Get the free Instructions for Forms 1099-A and 1099-C

Show details

The document provides detailed instructions on how to complete Forms 1099-A and 1099-C, including filing requirements, definitions of relevant terms, and specific guidance for various scenarios related

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign instructions for forms 1099-a

Edit your instructions for forms 1099-a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions for forms 1099-a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing instructions for forms 1099-a online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit instructions for forms 1099-a. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out instructions for forms 1099-a

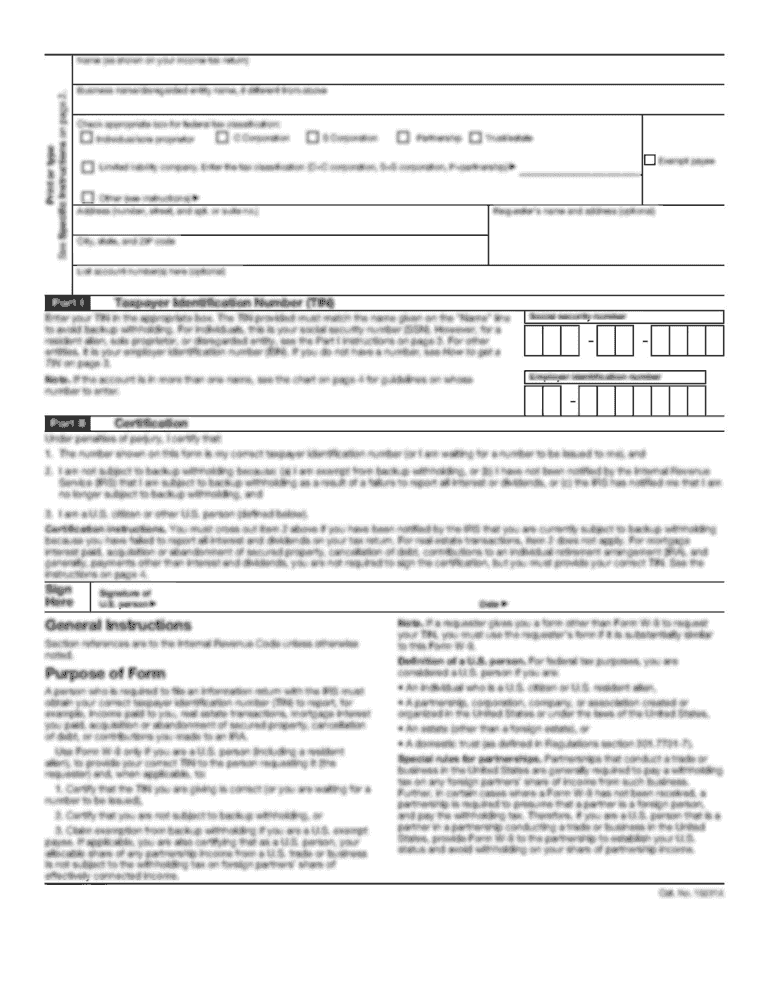

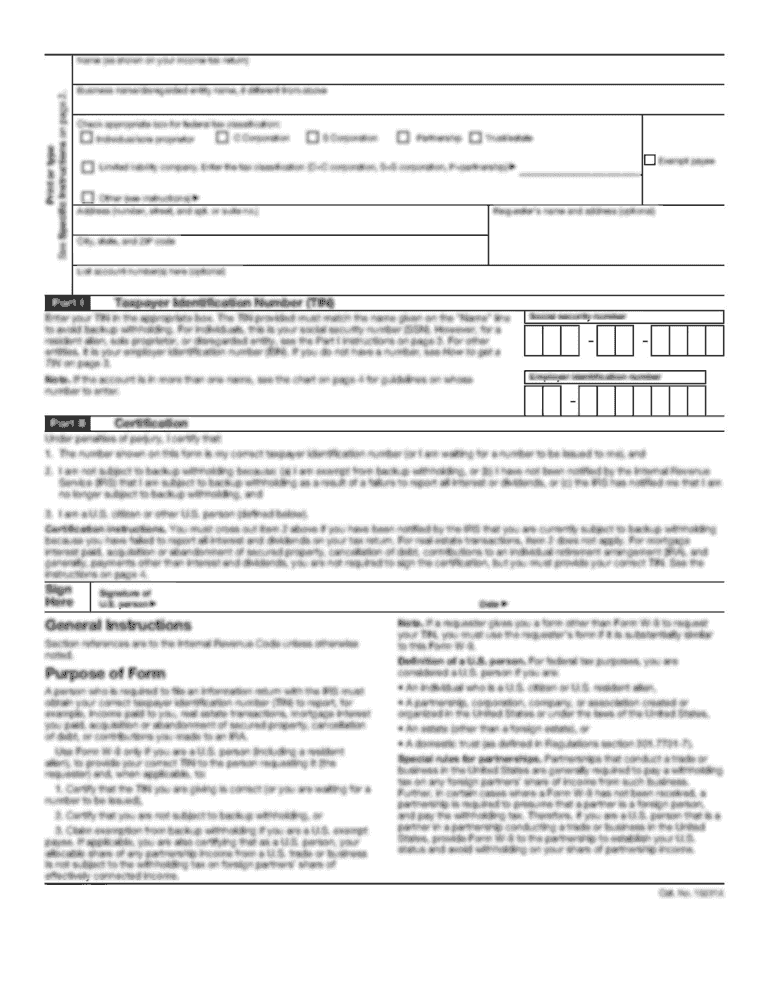

How to fill out Instructions for Forms 1099-A and 1099-C

01

Obtain the Forms 1099-A and 1099-C from the IRS website or a tax professional.

02

Read the instructions for the forms carefully, including who must file and the deadlines.

03

Fill out Form 1099-A with information about the acquisition or abandonment of secured property.

04

Enter details such as the date of the event, the balance of principal outstanding, and the fair market value of the property.

05

Complete Form 1099-C with information regarding the cancellation of debt, including the date of cancellation and the debt canceled amount.

06

Include the recipient's information, such as their name, address, and taxpayer identification number (TIN).

07

Review all entered information for accuracy.

08

Submit the completed forms to the IRS and provide copies to the recipients by the due date.

Who needs Instructions for Forms 1099-A and 1099-C?

01

Individuals or businesses that have had a cancellation of debt in the tax year.

02

Lenders who have canceled debts for borrowers that meet IRS criteria.

03

Taxpayers who have acquired property through foreclosure or abandonment.

Fill

form

: Try Risk Free

People Also Ask about

What is 1099-A and 1099-C?

432, Form 1099-A, Acquisition or Abandonment of Secured Property and Form 1099-C, Cancellation of Debt." Internal Revenue Service.

Do I need to report 1099-A on my tax return?

Form 1099-A contains several important pieces of information that you'll need to report the foreclosure, repossession, or abandonment of property on your tax return.

Where do I enter a 1099s on my tax return?

How do I report a 1099-S on my tax return? If necessary, you'll report the sale on Schedule D and the specific details on Form 8949. TaxAct will walk you through the process to help you report the details of the sale (see the next section).

Do I have to report a 1099 on my tax return?

There are different 1099 forms that report various types of income and how they were earned. These payments might be for interest, dividends, nonemployee compensation, retirement plan distributions. If you receive a 1099 form, it's your responsibility to report the income earned on your tax return.

How badly does a 1099-C affect my taxes?

Unfortunately, your next challenge might be a huge tax bill. In most situations, if you receive a Form 1099-C from a lender, you'll have to report the amount of cancelled debt on your tax return as taxable income. Certain exceptions do apply.

What happens if I don't declare a 1099?

If you don't include this and any other taxable income on your tax return, you may be subject to a penalty. Failing to report income may cause your return to understate your tax liability. If this happens, the IRS may impose an accuracy-related penalty that's equal to 20% of your underpayment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Instructions for Forms 1099-A and 1099-C?

Instructions for Forms 1099-A and 1099-C provide guidelines for reporting the acquisition or abandonment of secured property and the cancellation of debt.

Who is required to file Instructions for Forms 1099-A and 1099-C?

Lenders and certain financial institutions that cancel debts or acquire property through foreclosure are required to file these forms.

How to fill out Instructions for Forms 1099-A and 1099-C?

To fill out these forms, gather necessary information regarding the borrower, the amount of debt canceled, and property details, then complete the respective sections as outlined in the instructions.

What is the purpose of Instructions for Forms 1099-A and 1099-C?

The purpose is to ensure that taxpayers report income accurately concerning canceled debts and property acquired through foreclosure.

What information must be reported on Instructions for Forms 1099-A and 1099-C?

Information that must be reported includes the debtor's details, the amount of debt canceled, the description of the property, and dates related to the transaction.

Fill out your instructions for forms 1099-a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instructions For Forms 1099-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.