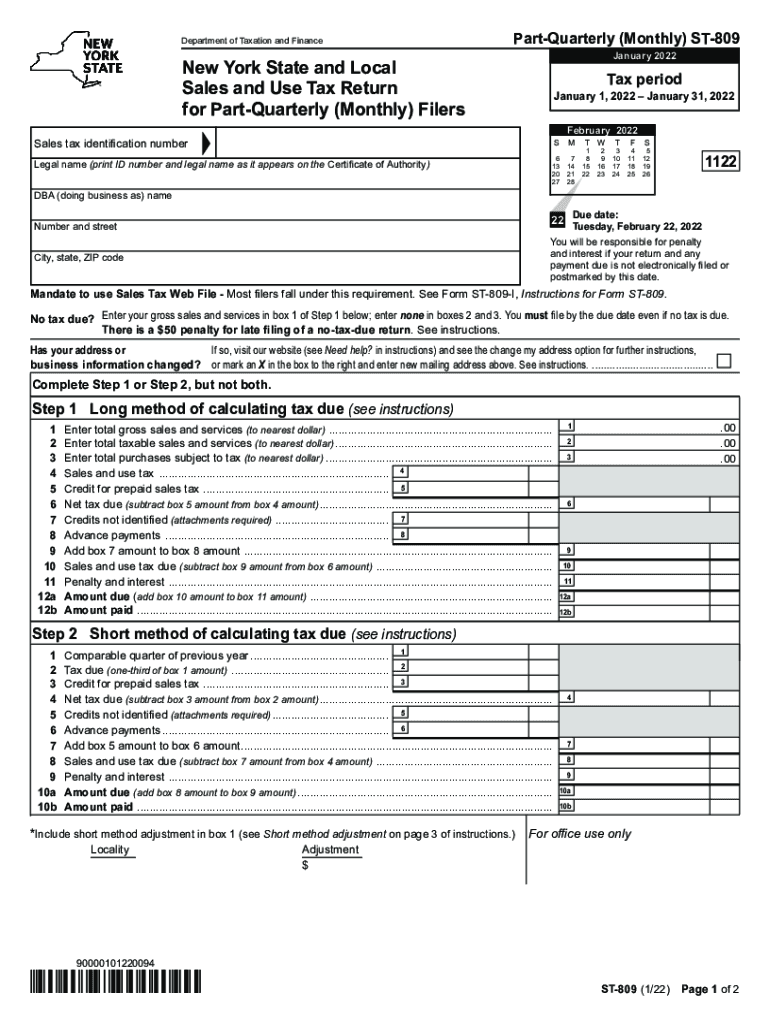

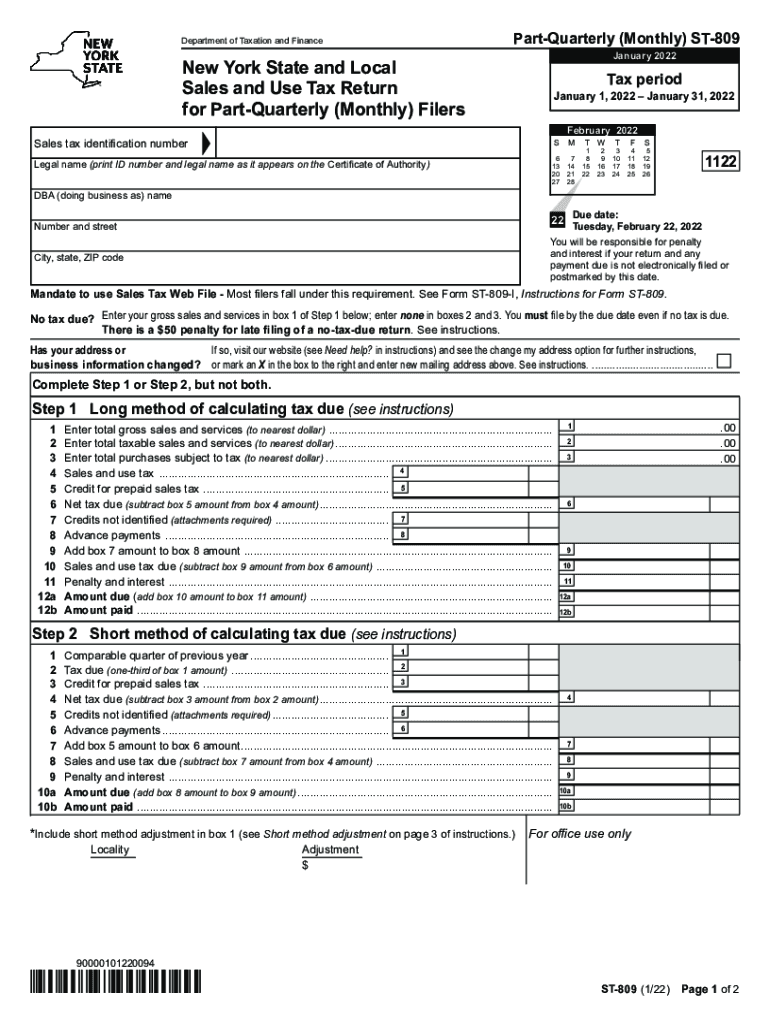

NY ST-809 2022 free printable template

Get, Create, Make and Sign new york st 809

How to edit new york st 809 online

Uncompromising security for your PDF editing and eSignature needs

NY ST-809 Form Versions

How to fill out new york st 809

How to fill out NY ST-809

Who needs NY ST-809?

Instructions and Help about new york st 809

Music situated on a premium corner loss with a great central location in repeat welcome to 809 Henry Street in addition to a single car garage is two plus one bedroom brick bungalow features two separate driveways with ample outdoor parking and has flagstone and interlocked walkways to its inviting front entryway showcasing large principal rooms elegantly finished with crown moldings the formal entertaining rooms are found off the reception hallway a graciously sized and light field living room warmed by a gas fireplace as well as a formal dining room with ambient lighting chair rail and a decorative fireplace California shutters are found on most of the windows while beautifully maintained parquet hardwood flooring and French door entries can be found throughout most of the level off the main hallway is a spacious breakfast room which has access to a cozy sunroof with south-east and west facing exposures Music the kitchen features easy-care laminate flooring plenty of counter space abundant cabinetry storage including pantry areas ceramic tile backsplash stainless steel appliances and has walkout access to the backyard and the garage the backyard is well-suited for outdoor entertaining and features a large interlocked patio with landscaped garden beds a charming welcome into the home the enclosed ceramic tiled mudroom has a double coat closet with an interior French door surrounded by leaded glass windows Music the four-piece main washroom features striking black and white tile detailing on the walls and floor as well as a space-saving vanity hot lighting and a tiled shower area with rain shower the second bedroom comes with a large double closet and the master bedroom features a ceiling fan and chair rail and is complete with a walk-in closet as well as a two-piece ensuite washroom a fully finished lower level as incredible living space to the home and has potential as an in-law suite this level features a cold room and plenty of closet storage and with a roughed forest stove as well as an existing sink a second kitchen can easily be added office space is also access to a combined storage area and laundry room and this level also features a modern three-piece washroom with tiled for vanity with integrated countertop basin as well as an oversized shower area with sliding glass door Music completing the lower level is the massive recreation area finished with high quality laminate flooring and pot lighting which are also found in this home third bedroom as well as a bonus room that is ideal is a private home office workout room or media room Music enjoying a great central location this charming home is close to numerous prime amenities including schools public transit parks and shopping plazas with these beautiful waterfront the entertainment center GO Transit and access to highway 401 just short drives away

People Also Ask about

What is New York State sales tax 2022?

What is NYS ST 809?

What is NYS DTF sales tax?

What does NYS DTF stand for?

Does New York State charge sales tax?

Who is NYS DTF pit?

How do I cancel my NYS tax payment?

What is NYS DTF payment?

Why would I get a certified letter from NYS tax?

How do I pay sales tax in NY?

What is DTF in Tax?

What is the NYS sales tax rate for 2022?

Does NY charge sales tax on clothing?

What is NYS sales tax 2022?

How to calculate sales tax?

Why would I get a letter from New York State Department of Taxation and Finance?

What states have no sales tax?

What is DTF tax?

Does New York charge sales tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit new york st 809 from Google Drive?

How do I make edits in new york st 809 without leaving Chrome?

How can I fill out new york st 809 on an iOS device?

What is NY ST-809?

Who is required to file NY ST-809?

How to fill out NY ST-809?

What is the purpose of NY ST-809?

What information must be reported on NY ST-809?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.