRS W-4P by contacting your payer or financial institution. They often have systems in place to confirm receipt and processing of forms, or you can ask for confirmation through their online portal if available.

What should I consider regarding record retention for my IRS W-4P?

It's advisable to retain a copy of your IRS W-4P for at least four years after submission, as this can be helpful in case of audits or discrepancies. Ensure that you keep it in a secure location to protect your personal information.

Are e-signatures acceptable for submitting the IRS W-4P?

Yes, many payers accept e-signatures for the IRS W-4P, but it's essential to confirm with your payer about their specific requirements. Make sure that any electronic submission meets the IRS standards for validity.

See what our users say