IRS 1040-NR (SP) 2024-2025 free printable template

Show details

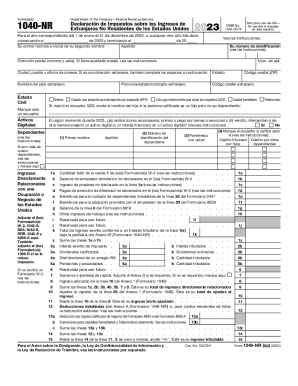

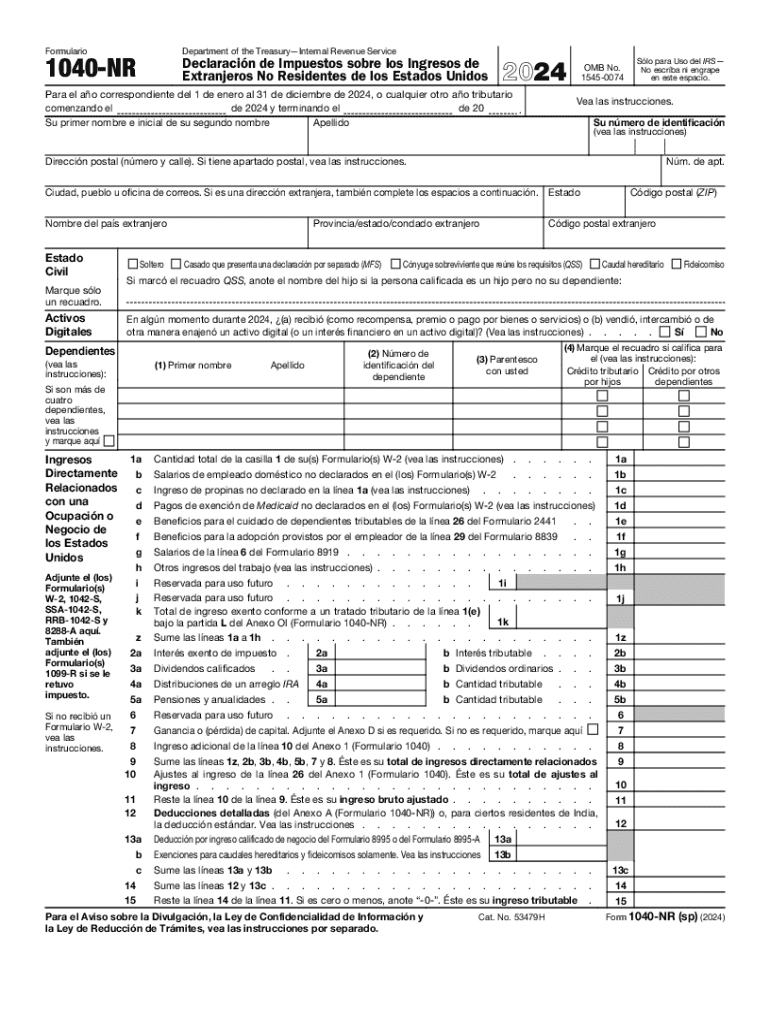

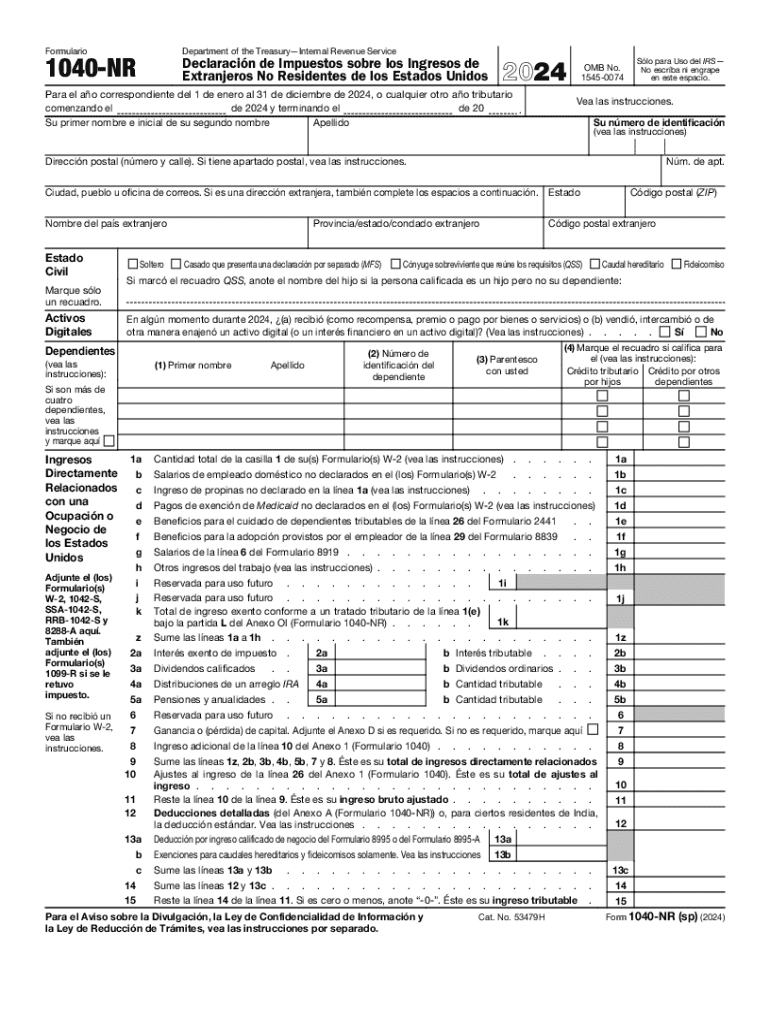

Formulario1040NR(SP) Estado Civil Marque slo un recuadro.SolteroDepartment of the TreasuryInternal Revenue Service(99)Declaracin de Impuestos sobre los Ingresos de Extranjeros No Residentes de los

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs 1040-nr sp 2024-2025

Edit your irs 1040-nr sp 2024-2025 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs 1040-nr sp 2024-2025 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs 1040-nr sp 2024-2025 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs 1040-nr sp 2024-2025. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040-NR (SP) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs 1040-nr sp 2024-2025

How to fill out IRS 1040-NR (SP)

01

Obtain the IRS 1040-NR (SP) form from the IRS website or other authorized sources.

02

Fill in your personal information, including your name, address, and taxpayer identification number.

03

Declare your filing status by checking the appropriate box on the form.

04

Report your income for the year, categorizing it appropriately (e.g., wages, interest, dividends).

05

Calculate your taxable income by subtracting any deductions and exemptions you are eligible for.

06

Compute your tax liability using the tax tables provided in the form instructions.

07

Report any tax credits that apply to your situation.

08

Fill in the section for other taxes, if applicable.

09

Complete the payment section by indicating any taxes owed or refund expected.

10

Sign and date the form before submitting it to the IRS.

Who needs IRS 1040-NR (SP)?

01

Non-resident aliens who are engaged in trade or business in the United States.

02

Individuals who received income from U.S. sources but do not meet the residency requirements.

03

Students or scholars from foreign countries who are temporarily in the U.S. on certain visas.

04

Foreign nationals who have a tax obligation in the U.S. due to income earned in the country.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send irs 1040-nr sp 2024-2025 for eSignature?

When you're ready to share your irs 1040-nr sp 2024-2025, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the irs 1040-nr sp 2024-2025 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your irs 1040-nr sp 2024-2025 in seconds.

Can I create an electronic signature for signing my irs 1040-nr sp 2024-2025 in Gmail?

Create your eSignature using pdfFiller and then eSign your irs 1040-nr sp 2024-2025 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is IRS 1040-NR (SP)?

IRS 1040-NR (SP) is the U.S. tax return form specifically designed for non-resident aliens who are earning income in the United States. The 'SP' stands for 'Spanish,' indicating that the form and its instructions are available in Spanish language.

Who is required to file IRS 1040-NR (SP)?

Non-resident aliens who have U.S.-sourced income, are claiming tax treaty benefits, or are fulfilling filing requirements based on income thresholds must file IRS 1040-NR (SP). This includes foreign students, scholars, and workers in the U.S.

How to fill out IRS 1040-NR (SP)?

To fill out IRS 1040-NR (SP), one should start by providing personal information such as name, address, and ITIN or SSN. Then, report income sources and amounts, claims for deductions, and applicable tax credits. Follow the instructions carefully, and sign the form before submission.

What is the purpose of IRS 1040-NR (SP)?

The purpose of IRS 1040-NR (SP) is to allow non-resident aliens to properly report their income to the IRS and calculate any tax liability. It ensures compliance with U.S. tax laws for individuals who do not meet the criteria for resident status.

What information must be reported on IRS 1040-NR (SP)?

The information that must be reported on IRS 1040-NR (SP) includes gross income amounts, deductions, any applicable tax credits, income sources from within the U.S., and additional information like filing status and foreign addresses if applicable.

Fill out your irs 1040-nr sp 2024-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs 1040-Nr Sp 2024-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.