MO DoR 4923 2021 free printable template

Show details

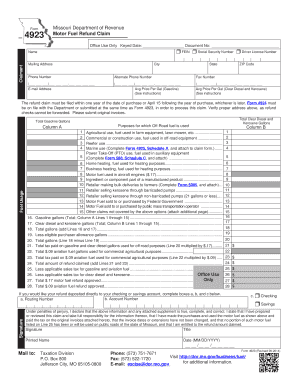

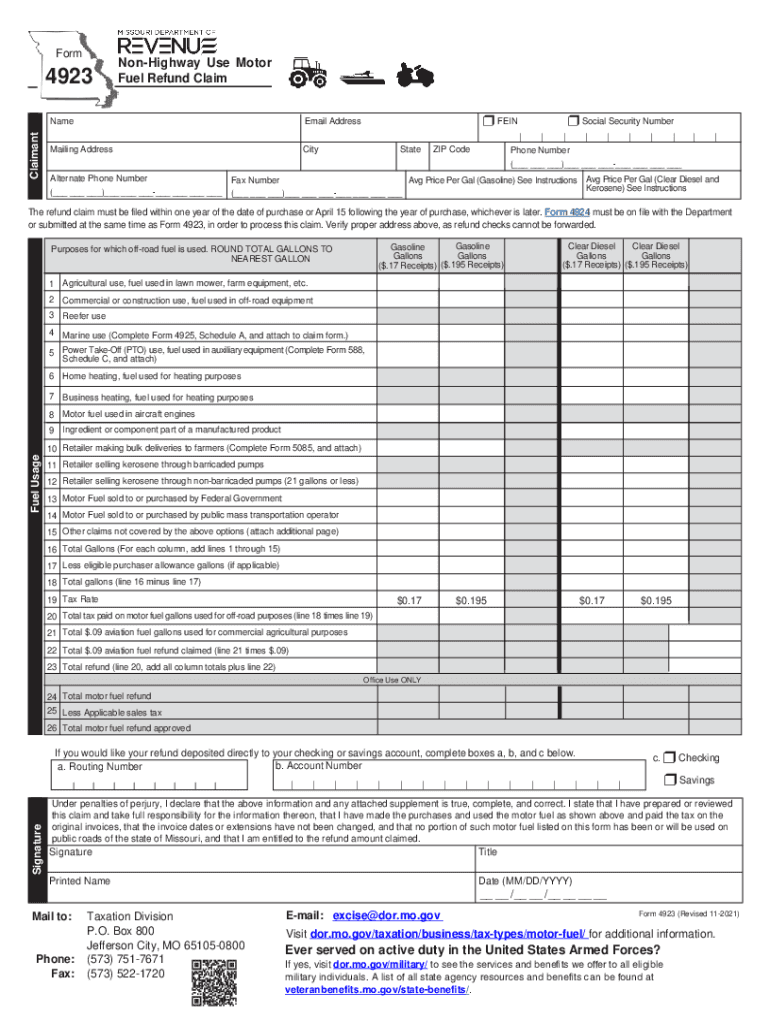

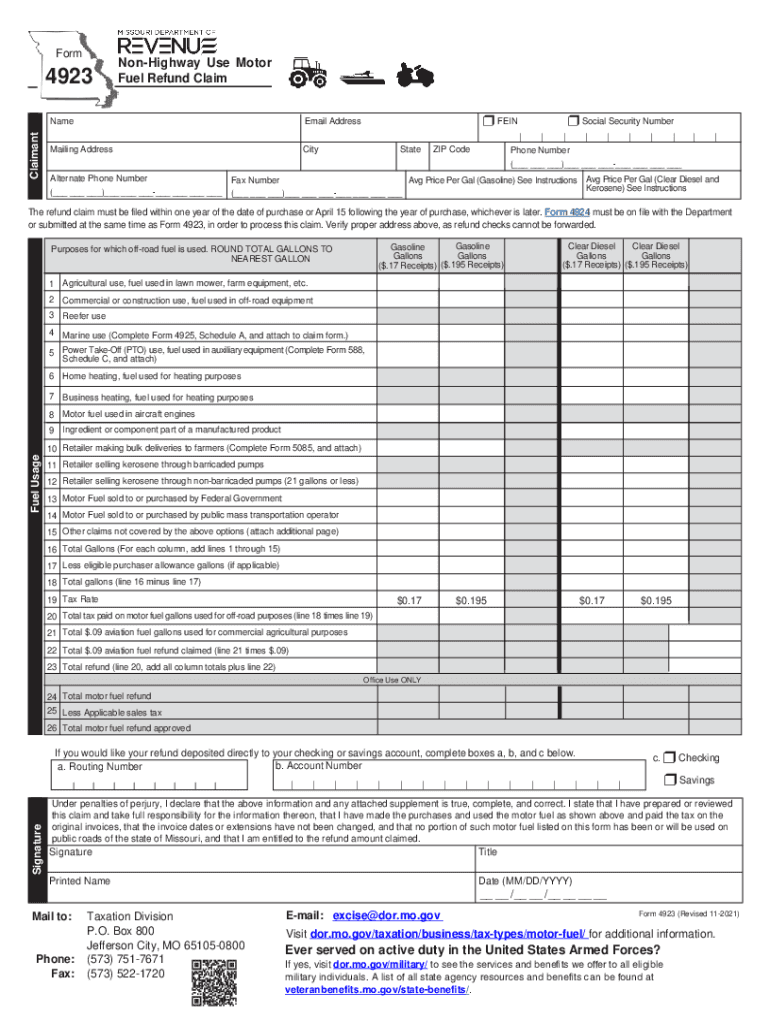

O. Box 800 Jefferson City MO 65105-0800 Form 4923 Revised 09-2014 Phone 573 751-7671 Visit http //dor. mo. gov/business/fuel/ Fax 573 522-1720 for additional information. E-mail excise dor. mo. gov Section 142. 824 Motor Fuel Tax Law Provides the following requirements To claim a refund the ultimate consumer or retailer must file the claim within one year of the date of purchase or April 15th following the year of purchase whichever is later. I state that I have prepared or reviewed this...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO DoR 4923

Edit your MO DoR 4923 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO DoR 4923 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO DoR 4923 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MO DoR 4923. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DoR 4923 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO DoR 4923

How to fill out MO DoR 4923

01

Obtain a copy of the MO DoR 4923 form from the official website or your local Department of Revenue office.

02

Begin by filling in your personal information at the top of the form, including name, address, and contact details.

03

Specify the tax year for which you are filing the form.

04

Provide details regarding your income sources, including wages, interest, dividends, and any other income.

05

Itemize any deductions you are eligible for, such as business expenses or personal deductions.

06

Calculate the total tax owed or refund due based on the information provided.

07

Review the form for any errors or omissions.

08

Sign and date the form before submitting it.

Who needs MO DoR 4923?

01

Individuals who have earned income in Missouri.

02

Taxpayers looking to report their income for a specific tax year.

03

Persons seeking any tax refunds or credits they may be eligible for.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim my gas tax refund in Missouri?

How do I request a refund of the motor fuel tax increase? To request a refund of the of the motor fuel tax increase for fuel used for highway purposes, you will need to complete Form 4923-H. Motor fuel is considered to be used for highway purposes if it is used to propel a motor vehicle on highways.

What is Missouri Motor Fuel refund Claim form 4923?

Use this form to file a refund claim for the Missouri motor fuel tax increase paid beginning July 1, 2022, through June 30, 2023, for motor fuel used for on road purposes. Refund claims must be postmarked on or after July 1, but no later than October 2 following the fiscal year for which the refund is claimed.

How do I claim back gas tax in Missouri?

Missouri gas tax refund form Drivers can submit a 4923-H form to the Department of Revenue to be eligible for the tax refund on the extra 2.5 cents from the October 2021 increase. The form requires vehicle and fuel information, and drivers must report the number of gallons of fuel they purchased between Oct.

Who is eligible for the Missouri tax rebate?

If single, your total household income must be $30,000 or less. If married filing combined, your total household income must be $34,000 or less.

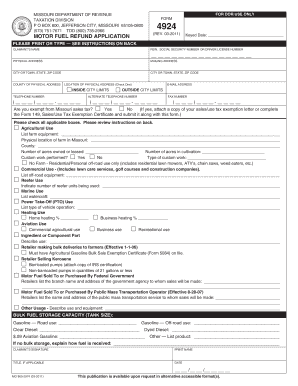

What is form 4924?

Revision Date. 4924 Document. Non-Highway Use Motor Fuel Refund Application. 5/16/2022.

Who qualifies for Missouri gas tax refund?

On October 1, 2021 Missouri's motor fuel tax rate increased to 19.5 cents per gallon. You may be eligible to receive a refund of the 2.5 cents tax increase you pay on Missouri motor fuel if: vehicle weighs less than 26,000 pounds. vehicle for highway use.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my MO DoR 4923 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your MO DoR 4923 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How can I fill out MO DoR 4923 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your MO DoR 4923, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete MO DoR 4923 on an Android device?

On Android, use the pdfFiller mobile app to finish your MO DoR 4923. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

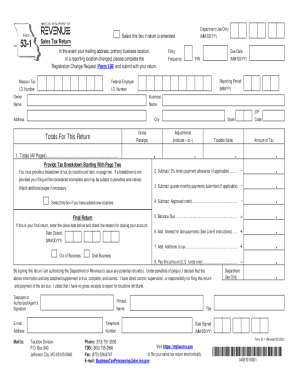

What is MO DoR 4923?

MO DoR 4923 is a Missouri Department of Revenue form used for reporting certain tax information, typically related to withholding taxes.

Who is required to file MO DoR 4923?

Employers who withhold tax from employee wages or make certain types of payments are required to file MO DoR 4923.

How to fill out MO DoR 4923?

To fill out MO DoR 4923, provide the relevant taxpayer information, itemize the amounts withheld, and ensure all calculations are accurate before submitting to the Missouri Department of Revenue.

What is the purpose of MO DoR 4923?

The purpose of MO DoR 4923 is to report and reconcile state withholding taxes withheld from employees’ paychecks and ensure compliance with state tax laws.

What information must be reported on MO DoR 4923?

Information that must be reported on MO DoR 4923 includes the employer's information, total wages paid, the amount of tax withheld, and any corrections from previous reports.

Fill out your MO DoR 4923 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO DoR 4923 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.