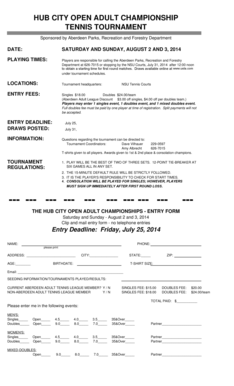

Get the free Form 872 Consent To Extend The Time To Assess Tax

Show details

This memorandum discusses the review of a draft Form 872, which involves extending the statute of limitations on tax liabilities for certain individuals and corporate entities regarding their income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 872 consent to

Edit your form 872 consent to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 872 consent to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 872 consent to online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 872 consent to. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 872 consent to

How to fill out Form 872 Consent To Extend The Time To Assess Tax

01

Obtain Form 872 from the IRS website or your tax advisor.

02

Complete the taxpayer's name, address, and identification number at the top of the form.

03

Specify the type of tax and the year(s) for which you are consenting to extend the assessment period.

04

Review the section indicating that you understand the implications of extending the time to assess tax.

05

Sign and date the form, indicating your position (e.g., taxpayer, spouse).

06

Submit the completed form to the IRS at the address indicated in the instructions.

Who needs Form 872 Consent To Extend The Time To Assess Tax?

01

Taxpayers who want to extend the tax assessment period for a specific tax year.

02

Individuals or businesses under audit or having unresolved tax issues.

03

Taxpayers seeking to ensure adequate time for the IRS to complete its assessment.

Fill

form

: Try Risk Free

People Also Ask about

Can you request an extension for a tax audit?

For audits conducted by in-person interview – If your audit is being conducted in person, contact the auditor assigned to your audit to request an extension. If necessary, you may contact the auditor's manager.

What is a consent to use of tax return?

The Consent to Use must be signed prior to using the taxpayer's information for any other purpose than to prepare or e-file the return. This would apply to offering the taxpayer any type of product, such as a bank product, that is based on taxpayer information.

What does taxation by consent mean?

The term “tax consent” refers to the agreement of citizens to submit to taxes set by public authorities. This support rests on several pillars: understanding of the tax system, the perception of fairness in the distribution of public burdens, and the level of confidence in the use of the funds collected.

What are consent forms for taxes?

File Form 8821 to: Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form.

What is a form 872 a special consent to extend the time to assess tax?

Form 872-A, Special Consent to Extend the Time to Assess Tax, is used for agreeing to an open-ended assessment period. However, Form 872-A may not be used for employment taxes or certain miscellaneous excise taxes. be covered by the restricted consent does not make it impractical to do so.

Why is TurboTax asking for my consent?

It is for your own safety that they ask you the verification questions. TurboTax asks the questions to do all they can to prevent identity theft.

Is it normal for a mortgage lender to ask for tax returns?

Yes, mortgage lenders do look at and verify tax returns for most loan types. When you submit your tax returns with your loan application, your lender will analyze and verify the information contained in your tax documents in order to gain insights about your income and financial health.

What is the form for the extension of time to file taxes?

File Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return PDF. You can file by mail, online with an IRS e-filing partner or through a tax professional.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 872 Consent To Extend The Time To Assess Tax?

Form 872 is a document used by taxpayers to consent to extend the period for the IRS to assess additional tax. This form allows both the taxpayer and the IRS to agree on extending the time frame for tax assessment, ensuring adequate time to review and resolve any outstanding tax issues.

Who is required to file Form 872 Consent To Extend The Time To Assess Tax?

Form 872 is typically filed by taxpayers who are under audit or have unresolved tax issues that require additional time for assessment. It may be requested by the IRS as part of an ongoing examination or audit process.

How to fill out Form 872 Consent To Extend The Time To Assess Tax?

To fill out Form 872, taxpayers should provide identifying information, including their name, address, and the tax year in question. They must then sign and date the form to indicate consent for the extension of time to assess tax. It's important to read the instructions on the form carefully and consult with a tax professional if needed.

What is the purpose of Form 872 Consent To Extend The Time To Assess Tax?

The purpose of Form 872 is to legally extend the time frame within which the IRS can assess taxes, ensuring that both parties have the necessary time to consider all relevant information and resolve any discrepancies regarding tax liability.

What information must be reported on Form 872 Consent To Extend The Time To Assess Tax?

Form 872 requires basic taxpayer information such as name, address, taxpayer identification number, the tax year in question, and the signature of the taxpayer or their authorized representative. Additionally, the form indicates the specific time period for which the consent to extend is granted.

Fill out your form 872 consent to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 872 Consent To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.