AZ DoR Form 830 2020-2025 free printable template

Show details

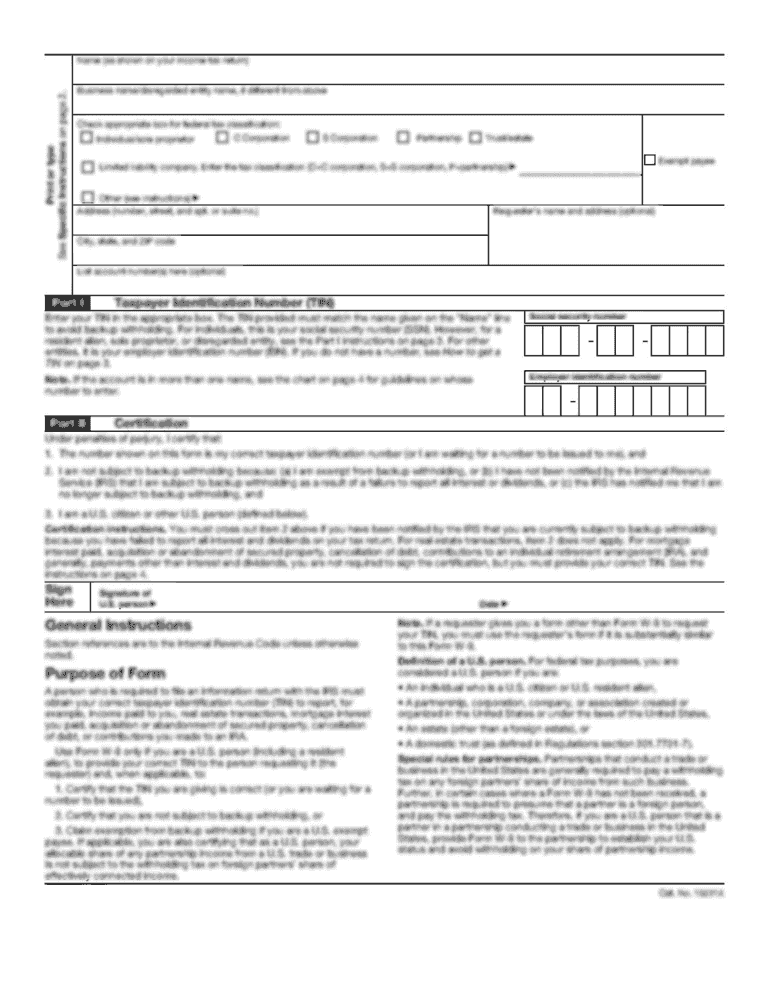

Arizona Form

830AffidavitBingoThis affidavit must be completed by each person who wishes to assist in the conduct of any game of bingo. If any information is blank or incorrect, the

affidavit will

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 830

Edit your form 830 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 830 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 830 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 830. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ DoR Form 830 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 830

How to fill out AZ DoR Form 830

01

Obtain a copy of the AZ DoR Form 830 from the Arizona Department of Revenue website or your local office.

02

Fill in your personal information at the top of the form, including your name, address, and Taxpayer Identification Number.

03

Provide details about the tax period for which you are filing the form.

04

Complete the income section by reporting your total income accurately.

05

Fill out any applicable deductions as specified in the form instructions.

06

Calculate your tax liability using the provided tables or worksheets in the form.

07

Review the form for accuracy, ensuring all fields are filled out correctly.

08

Sign and date the form to certify that the information is true and complete.

09

Submit the completed form either electronically or via mail, following the instructions provided.

Who needs AZ DoR Form 830?

01

Individuals or businesses engaged in activities requiring tax reporting in Arizona.

02

Taxpayers who have income earned in Arizona and need to report it to the Department of Revenue.

03

Those who have received a notice from the Arizona Department of Revenue regarding their tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

In what states is bingo illegal?

Counted as Gambling If playing bingo online, there are ten states that consider the game illegal. These locations include Illinois, Indiana, Louisiana, Nevada, Michigan, New York, Oregon, Wisconsin, Washington and South Dakota.

How do I file an extension for Arizona state taxes?

You have the follow two options to file a AZ tax extension: Pay all or some of your Arizona income taxes online via: AZTaxes and select "204" as your payment type. Complete Form 204, include a Check or Money Order, and mail both to the address on Form 204.

What is the Arizona Department of Revenue?

Function: The mission of the Arizona Department of Revenue is to serve taxpayers. The Department administers and enforces collection of individual and corporate income tax, transaction privilege (sales), use, luxury, withholding, property, estate, fiduciary, bingo, and severance taxes.

What is the bingo tax in Arizona?

Class C License Class C licensees file monthly financial reports and pay 2.0% of their gross receipts as a bingo tax.

Why is bingo legal in California?

Bingo Primarily Exists as a Popular Form of Charitable Gaming. The California Penal Code 326.5 excludes bingo from the statewide prohibition on gambling if the game raises money for charity.

How much is a bingo license in Arizona?

Registration Renewal Agency:Arizona Department of Revenue - Bingo SectionForm:Form 10331: Application for Bingo License PacketAgency Fee:$10 for a class A license, $50 for a class B license, and $200 for a class C license.Due:Annually by the date of issuance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 830 to be eSigned by others?

Once you are ready to share your form 830, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out the form 830 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign form 830 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete form 830 on an Android device?

Complete your form 830 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is AZ DoR Form 830?

AZ DoR Form 830 is a document used for reporting certain financial information to the Arizona Department of Revenue, particularly related to tax credits for donations to public schools and qualified charities.

Who is required to file AZ DoR Form 830?

Individuals and corporations who have made eligible donations to public schools or qualified charities in Arizona and wish to claim the associated tax credits are required to file AZ DoR Form 830.

How to fill out AZ DoR Form 830?

To fill out AZ DoR Form 830, taxpayers need to provide their personal or business information, detail the donations made, and include relevant financial data as instructed on the form. Accurate documentation of donations is also required.

What is the purpose of AZ DoR Form 830?

The purpose of AZ DoR Form 830 is to allow taxpayers to report donations for tax credit considerations, helping them reduce their state tax liability while supporting Arizona public schools and charitable organizations.

What information must be reported on AZ DoR Form 830?

AZ DoR Form 830 requires the reporting of the taxpayer's identification information, details of the donations made (including the recipient organization and amounts), and any other pertinent financial information needed to validate the tax credits claimed.

Fill out your form 830 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 830 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.