Get the free 2021 Form 1099-R - IRS tax forms2021 Form 1099-R - IRS tax formsNebraska Public Empl...

Show details

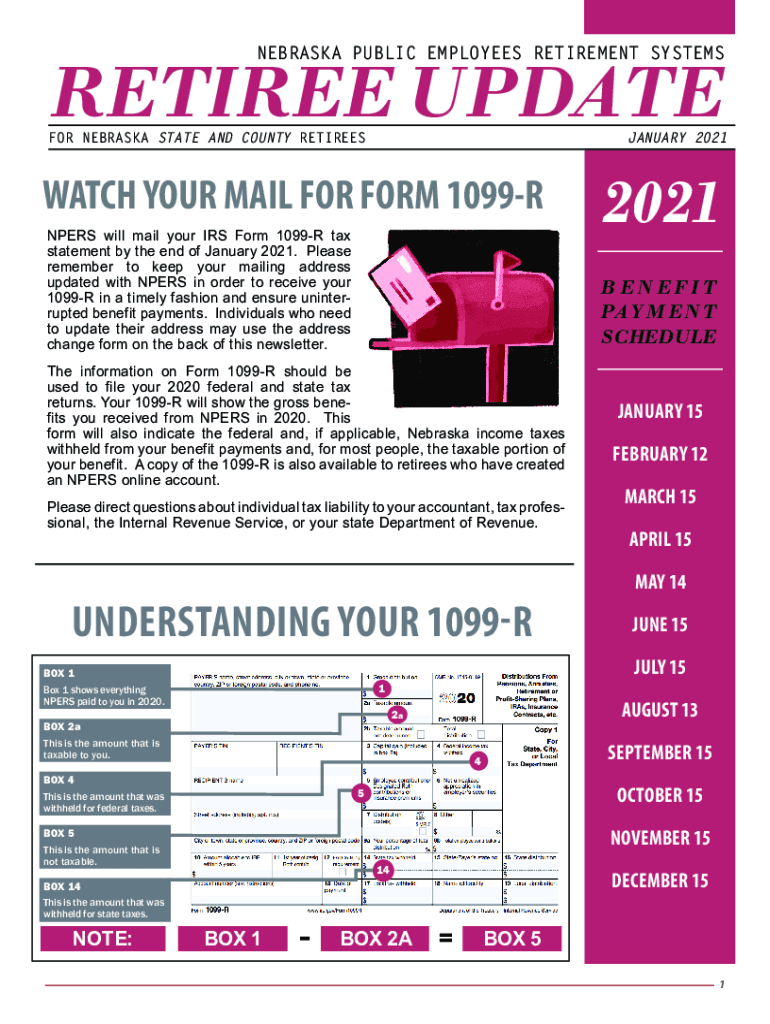

NEBRASKA PUBLIC EMPLOYEES RETIREMENT SYSTEMSRETIREE UPDATER NEBRASKA STATE AND COUNTY RETIREESJANUARY 2021WATCH YOUR MAIL FOR FORM 1099R NP ERS will mail your IRS Form 1099R tax statement by the end

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2021 form 1099-r

Edit your 2021 form 1099-r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2021 form 1099-r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2021 form 1099-r online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2021 form 1099-r. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2021 form 1099-r

How to fill out 2021 form 1099-r

01

To fill out the 2021 form 1099-R, follow these steps:

02

Obtain the necessary forms: You can download the form from the IRS website or request a copy from the IRS.

03

Gather the required information: You will need the recipient's name, address, and social security number. You will also need details about the distribution, such as the amount, the type of payment, and the federal tax withheld.

04

Complete Boxes 1-18: Enter the necessary information in each box as instructed on the form. Make sure to double-check your entries for accuracy.

05

Complete Boxes 1-5 in Part II: If the distribution is a rollover or conversion, you will need to provide additional information in Part II of the form.

06

Check for additional requirements: Depending on the circumstances of the distribution, you may need to fill out additional forms or schedules. Review the instructions provided with the form to determine if any additional reporting is needed.

07

Submit the form: Once you have completed the form, send Copy A to the IRS, Copy B to the recipient, and keep Copy C for your records.

08

Remember to review the form instructions and consult with a tax professional if you have any questions or need further assistance.

Who needs 2021 form 1099-r?

01

Form 1099-R is typically used by individuals and entities who have made distributions from various retirement plans, pensions, annuities, or life insurance contracts. The form is required to report these distributions to the IRS and the recipient of the funds.

02

Some examples of who may need to file Form 1099-R include:

03

- Retirement plan administrators

04

- Pension plan trustees

05

- Insurance companies

06

- Financial institutions

07

- Individuals who distributed funds from retirement plans or life insurance contracts

08

It is important to note that the specific requirements for filing Form 1099-R may vary based on the type of distribution and the recipient's circumstances. It is recommended to consult the IRS instructions for Form 1099-R or seek assistance from a tax professional to determine if you need to file this form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2021 form 1099-r?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the 2021 form 1099-r in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out the 2021 form 1099-r form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign 2021 form 1099-r. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete 2021 form 1099-r on an Android device?

On an Android device, use the pdfFiller mobile app to finish your 2021 form 1099-r. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is form 1099-r - irs?

Form 1099-R is an IRS form used to report distributions from pensions, annuities, retirement plans, IRAs, and other similar types of accounts.

Who is required to file form 1099-r - irs?

Entities that make distributions from retirement accounts, such as employers, pension plans, and financial institutions, are required to file Form 1099-R for any distributions they make.

How to fill out form 1099-r - irs?

To fill out Form 1099-R, you need to provide information such as the recipient's details, the amount of the distribution, the type of distribution, and any federal tax withheld. Make sure to follow the IRS instructions carefully.

What is the purpose of form 1099-r - irs?

The purpose of Form 1099-R is to inform the IRS and the recipient about the amount of money distributed from retirement accounts so that it can be properly reported as income.

What information must be reported on form 1099-r - irs?

Form 1099-R must report details including the payer's information, recipient's information, gross distribution amount, taxable amount, distribution code, and any federal income tax withheld.

Fill out your 2021 form 1099-r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2021 Form 1099-R is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.