Get the free Form 5472

Show details

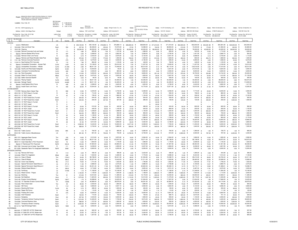

This document provides final regulations indicating that a Form 5472 filed electronically is treated as satisfying the requirement to file a duplicate Form 5472 with the IRS.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 5472

Edit your form 5472 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 5472 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 5472 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 5472. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 5472

How to fill out Form 5472

01

Obtain Form 5472 from the IRS website.

02

Ensure you have your Employer Identification Number (EIN) ready.

03

Fill out Part I with identifying information, including the name and address of the reporting corporation.

04

Complete Part II for transactions with foreign or domestic related parties.

05

Include details of any reportable transactions, such as sales, leases, and payments.

06

Attach Form 5472 to the corporate tax return (Form 1120 or 1120A) or file it separately as required.

07

Keep a copy of the completed form for your records.

Who needs Form 5472?

01

Any foreign corporation engaged in a trade or business in the United States.

02

U.S. corporations that are 25% foreign-owned.

03

Corporations that have a reportable transaction with a related party.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to report capital contributions on form 5472?

Yes you should be reporting the capital contributions. Under the old Form 5472 rules, it's true that only items that impacted taxable income would be reportable transactions.

What is an example of a reportable transaction?

These types of transactions include: Charitable contribution deductions for taxpayers who hold an interest in an entity holding real estate. Grantor-type trusts terminating and then being re-established. Sale of an interest in a charitable remainder trust.

What is an example of a reportable transaction on Form 5472?

What Is Considered a Reportable Transaction? Under IRS Form 5472, a reportable transaction includes any monetary and non-monetary exchanges between the reporting corporation and related parties. These cover a wide range of transactions, such as: Inventory and tangible property sales and purchases.

What is reportable payment transactions?

Reportable payments are payments to or on behalf of an individual that must be “reported” to the government as income received.

What are reportable transactions for form 5472?

What Is Considered a Reportable Transaction? Inventory and tangible property sales and purchases. Platform contribution and cost-sharing transaction payments (paid and received) Royalties, rents, loan guarantee fees, interest, and insurance premiums (paid and received)

What is the difference between a reportable and listed transaction?

Listed transactions are a type of a reportable transaction. A "listed transaction" is a transaction that is the same as or substantially similar to one that the IRS has determined to be a tax avoidance transaction and identified by IRS notice or other form of published guidance.

What is the IRS form 5472 used for?

Purpose of Form Use Form 5472 to provide information required under sections 6038A and 6038C when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party.

What are the exemptions for form 5472?

You are exempt from filing Form 5472 if you had no reportable transactions during the tax year. Further exemptions apply to specific foreign sales corporations and foreign corporations without a permanent establishment in the U.S. under an applicable income tax treaty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 5472?

Form 5472 is a U.S. Internal Revenue Service (IRS) form used to provide information about certain reportable transactions between a reporting corporation and its foreign-related parties.

Who is required to file Form 5472?

Foreign corporations that are engaged in a trade or business in the United States and American corporations with foreign owners, typically those having at least 25% foreign ownership, are required to file Form 5472.

How to fill out Form 5472?

To fill out Form 5472, you must provide details about the reporting corporation, information about foreign-related parties, and report specific transactions between the corporation and its foreign related parties. Ensure accurate and complete disclosure of the required information.

What is the purpose of Form 5472?

The purpose of Form 5472 is to ensure that the IRS receives necessary information about certain transactions between U.S. entities and foreign entities, which helps in preventing tax avoidance and ensuring compliance with U.S. tax laws.

What information must be reported on Form 5472?

Form 5472 requires reporting information such as the names and addresses of related parties, the nature of the relationships, and details of reportable transactions including sales, rents, royalties, and other financial transactions.

Fill out your form 5472 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 5472 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.