Get the free Check if Applicable:

Show details

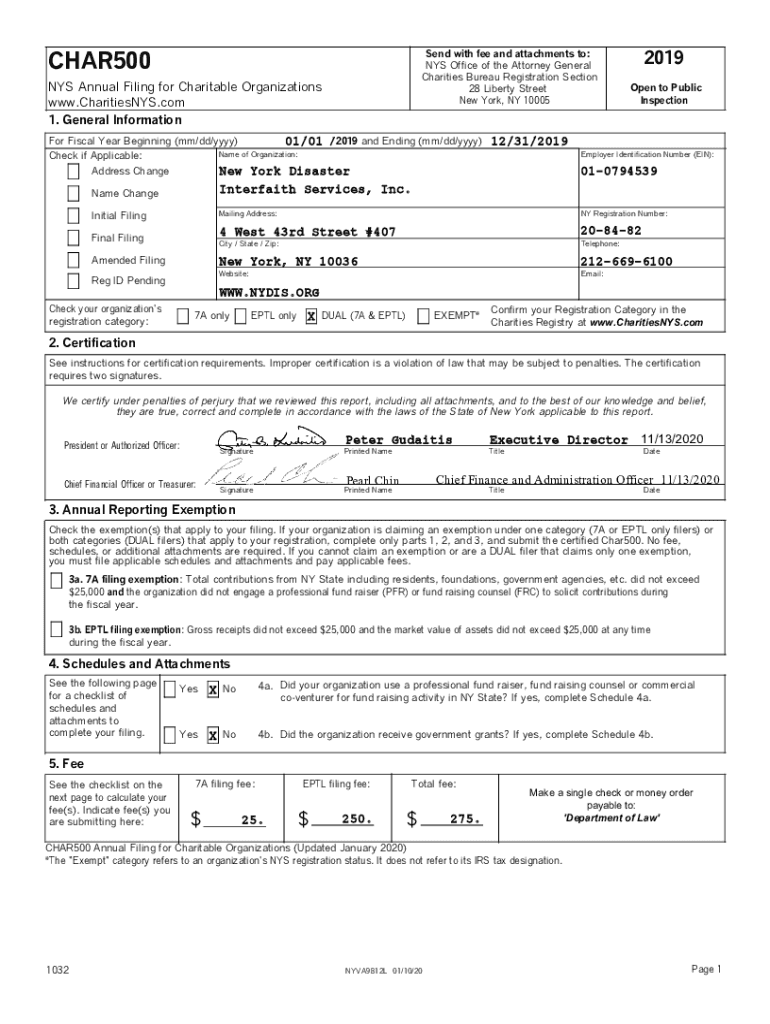

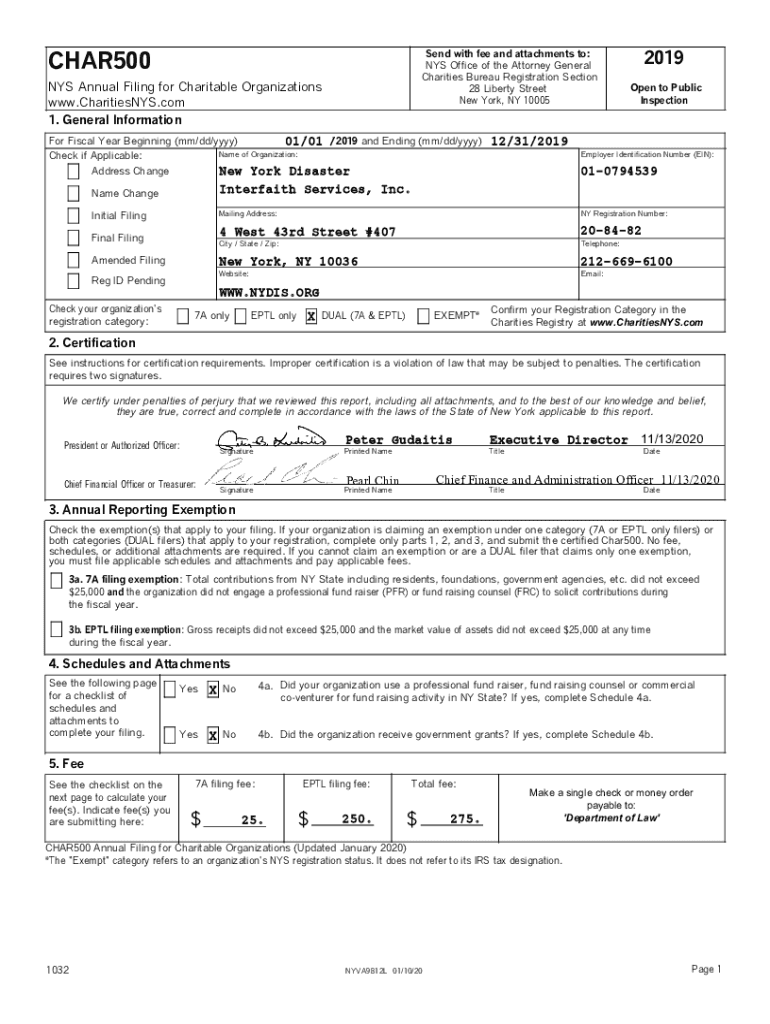

Send with fee and attachments to: NYS Office of the Attorney General Charities Bureau Registration Section 28 Liberty Street New York, NY 10005CHAR500 NYS Annual Filing for Charitable Organizations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign check if applicable

Edit your check if applicable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your check if applicable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing check if applicable online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit check if applicable. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out check if applicable

How to fill out check if applicable

01

Start by writing the date on the line provided at the top right corner of the check.

02

Write the name of the recipient or payee on the line labeled 'Pay to the Order of.' Make sure to write the full name or the name of the business.

03

Write the numerical amount of money you want to pay in the box provided. Start writing at the far left of the box, leaving no space between the dollar sign and the numerical amount.

04

Write the written amount of money in words on the line below the recipient's name. Be sure to write the amount clearly and avoid using abbreviations.

05

Sign the check at the bottom right corner using your legal signature. Make sure your signature matches the one the bank has on file.

06

Optionally, you can write a memo or note on the memo line, usually located on the bottom left corner of the check, to indicate the purpose of the payment.

07

Lastly, double-check all the information on the check for accuracy before sending or depositing it.

Who needs check if applicable?

01

Checks are commonly used by individuals and businesses for various monetary transactions.

02

Individuals may need checks to pay bills, make rent or mortgage payments, pay for goods or services, or send money to someone.

03

Businesses often use checks to make payments to suppliers or vendors, pay employee salaries, or collect payments from customers.

04

Financial institutions also use checks for various banking transactions and to issue funds to customers when requested.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my check if applicable directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your check if applicable as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I fill out the check if applicable form on my smartphone?

Use the pdfFiller mobile app to fill out and sign check if applicable on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete check if applicable on an Android device?

On Android, use the pdfFiller mobile app to finish your check if applicable. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is check if applicable?

Check if applicable is a question or option on a form that indicates whether a certain condition or statement applies to the individual or entity filling out the form.

Who is required to file check if applicable?

Any individual or entity that is required to complete the form and the specific condition or statement applies to them.

How to fill out check if applicable?

To fill out check if applicable, simply mark the check box or indicate 'yes' if the condition or statement applies, otherwise leave it unchecked or indicate 'no'.

What is the purpose of check if applicable?

The purpose of check if applicable is to ensure accurate reporting and compliance with the requirements of the form by capturing relevant information from the individual or entity.

What information must be reported on check if applicable?

The information to be reported on check if applicable includes any specifics related to the condition or statement being checked, as required by the form or document.

Fill out your check if applicable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Check If Applicable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.