Get the free Form 990 - Assistance League of Austin - alaustin

Show details

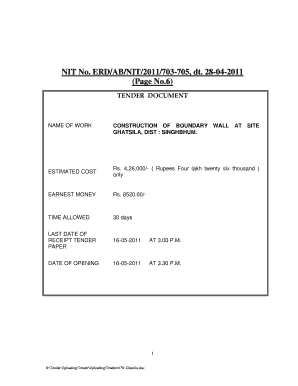

CLIENT 1162

DUNCAN JACK LLP

3724 JEFFERSON STREET, SUITE 307

AUSTIN, TX 78731

(512) 420-8997

December 10, 2013,

Assistance League of Austin, Texas, Inc.

4901 Burned Road

Austin, TX 78756

FEDERAL ID:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 990 - assistance

Edit your form 990 - assistance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 990 - assistance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 990 - assistance online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 990 - assistance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 990 - assistance

How to fill out form 990 - assistance?

01

Gather all necessary financial information: Start by collecting all the relevant financial documents such as income statements, balance sheets, and statements of activities. This will help you accurately complete the form.

02

Fill out the organizational information: Begin by providing basic details about your organization, such as its name, address, and Employer Identification Number (EIN). Include any changes in contact information or organizational structure if applicable.

03

Report program service accomplishments: Describe the mission and activities of your organization, including the programs and services it offers. Provide information on the number of individuals served, the outcomes achieved, and any collaborations with other organizations.

04

Provide financial information: This section requires you to disclose your organization's revenues, expenses, assets, and liabilities. Be prepared to report on various sources of income such as donations, grants, and program service revenue. Include details on any significant transactions or financial arrangements.

05

Complete the governance section: Report on the composition of your organization's governing body, including the names and titles of key officers and directors. Provide information about any potential conflicts of interest and compensation arrangements.

06

Answer specific questions: The form includes a series of questions that require additional information or explanations. Carefully read each question and provide accurate and complete responses.

07

Review and file the form: Take the time to review your completed form for any errors or omissions. Make sure your calculations are accurate and all required information is provided. Once you are satisfied with the form, file it according to the instructions provided by the Internal Revenue Service (IRS).

Who needs form 990 - assistance?

01

Nonprofit organizations: Nonprofit organizations, including public charities, private foundations, and certain other tax-exempt organizations, are usually required to file Form 990. This form provides transparency to the IRS and the public about the organization's financial activities.

02

Donors and grantors: Individuals or entities providing funding or grants to nonprofit organizations often rely on Form 990 to assess the financial health and accountability of the organization. Understanding the information disclosed in the form can help donors make informed decisions about their philanthropic activities.

03

Grant-making foundations: Foundations that distribute grants to nonprofit organizations may require grantees to submit a copy of their Form 990. This allows the foundation to evaluate the grantee's financial position and determine if it aligns with their funding priorities.

04

Government agencies: Local, state, and federal government agencies may require nonprofit organizations to submit Form 990 as part of their reporting obligations. This helps the government track the activities and finances of these organizations and ensure compliance with applicable regulations.

05

General public: Form 990 is a public document that can be accessed by anyone interested in learning more about a nonprofit organization. It provides insights into an organization's activities, financial health, and governance structure, allowing the public to make informed decisions about supporting or engaging with the organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 990 - assistance directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your form 990 - assistance and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get form 990 - assistance?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific form 990 - assistance and other forms. Find the template you need and change it using powerful tools.

Can I edit form 990 - assistance on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute form 990 - assistance from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is form 990 - assistance?

Form 990-ASSISTANCE is used by organizations to report information related to assistance provided to individuals, including grants, scholarships, fellowships, direct financial aid, and other forms of assistance.

Who is required to file form 990 - assistance?

Organizations that provide assistance to individuals and meet certain criteria are required to file Form 990-ASSISTANCE.

How to fill out form 990 - assistance?

Form 990-ASSISTANCE must be completed with details of the assistance provided, including the type of assistance, the amount, the recipients, and any other relevant information.

What is the purpose of form 990 - assistance?

The purpose of Form 990-ASSISTANCE is to provide transparency and accountability regarding the assistance provided by organizations to individuals.

What information must be reported on form 990 - assistance?

Information that must be reported on Form 990-ASSISTANCE includes details of the assistance provided, the recipients, the purpose of the assistance, and any other relevant information.

Fill out your form 990 - assistance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 990 - Assistance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.