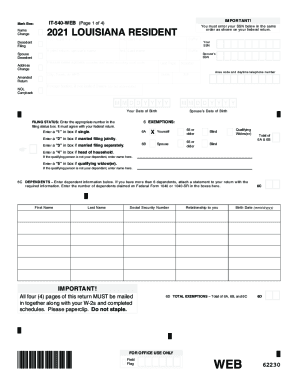

IRS Instructions 1040 Schedule A 2021 free printable template

Show details

Department of the Treasury

Internal Revenue Service2021 Instructions for Schedule A

Itemized

Deductions Schedule A (Form 1040) to figure your itemized deductions. In most cases, your

federal income

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 1040 Schedule A

Edit your IRS Instructions 1040 Schedule A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 1040 Schedule A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instructions 1040 Schedule A online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS Instructions 1040 Schedule A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 1040 Schedule A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 1040 Schedule A

How to fill out IRS Instructions 1040 Schedule A

01

Gather all necessary documents such as W-2s, 1099s, and receipts for deductible expenses.

02

Begin with the top section of Schedule A, which asks for your name and Social Security number.

03

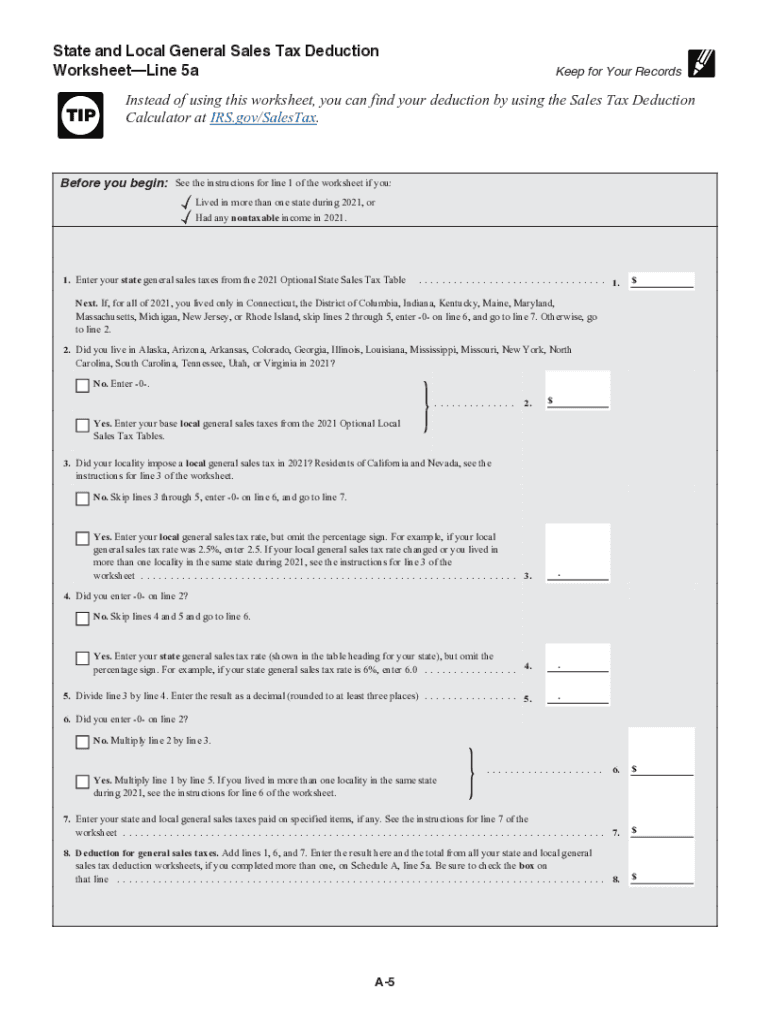

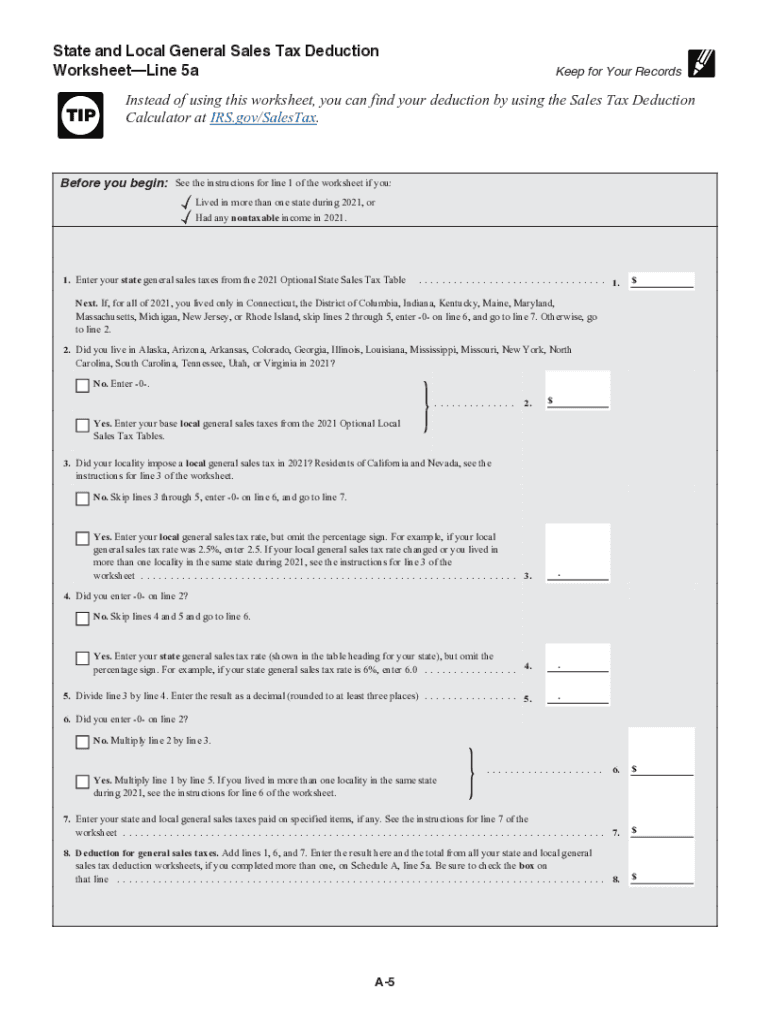

Move to the 'Medical and Dental Expenses' section and record your total eligible expenses.

04

In the 'Taxes You Paid' section, list any state and local income taxes and property taxes you paid.

05

Fill in the 'Interest You Paid' section, including mortgage interest and points.

06

Document any gifts to charity under the 'Gifts to Charity' section, including cash and non-cash contributions.

07

Complete the 'Casualty and Theft Losses' section if applicable.

08

Review and total all sections, ensuring accuracy and proper documentation.

09

Transfer the total amount from Schedule A to the corresponding line on IRS Form 1040.

Who needs IRS Instructions 1040 Schedule A?

01

Individuals who itemize their deductions instead of taking the standard deduction may need IRS Instructions 1040 Schedule A.

02

Taxpayers with significant medical expenses, state and local taxes, mortgage interest, and charitable contributions should use Schedule A.

03

Anyone who experienced casualty or theft losses may also require this schedule to claim those deductions.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I itemized my last year's deductions?

If you do not remember whether you itemized your deductions last year, you can check your tax forms to see if you submitted Form 1040 Schedule A. If you did, you itemized your deductions. If you did not submit Schedule A, then you did not itemize your deductions.

How much deductions can I claim without receipts?

In order to be eligible for a tax deduction, you are required to present documented documentation if the total amount of your claimed expenses is more than $300. On the other hand, if the entire amount of your claimed expenses is less than $300, you are exempt from the requirement to present receipts.

What is Schedule B form for?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

Which expenses can be deducted?

The main operating expenses you can deduct from your taxes Business start-up costs. You can deduct expenses that preceded the operation of the business. Supplies. Business tax, fees, licences and dues. Office expenses. Business use-of-home expense. Salaries, wages, benefits. Travel. Rent.

When should you itemize instead of claiming the standard deduction?

If the value of expenses that you can deduct is more than the standard deduction (as noted above, for the tax year 2023 these are: $13,850 for single and married filing separately, $27,700 for married filing jointly, and $20,800 for heads of households) then you should consider itemizing.

What deductions can I claim without receipts?

10 Deductions You Can Claim Without Receipts Home Office Expenses. This is usually the most common expense deducted without receipts. Cell Phone Expenses. Vehicle Expenses. Travel or Business Trips. Self-Employment Taxes. Self-Employment Retirement Plan Contributions. Self-Employed Health Insurance Premiums. Educator expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IRS Instructions 1040 Schedule A online?

pdfFiller has made filling out and eSigning IRS Instructions 1040 Schedule A easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I sign the IRS Instructions 1040 Schedule A electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your IRS Instructions 1040 Schedule A in seconds.

How can I edit IRS Instructions 1040 Schedule A on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing IRS Instructions 1040 Schedule A.

What is IRS Instructions 1040 Schedule A?

IRS Instructions 1040 Schedule A is a document that provides guidelines on how to itemize deductions on your federal income tax return. It outlines the various deductions that taxpayers can claim in order to reduce their taxable income.

Who is required to file IRS Instructions 1040 Schedule A?

Taxpayers who choose to itemize their deductions rather than taking the standard deduction must file IRS Schedule A. This is typically required for individuals with significant deductible expenses, such as medical costs, mortgage interest, and state taxes.

How to fill out IRS Instructions 1040 Schedule A?

To fill out IRS Schedule A, taxpayers must gather relevant financial documents, list their deductible expenses in the appropriate sections, total the amounts, and carry the total to Form 1040. Detailed instructions can be found within the IRS Schedule A guidelines.

What is the purpose of IRS Instructions 1040 Schedule A?

The purpose of IRS Instructions 1040 Schedule A is to provide taxpayers with a method to report itemized deductions that can reduce their overall taxable income, thus potentially lowering their tax liability.

What information must be reported on IRS Instructions 1040 Schedule A?

Taxpayers must report various forms of deductible expenses on Schedule A, including medical expenses, state and local taxes, mortgage interest, charitable contributions, and certain miscellaneous deductions, among others.

Fill out your IRS Instructions 1040 Schedule A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 1040 Schedule A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.