CO DoR 104PN 2021 free printable template

Show details

*210104PN19999*

DR 0104 IN (11/15/21)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 1 of 3Form 104PNPartYear Resident/Nonresident

Tax Calculation Schedule 2021

Taxpayers Name SSN or Chinese

pdfFiller is not affiliated with any government organization

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

How to fill out CO DoR 104PN

Instructions and Help about CO DoR 104PN

How to edit CO DoR 104PN

To edit the CO DoR 104PN Tax Form, you can use pdfFiller's tools to make necessary amendments directly on a digital copy. After uploading the form, select the fields you wish to modify and enter your new information. Ensure all changes are saved before proceeding to download or submit the revised form.

How to fill out CO DoR 104PN

Filling out the CO DoR 104PN requires specific information about the payee and the payments made. Start by entering your identifying information at the top of the form, including your name, address, and Social Security number. Follow with information about the payments made, using accurate dollar amounts and appropriate categories to ensure compliance with reporting requirements.

About CO DoR 104PN 2021 previous version

What is CO DoR 104PN?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO DoR 104PN 2021 previous version

What is CO DoR 104PN?

CO DoR 104PN is a tax form used in Colorado to report certain payments made to non-residents. This form is essential for ensuring that income payments are accurately reported to the Colorado Department of Revenue and that any taxes due are properly calculated and remitted.

What is the purpose of this form?

The purpose of the CO DoR 104PN Tax Form is to document and report payments made to non-resident individuals or entities that would be subject to Colorado income tax withholding. This reporting helps the state to track and collect tax revenues from individuals who earn income in Colorado but are not state residents.

Who needs the form?

The CO DoR 104PN must be filed by businesses or individuals who make certain payments, including but not limited to commissions, fees for services, and rental payments to non-resident individuals. If these payments exceed a specified threshold, the form is required to ensure proper tax compliance.

When am I exempt from filling out this form?

You may be exempt from filling out the CO DoR 104PN if the payments you are reporting do not meet the minimum threshold established by the Colorado Department of Revenue. Additionally, payments made to certain tax-exempt organizations or for specific types of services may not require this tax form.

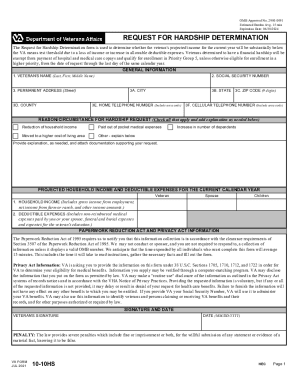

Components of the form

The CO DoR 104PN includes several key sections: identifying the payer and payee, detailing the types and amounts of payments made, and providing certification of accuracy. Each section must be completed thoroughly to avoid issues with the tax authorities.

Due date

The due date for filing the CO DoR 104PN is typically January 31 of the year following the calendar year in which the payments were made. This due date ensures timely reporting and tax compliance for the previous tax year.

What are the penalties for not issuing the form?

Failing to issue the CO DoR 104PN when required can result in penalties imposed by the Colorado Department of Revenue. This may include fines or interest on any unpaid taxes, which can increase the financial burden on the taxpayer.

What information do you need when you file the form?

When filing the CO DoR 104PN, you will need specific information, including the total amounts of payments made, the names and addresses of both the payee and payer, and the payee's Social Security number or tax identification number. Collecting this information beforehand helps to prevent errors during the filing process.

Is the form accompanied by other forms?

The CO DoR 104PN may need to be submitted alongside other forms, such as supporting documentation related to the payments made or forms detailing state income tax withholding. Ensure that you review filing requirements specific to your payment situation to avoid missing essential documents.

Where do I send the form?

The completed CO DoR 104PN should be sent to the Colorado Department of Revenue. Depending on the payment situation, you may need to file the form electronically or mail it to the designated address provided on the form itself or the Colorado Department of Revenue website.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

It has been GREAT lots of forms to choose from and easy to fill out.

It works great, and here is all I neeed for my job. GOD BLESS YOU ALL. GOOD WOEK

See what our users say