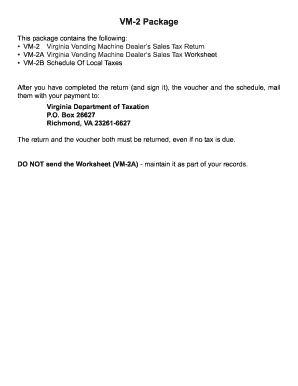

VA VM-2 2020-2026 free printable template

Show details

Electronic Filing and Payment Requirement You are required to electronically file Form VM2 and submit payment using the Departments online forms option available at www.tax.virginia.gov. Payments

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA VM-2

Edit your VA VM-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA VM-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA VM-2 online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit VA VM-2. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA VM-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA VM-2

How to fill out VA VM-2

01

Gather all necessary personal information and documents.

02

Download the VA VM-2 form from the official VA website.

03

Fill out your personal details in the designated fields, including your name, address, and Social Security number.

04

Provide information about your service history, including dates of service and branch.

05

Complete the sections related to your disability or health condition, if applicable.

06

If required, attach supporting documents that verify your claims.

07

Review the form for accuracy and ensure all required fields are filled.

08

Sign and date the form at the designated location.

09

Submit the completed form to the appropriate VA office, either by mail or electronically, as instructed on the form.

Who needs VA VM-2?

01

Veterans who are applying for benefits related to their military service.

02

Individuals seeking to request a change or update to their service-related information.

03

Survivors or dependents of veterans who may need to enroll in programs or benefits.

Fill

form

: Try Risk Free

People Also Ask about

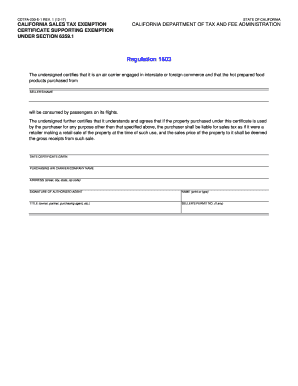

Do you have to file taxes for a vending machine business?

Fully taxable sales. Vending machine sales of all carbonated beverages and hot food products (other than hot beverages) are fully taxable, just as they would be in a store or at a restaurant. Please note: Be sure to keep separate records of your partially taxable and fully taxable sales.

How do taxes work on a vending machine business?

Vending machine receipts include all applicable state and local sales tax. Because vending machine receipts include the sales tax collected, you need to subtract the sales tax from receipts before reporting your sales and use tax.

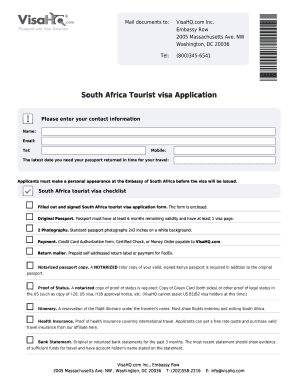

Do you need a business license for a vending machine in Virginia?

Except as otherwise authorized by the Tax Commissioner, every person engaged in the business of placing vending machines and selling tangible personal property through such machines shall apply for a Certificate of Registration for each county and city in which machines are placed.

What is the vending tax in Virginia?

B. Notwithstanding the provisions of 58.1-605 and 58.1-606, dealers makingsales of tangible personal property through vending machines shall report andremit the one percent local sales and use tax computed as provided insubsection A of this section.

Does owning a vending machine count as a business?

Owning anywhere from a few to a few hundred vending machines can be a manageable, successful business for owners of any experience level. The cost to start a vending machine is basically just the cost of the machines and stocking them—you won't need an office space to house them.

How to start a vending machine business in Virginia?

Check out other small business ideas. STEP 1: Plan your business. STEP 2: Form a legal entity. STEP 3: Register for taxes. STEP 4: Open a business bank account & credit card. STEP 5: Set up business accounting. STEP 6: Obtain necessary permits and licenses. STEP 7: Get business insurance. STEP 8: Define your brand.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my VA VM-2 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign VA VM-2 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I get VA VM-2?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the VA VM-2 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in VA VM-2 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your VA VM-2, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is VA VM-2?

VA VM-2 is a form used by the Virginia Department of Taxation for reporting the annual vehicle registration and titling fees.

Who is required to file VA VM-2?

Persons or entities who own vehicles registered in Virginia are required to file VA VM-2.

How to fill out VA VM-2?

To fill out VA VM-2, provide the required vehicle information, including vehicle identification number, make, model, year, and other relevant details as requested on the form.

What is the purpose of VA VM-2?

The purpose of VA VM-2 is to ensure accurate reporting of vehicle ownership and to facilitate the collection of registration and titling fees.

What information must be reported on VA VM-2?

Information that must be reported on VA VM-2 includes the vehicle's make, model, year, VIN (Vehicle Identification Number), owner's information, and any applicable fees.

Fill out your VA VM-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA VM-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.