Get the free Aplazamiento y fraccionamiento de deudas - Agencia Tributaria - sedeelectronica lasp...

Show details

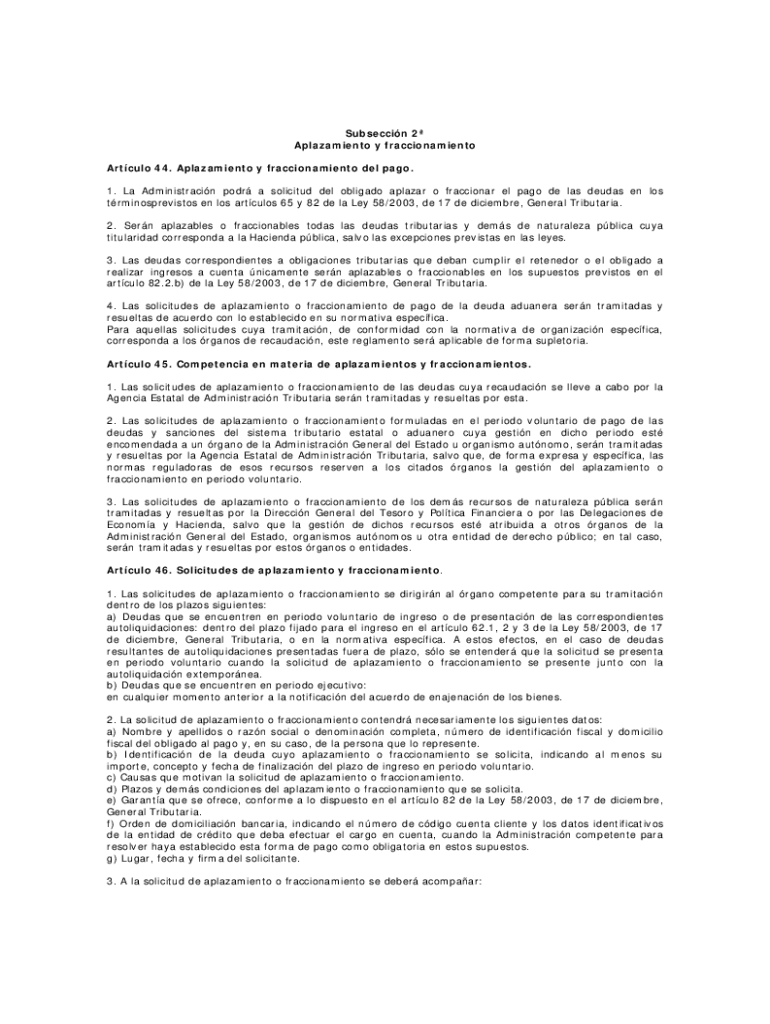

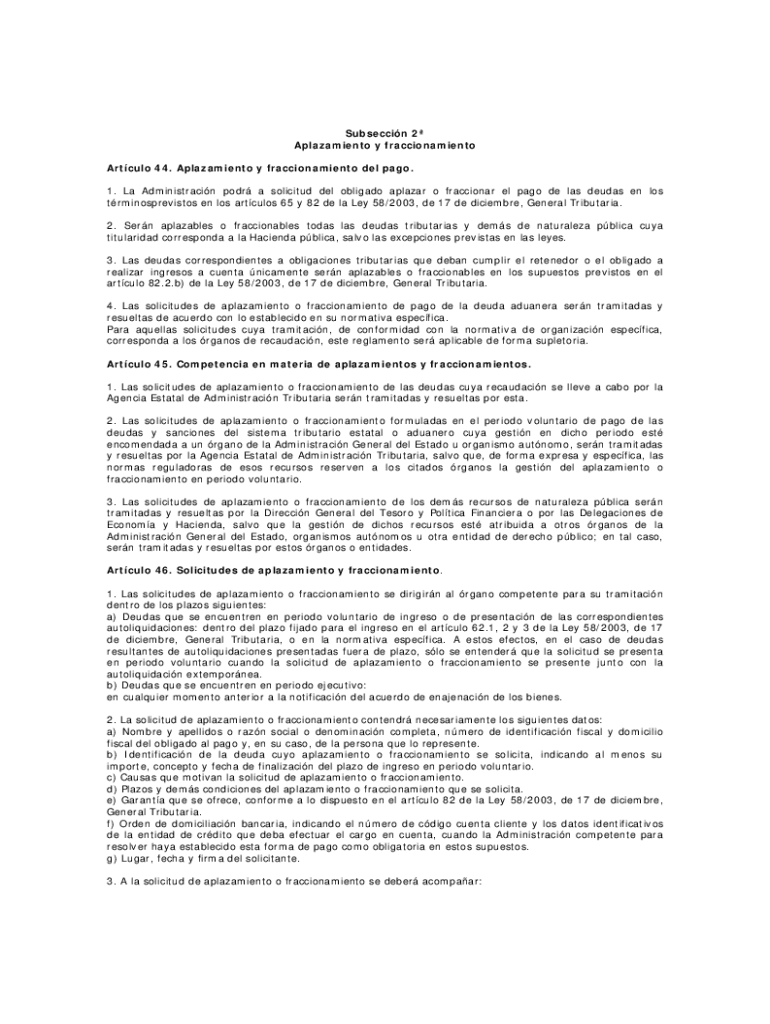

Subsection 2

Aplazamiento y fraccionamiento

Arturo 44. Aplazamiento y fraccionamiento Del Pago.

1. La Administration poor a solicited Del obliged plaza o fractional el Pago de leis feudal en Los

trminosprevistos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aplazamiento y fraccionamiento de

Edit your aplazamiento y fraccionamiento de form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aplazamiento y fraccionamiento de form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aplazamiento y fraccionamiento de online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit aplazamiento y fraccionamiento de. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

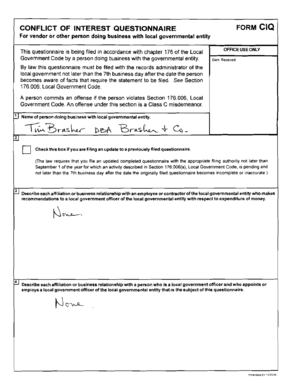

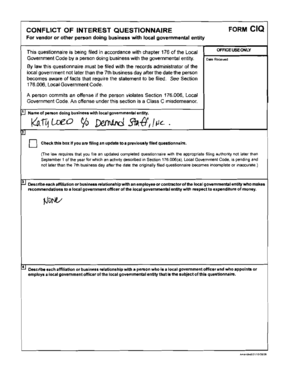

How to fill out aplazamiento y fraccionamiento de

How to fill out aplazamiento y fraccionamiento de

01

To fill out aplazamiento y fraccionamiento de, follow these steps:

02

Start by accessing the official website of the government or tax authority.

03

Look for the section or page dedicated to aplazamiento y fraccionamiento de.

04

Read the instructions and requirements carefully.

05

Gather all the necessary documentation and information, such as your tax identification number, tax forms, and financial statements.

06

Fill out the application form provided online or download it if available.

07

Provide accurate and complete information on the form, including your personal details and the specific tax obligations you wish to defer or divide into installments.

08

Attach any supporting documents required, such as proof of financial hardship or a payment plan proposal.

09

Double-check all the information filled in the form and make sure it is accurate and up to date.

10

Submit the form electronically through the designated submission method on the website.

11

Keep a copy of the submitted form and any accompanying documents for your records.

12

Wait for a response from the tax authority regarding your request for aplazamiento y fraccionamiento de. This may take some time, so be patient.

13

If your request is approved, follow any further instructions provided by the tax authority regarding payment methods and deadlines.

14

If your request is denied, you may consider seeking professional advice or exploring alternative options to meet your tax obligations.

15

Remember to fulfill your tax obligations according to the approved aplazamiento y fraccionamiento de arrangement to avoid further penalties or consequences.

Who needs aplazamiento y fraccionamiento de?

01

Aplazamiento y fraccionamiento de is needed by individuals or businesses who are unable to pay their tax obligations in full and on time.

02

This may be due to financial difficulties, unexpected expenses, or temporary cash flow problems.

03

By requesting aplazamiento y fraccionamiento de, individuals and businesses can seek a deferral or installment plan to pay their taxes over a longer period.

04

This helps them manage their financial obligations without incurring immediate penalties or facing legal consequences.

05

It is important to note that aplazamiento y fraccionamiento de is subject to approval by the tax authority and may have specific eligibility criteria and conditions that need to be met.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit aplazamiento y fraccionamiento de online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your aplazamiento y fraccionamiento de to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the aplazamiento y fraccionamiento de electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your aplazamiento y fraccionamiento de in seconds.

How do I edit aplazamiento y fraccionamiento de on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as aplazamiento y fraccionamiento de. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is aplazamiento y fraccionamiento de?

Aplazamiento y fraccionamiento de refers to deferment and installment payment plans for taxes or debts, allowing individuals or entities to make smaller payments over time instead of paying the full amount at once.

Who is required to file aplazamiento y fraccionamiento de?

Individuals or businesses that owe taxes or debts to the government and need assistance in payment terms may be required to file aplazamiento y fraccionamiento de.

How to fill out aplazamiento y fraccionamiento de?

To fill out aplazamiento y fraccionamiento de, gather all required financial documents, complete the application form accurately, provide necessary personal or business information, and submit it to the appropriate tax authority.

What is the purpose of aplazamiento y fraccionamiento de?

The purpose of aplazamiento y fraccionamiento de is to provide taxpayers with a flexible payment option to manage their financial obligations without facing immediate payment pressure.

What information must be reported on aplazamiento y fraccionamiento de?

The information that must be reported includes taxpayer identification, details of the debt or taxes owed, proposed payment plan, and any supporting documentation requested by the tax authority.

Fill out your aplazamiento y fraccionamiento de online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aplazamiento Y Fraccionamiento De is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.