Get the free EMPLOYEES CHARITY ORGANIZATION

Show details

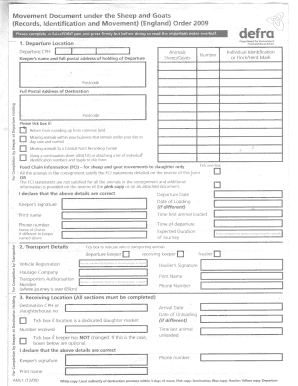

Return of Organization Exempt From Income Tax For, 990 Department of the Treasury Internal Revenue Service Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employees charity organization

Edit your employees charity organization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employees charity organization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employees charity organization online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit employees charity organization. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employees charity organization

How to fill out employees charity organization:

01

Start by researching different charities and organizations that align with your company's values and mission. Look for organizations that have a proven track record of making a positive impact and have a reputable reputation.

02

Once you have identified a charity or organization that you would like to support, reach out to them to establish a partnership. This may involve contacting their representative or filling out an application form provided by the organization.

03

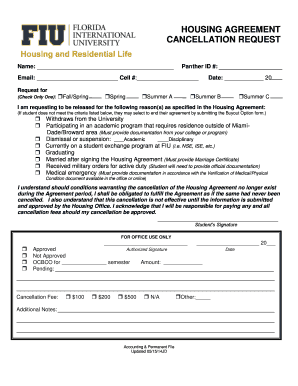

Obtain any necessary forms or documents required by the charity or organization for setting up a charitable contribution program. This may include paperwork to be filled out by employees who wish to participate, such as donation pledge forms or payroll deduction authorization forms.

04

Communicate the charity or organization's mission and goals to your employees. This can be done through company-wide communications, such as emails, newsletters, or memos, as well as through informational sessions or presentations.

05

Encourage employee participation by creating incentives or recognition programs for those who contribute to the charity. This could include matching donations made by employees, hosting fundraising events or campaigns, or offering volunteer opportunities for employees to get involved.

06

Keep track of employee contributions and ensure that they are allocated to the intended charity or organization. This may involve coordinating with your payroll department to set up automatic deductions or collecting and distributing donations on a regular basis.

07

Regularly evaluate the impact and effectiveness of your employees' charity organization. This can be done through monitoring participation rates, gathering feedback from employees, and assessing the tangible outcomes and impacts achieved through the employee contributions.

Who needs employees charity organization?

01

Companies and organizations of all sizes can benefit from having an employees charity organization. It allows them to give back to their communities and make a positive impact on social issues that align with their values.

02

Non-profit organizations and charities also benefit from employees charity organizations as they are able to tap into a new source of support and funding. By partnering with companies, these organizations can amplify their message and expand their reach.

03

Employees themselves can also benefit from employees charity organizations, as it gives them an opportunity to contribute to causes they care about and feel a sense of purpose and fulfillment through their work. Additionally, participating in charitable activities can enhance employee engagement, teamwork, and morale.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employees charity organization?

Employees charity organization is a non-profit organization that employees contribute to for charitable causes.

Who is required to file employees charity organization?

Employers are required to file employees charity organization.

How to fill out employees charity organization?

Employees charity organization can be filled out by providing the necessary details of the charity organization and contributions made by employees.

What is the purpose of employees charity organization?

The purpose of employees charity organization is to support charitable causes and give employees an opportunity to give back.

What information must be reported on employees charity organization?

Information such as the name of the charity organization, amount of contributions, and employee details must be reported on employees charity organization.

How can I modify employees charity organization without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your employees charity organization into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I create an electronic signature for the employees charity organization in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out employees charity organization using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign employees charity organization and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your employees charity organization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employees Charity Organization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.