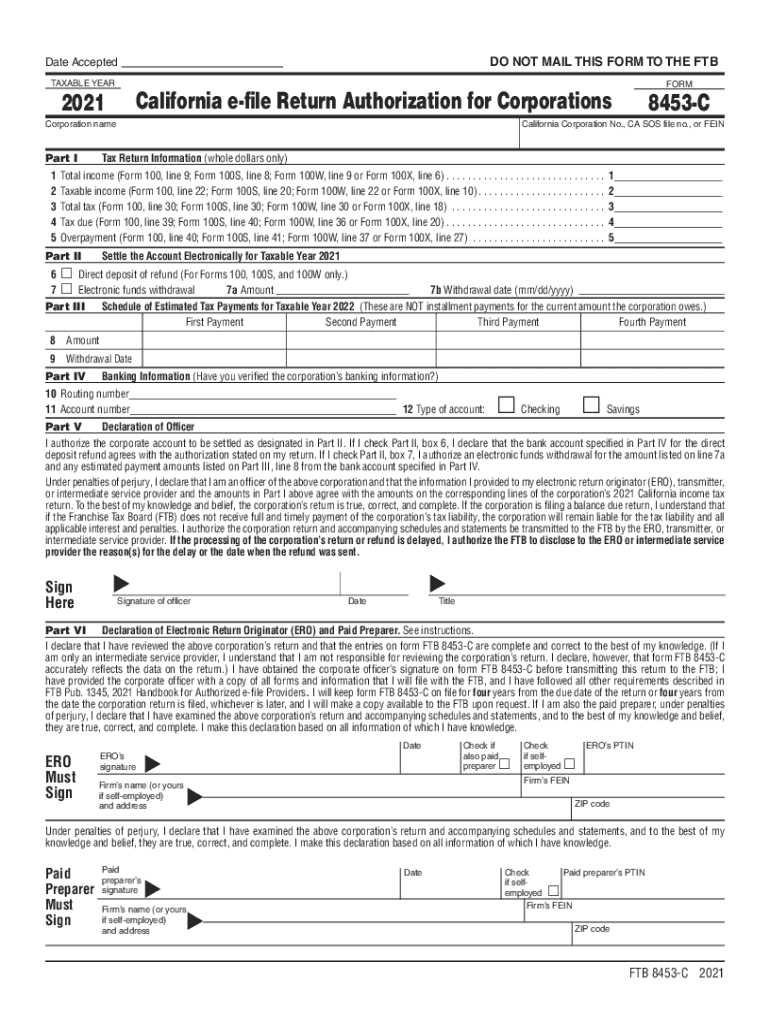

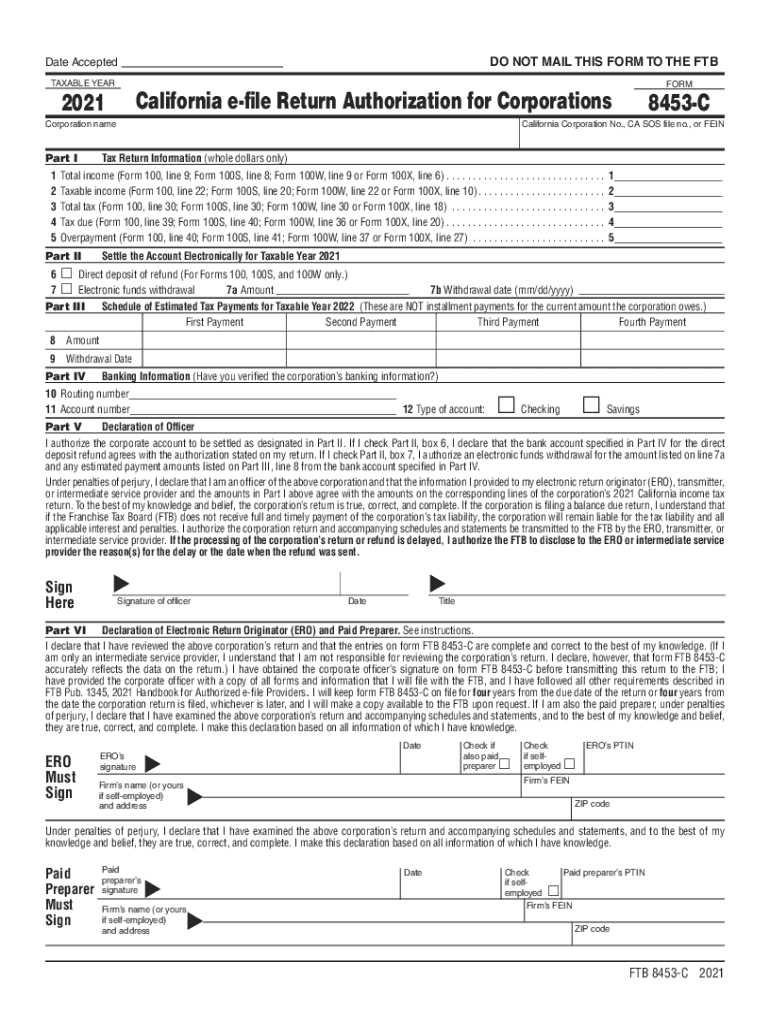

CA FTB 8453-C 2021 free printable template

Show details

DO NOT MAIL THIS FORM TO THE State Accepted

TAXABLE YEAR California file Return Authorization for Corporations2021Corporation rampart I

1

2

3

4

5

Tax Return Information (whole dollars only)

12345Settle

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 8453-C

Edit your CA FTB 8453-C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 8453-C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 8453-C online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA FTB 8453-C. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 8453-C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 8453-C

How to fill out CA FTB 8453-C

01

Start by downloading the CA FTB 8453-C form from the California Franchise Tax Board website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide the details of your tax return, including the year and type of return.

04

Include any required signatures from all involved parties, such as your spouse if filing jointly.

05

Review the completed form for accuracy before submission.

06

Submit the CA FTB 8453-C form to the appropriate California Franchise Tax Board address.

Who needs CA FTB 8453-C?

01

Individuals who e-file their California tax returns but must submit a signed paper form.

02

Taxpayers who have a tax professional prepare their tax returns and need to provide authorization.

03

Anyone required to submit additional documentation along with their e-filed return.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take to get corporate tax refund?

The IRS issues more than 9 out of 10 refunds in less than 21 days. However, it's possible your tax return may require additional review and take longer.

Can form 8453-C be signed electronically?

You can sign an electronic return by using either the Practitioner Personal Identification Number (PIN) or the Scanned Form 8453 option. Electronic signatures for electronically filed extensions are required only if you are using electronic funds withdrawal (EFW) to pay a balance due on the extension.

What is an 8453 signature document?

A signed Form 8453 authorizes the transmitter to send the return to the IRS. Form 8453 includes the taxpayer's declaration under penalties of perjury that the return is true and complete, as well as the taxpayer's Consent to Disclosure.

What is a 8879 form used for?

What's New. Form 8879 is used to authorize the electronic filing (e-file) of original and amended returns. Use this Form 8879 (Rev. January 2021) to authorize e-file of your Form 1040, 1040-SR, 1040-NR, 1040-SS, or 1040- X, for tax years beginning with 2019.

What is form 8453 C used for?

Use Form 8453-C to: Authenticate an electronic Form 1120, U.S. Corporation Income Tax Return. Authorize the electronic return originator (ERO), if any, to transmit via a third-party transmitter.

Can corporate refunds be direct deposited?

Corporations file this form to request that the IRS deposit a corporate income tax refund directly into an account at any U.S. bank or other financial institution that accepts direct deposits.

Can form 8453 C be signed electronically?

You can sign an electronic return by using either the Practitioner Personal Identification Number (PIN) or the Scanned Form 8453 option. Electronic signatures for electronically filed extensions are required only if you are using electronic funds withdrawal (EFW) to pay a balance due on the extension.

What is direct deposit for refunds?

What is Direct Deposit? Direct Deposit is a free service for electronically transferring your tax refund from the Internal Revenue Service into your financial account. More than eight out of ten taxpayers use Direct Deposit to get their tax refunds. Direct Deposit is easy, safe and secure.

What is a form 8453-C?

Use Form 8453-C to: Authenticate an electronic Form 1120, U.S. Corporation Income Tax Return. Authorize the electronic return originator (ERO), if any, to transmit via a third-party transmitter.

Is form 8453-C required?

If you are filing a 2021 Form 1120 through an ISP and/or transmitter and you are not using an ERO, you must file Form 8453-C with your electronically filed return. An ERO can use either Form 8453-C or Form 8879-C to obtain authorization to file a corporation's Form 1120.

Do I really need to mail form 8453?

If you are an ERO, you must mail Form 8453 to the IRS within 3 business days after receiving acknowledgement that the IRS has accepted the electronically filed tax return.

Is form 8453-C required?

If the corporation's return is filed through an ERO, the IRS requires the ERO's signature. A paid preparer, if any, must sign Form 8453-C in the space for Paid Preparer Use Only. But if the paid preparer is also the ERO, do not complete the paid preparer section.

Can tax refunds be direct deposited?

The best and fastest way to get your tax refund is to have it electronically deposited for free into your financial account. The IRS program is called direct deposit. You can use it to deposit your refund into one, two or even three accounts.

What is the difference between form 8879 and 8453?

If the taxpayer is signing the electronically filed return by using a PIN, use Form 8879, California e-file Signature Authorization for Individuals. If the taxpayer is signing the return via handwritten signature, use Form 8453, California e-file Return Authorization for Individuals.

Can you get a corporate tax refund?

If you own a pass-through business and your estimated tax payments and tax withholding exceed the tax due on your return, you can receive a tax refund. Only C corporations pay income taxes directly, so C corporations are the only businesses that can get a refund.

Do I need to file form 8453?

IRS Form 8453 is required to be completed and mailed to the IRS when one or more of the forms listed on it are included in an e-filed return. (See below for the mailing address.)

Who should file form 8453?

You'll need to file this federal tax signature form if you're attaching the following forms and documents: Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes.

What is 8453 form used for?

Use Form 8453 to send any required paper forms or supporting documentation listed next to the checkboxes on Form 8453 (don't send Form(s) W-2, W-2G, or 1099-R). Don't attach any form or document that isn't shown on Form 8453 next to the checkboxes.

Why do I have to send form 8453?

If you received a request to submit Form 8453 (U.S. Individual Income Tax Transmittal for an IRS e-file Return), it means you'll need to mail some forms to the IRS that can't be e-filed. Federal tax returns that are e-filed need to contain the same information that paper-filed returns contain.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CA FTB 8453-C?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific CA FTB 8453-C and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit CA FTB 8453-C on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing CA FTB 8453-C right away.

How can I fill out CA FTB 8453-C on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your CA FTB 8453-C. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is CA FTB 8453-C?

CA FTB 8453-C is a declaration form used by California taxpayers filing Form 540 for certain tax returns to authenticate their electronic filing.

Who is required to file CA FTB 8453-C?

Taxpayers who e-file their California personal income tax returns and are required to provide an electronic signature must file CA FTB 8453-C.

How to fill out CA FTB 8453-C?

To fill out CA FTB 8453-C, provide your personal information, including your name, Social Security number, and the tax year, and sign the form to confirm your agreement.

What is the purpose of CA FTB 8453-C?

The purpose of CA FTB 8453-C is to serve as a declaration that the tax return being e-filed is accurate, and it acts as an electronic signature for the taxpayer.

What information must be reported on CA FTB 8453-C?

The information required on CA FTB 8453-C includes the taxpayer's name, Social Security number, the tax year, and a declaration statement affirming the accuracy of the e-filed return.

Fill out your CA FTB 8453-C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 8453-C is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.