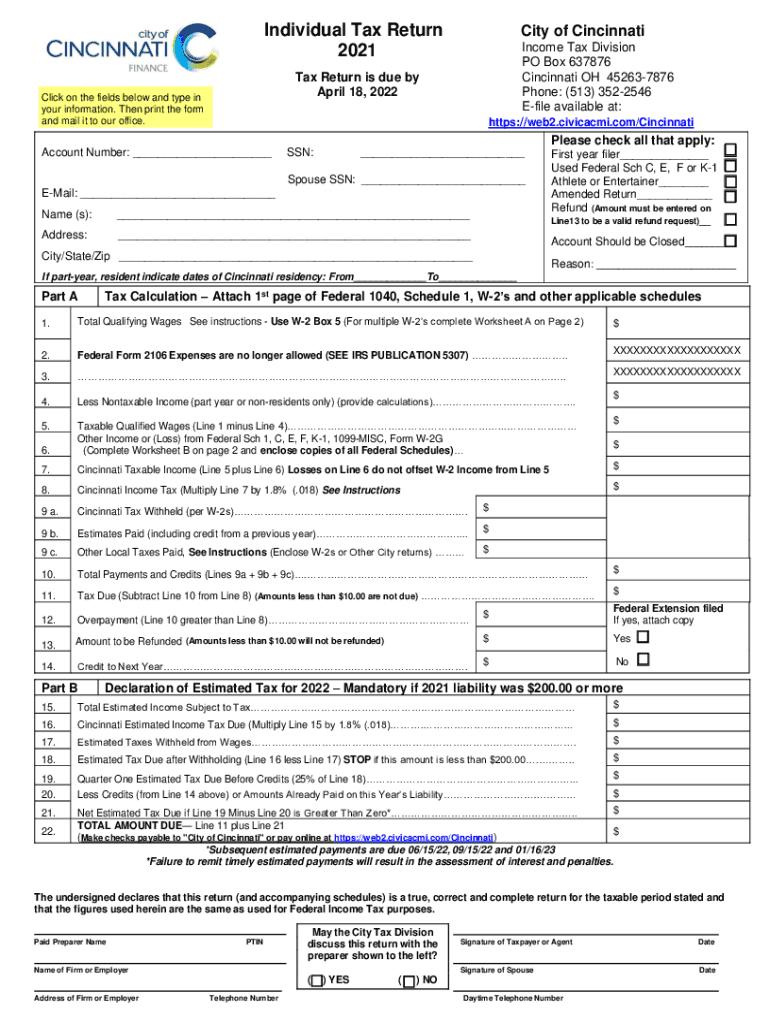

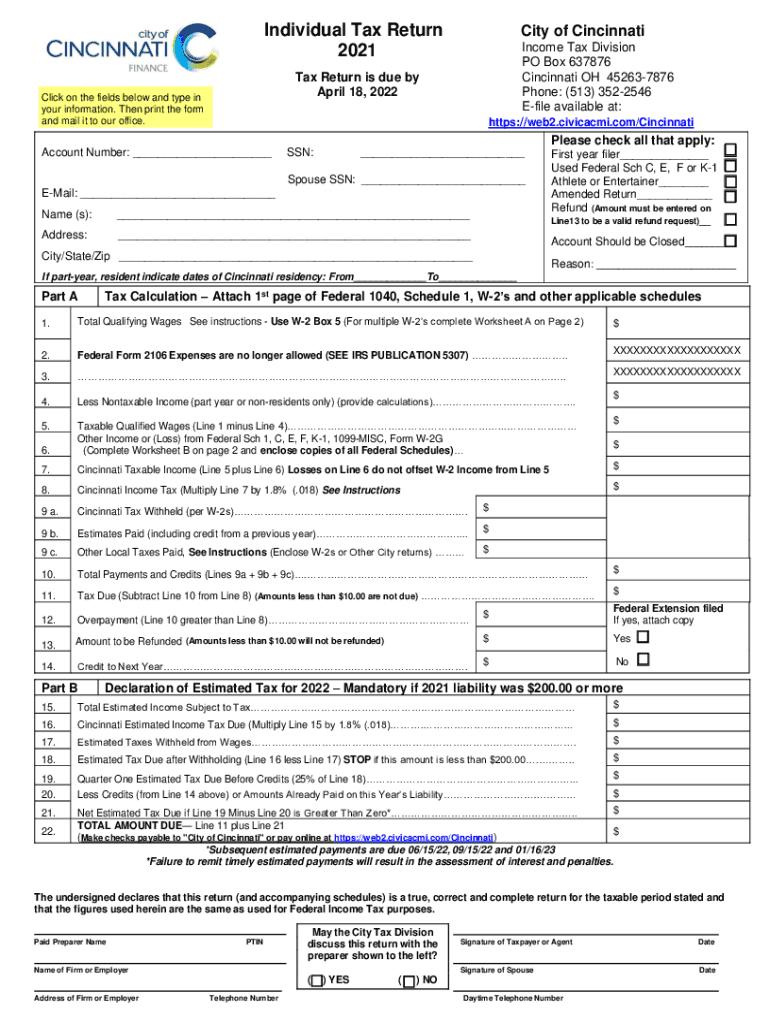

OH Individual Tax Return - Cincinnati 2021 free printable template

Get, Create, Make and Sign OH Individual Tax Return - Cincinnati

Editing OH Individual Tax Return - Cincinnati online

Uncompromising security for your PDF editing and eSignature needs

OH Individual Tax Return - Cincinnati Form Versions

How to fill out OH Individual Tax Return - Cincinnati

How to fill out OH Individual Tax Return - Cincinnati

Who needs OH Individual Tax Return - Cincinnati?

Instructions and Help about OH Individual Tax Return - Cincinnati

Hey what's up family it is your favorite uncle cousin Tyrone Gregory the self-employed tax go back edit again but today's video I am going to be talking about the all-new 1040 you know 2019 is just a couple of days away and speaking of them and if I don't hear from you or speak to you between now and next year let me wish you your family your business a very prosperous new year 2019 should be the year to break in the dough okay that is what I want you to do in 2019, but I just want to come to you today real quick honor I don't want to be before you long I just want to talk about this new 1040 right so as some of you may know Ana may not have known back in September 2017 there was this big talk about tax reform and how we're going to be able to file our taxes on a postcard and things like that and then in December the President signed the new tax reform bill right the tax cuts and Jobs Act well not surprisingly they actually kept their promise we now have a new 1040, and it's not quite postcard side I mother show it to you here in a second, but it is definitely not quite the postcard size and there are a few things I want you to be aware of and then the first thing is to be aware of this if you file using software if you file using the tax preparer or something like that you really should not see any differences you really should not see any type of noticeable difference or changes in what you file you'll still be able to put the same information and get hopefully the same exact results now for those of you who are the DIY and you really like to be hands-on, and you want to see the changes, and I was going to affect you that's what this video really is just so you can be aware of the new 1040 nothing will throw you off guard nothing will shock you because uncle cousin is bringing it to you right now so let's go ahead and take a look at the new 1040 all right so here we are the new 1040 for 2018 this is the one that is going to be used to file your tax return starting January 1st 2019 and that doesn't mean that you'll be able to file January 1st as a matter of fact as the recording of this video we have no idea when the IRS is going to be opening for file so definitely keep that in mind as there may be a delay as to win you can file your tax return but in any case here it is the new 1040 let's take a look at it and this is what I mean by not so quite postcard size because this is it, and you can see it cuts off from the page here at the bottom, and it picks up again or page 2 of the 1040 years here and cuts off here at the bottom, so it's not quite a full page size, but it's not postcard size either all right, so that's that's it a full view let me scroll back up here to the top, so you can see here it is let me see if I can maybe reduce that and make it smaller zoom out a little there we are, so maybe we can see it in its entirety, so that's it that's the first page of the 1040 in all this glory please Basket it and here it is the second page of...

People Also Ask about

Where do you pay property Taxes in Cincinnati Ohio?

When can I expect my refund 2022?

How do property taxes work in Cincinnati?

How long does it take for tax refund direct deposit 2022?

How are property taxes billed in Ohio?

What is the Ohio income tax rate 2022?

How do I pay my taxes in Cincinnati?

What is Ohio's income tax rate?

Where do I pay my Ohio property taxes?

Did Ohio taxes go up in 2022?

How long does it take to get a tax refund in Cincinnati?

Who has to pay city of Cincinnati taxes?

Are tax refunds delayed 2022?

Can you pay Cincinnati taxes online?

What is Ohio's state income tax rate?

What will the tax rate be in 2022?

What is Ohio tax rate 2022?

What months are property taxes due in Ohio?

What are the current tax brackets 2022?

How much is 75k after taxes in Ohio?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send OH Individual Tax Return - Cincinnati for eSignature?

How do I make edits in OH Individual Tax Return - Cincinnati without leaving Chrome?

How do I complete OH Individual Tax Return - Cincinnati on an iOS device?

What is OH Individual Tax Return - Cincinnati?

Who is required to file OH Individual Tax Return - Cincinnati?

How to fill out OH Individual Tax Return - Cincinnati?

What is the purpose of OH Individual Tax Return - Cincinnati?

What information must be reported on OH Individual Tax Return - Cincinnati?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.