Get the free Other Credits Form

Show details

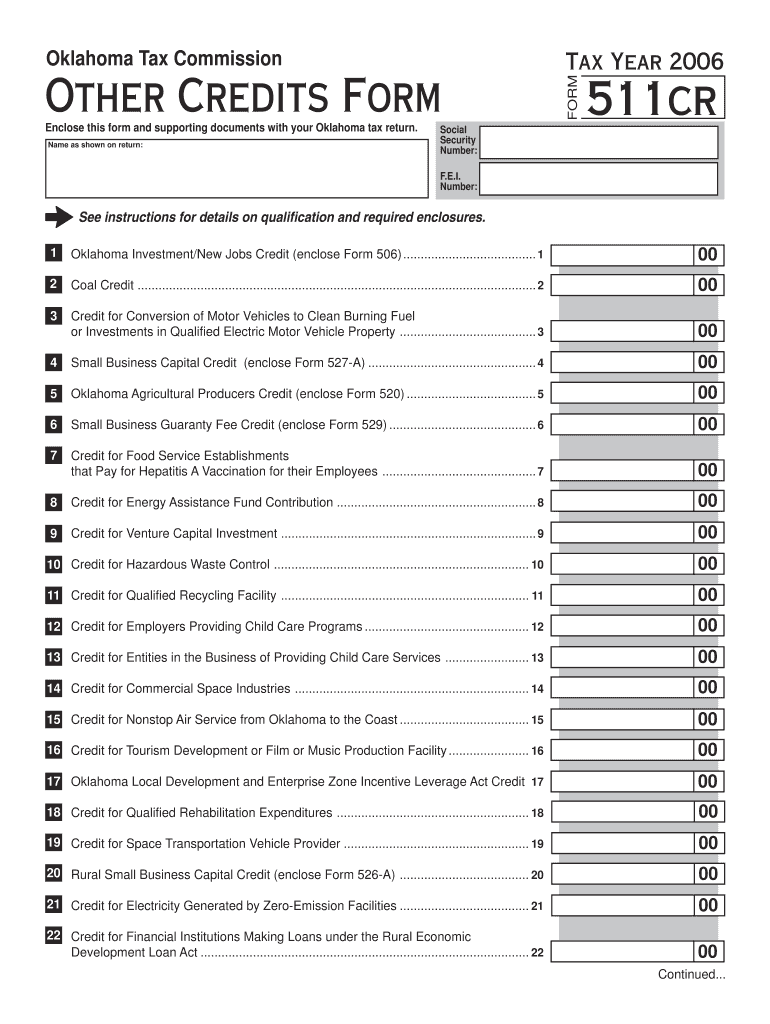

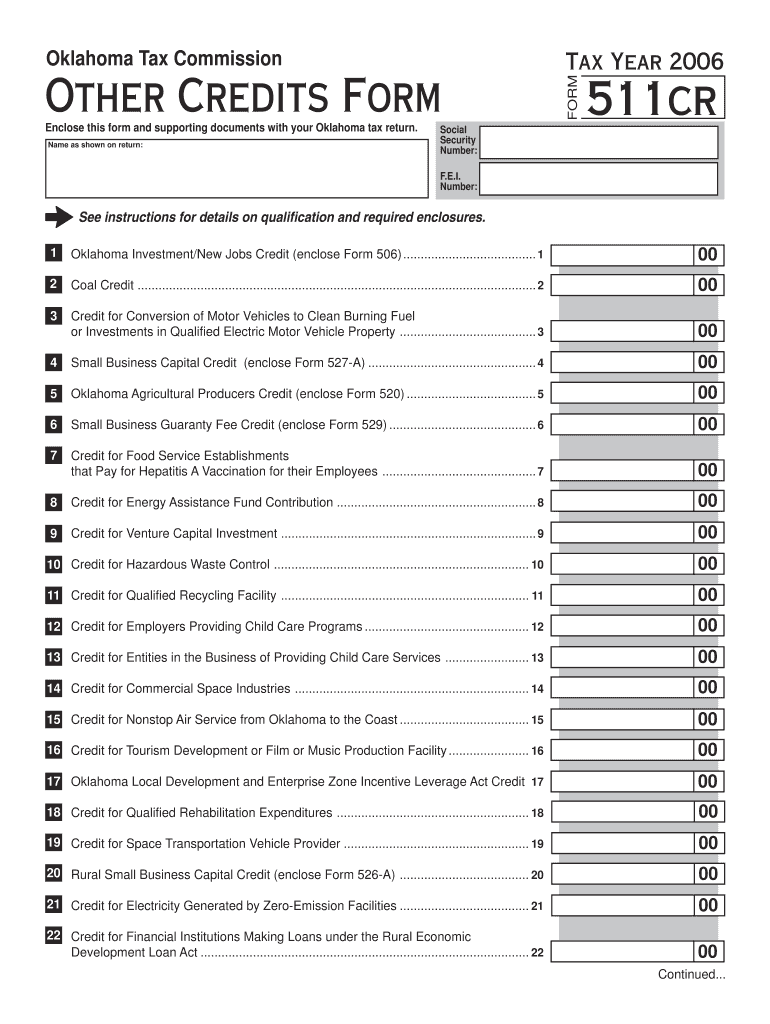

This form is used to claim various tax credits available under Oklahoma law for the tax year 2006. Taxpayers must enclose this form and supporting documents with their Oklahoma tax return to qualify

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oformr credits form

Edit your oformr credits form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oformr credits form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oformr credits form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit oformr credits form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oformr credits form

How to fill out Other Credits Form

01

Gather necessary information such as your name, address, and taxpayer identification number.

02

Identify the type of credits you are claiming and have supporting documentation ready.

03

Complete the identification section at the top of the form.

04

Fill out the section for each credit you are claiming, providing detailed information as required.

05

Double-check your entries for accuracy and completeness.

06

Attach any required schedules or forms that support your claims.

07

Sign and date the form before submitting it to the appropriate agency.

Who needs Other Credits Form?

01

Individuals or businesses claiming tax credits that are not included in the standard tax return.

02

Taxpayers who qualify for specific credits such as education, energy efficiency, or other eligible expenses.

03

Those looking to apply for state or federal benefits that require proof of additional credits.

Fill

form

: Try Risk Free

People Also Ask about

What are other credits?

Other credits cover the expense of child and dependent care as well as education credits.

Do you actually get money back from solar tax credit?

The solar credit is a non refundable credit meaning that it is limited by the amount of tax liability shown on your tax return. Once this credit, or any other credits with higher priority than this one, use up your liability and reduces it to $0, you can't get any more credit on this year's tax return.

Do you want to file form 5695 to claim the residential energy credit?

Claiming the non-business energy property credit or the residential energy-efficient property credit? You'll need to complete IRS Form 5695. This form is used to calculate the tax credit associated with your energy-efficient system and may be able to save you up to $500 on your taxes. Read to learn more.

What is the purpose of form 8978?

Form 8978 should only be used for changes to a partner's income tax. Any non-income tax changes that are related to the income tax adjustments on Form 8986 received by the partner, such as self-employment tax changes, should be reflected on an amended return for the partner's first affected year.

What documentation is needed for solar tax credit?

Claiming the ITC is easy. To get started, you'll first need your standard IRS 1040 Form, IRS Form 5695, "Residential Energy Credits," and the instructions for Form 5695. The purpose of Form 5695 is to validate your qualification for renewable energy credits.

Who fills out a 5695 form?

Who fills out IRS Form 5695? If you installed a qualifying renewable energy system, such as solar panels, you must complete IRS Form 5695 for 2024 to claim the Residential Clean Energy Credit. Submit this form with your tax return to apply the credit to your federal tax liability.

What qualifies for other dependent credit?

This credit can be claimed for: Dependents of any age, including those who are age 18 or older. Dependents who have Social Security numbers or Individual Taxpayer Identification numbers. Dependent parents or other qualifying relatives supported by the taxpayer.

What does the IRS consider home improvements?

A capital improvement that adds value to your home, prolongs its life, or adapts it to new uses can be added to the cost basis of your home and subtracted from the sales price to determine the amount of your profit when you sell it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Other Credits Form?

The Other Credits Form is a tax form used by taxpayers to report various credits that are not covered by standard credit forms.

Who is required to file Other Credits Form?

Taxpayers who have claims for specific credits related to expenses such as education, child care, or other qualified expenditures must file the Other Credits Form.

How to fill out Other Credits Form?

To fill out the Other Credits Form, you need to provide your personal information, list the specific credits you are claiming, and detail the amounts corresponding to each credit.

What is the purpose of Other Credits Form?

The purpose of the Other Credits Form is to allow taxpayers to claim deductions or credits due to certain qualifying expenses that reduce their overall tax liability.

What information must be reported on Other Credits Form?

The Other Credits Form must report taxpayer identification information, type and amount of credits being claimed, and any supporting documentation for the claimed expenses.

Fill out your oformr credits form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oformr Credits Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.