Get the free IF Accounting method (- Cash

Show details

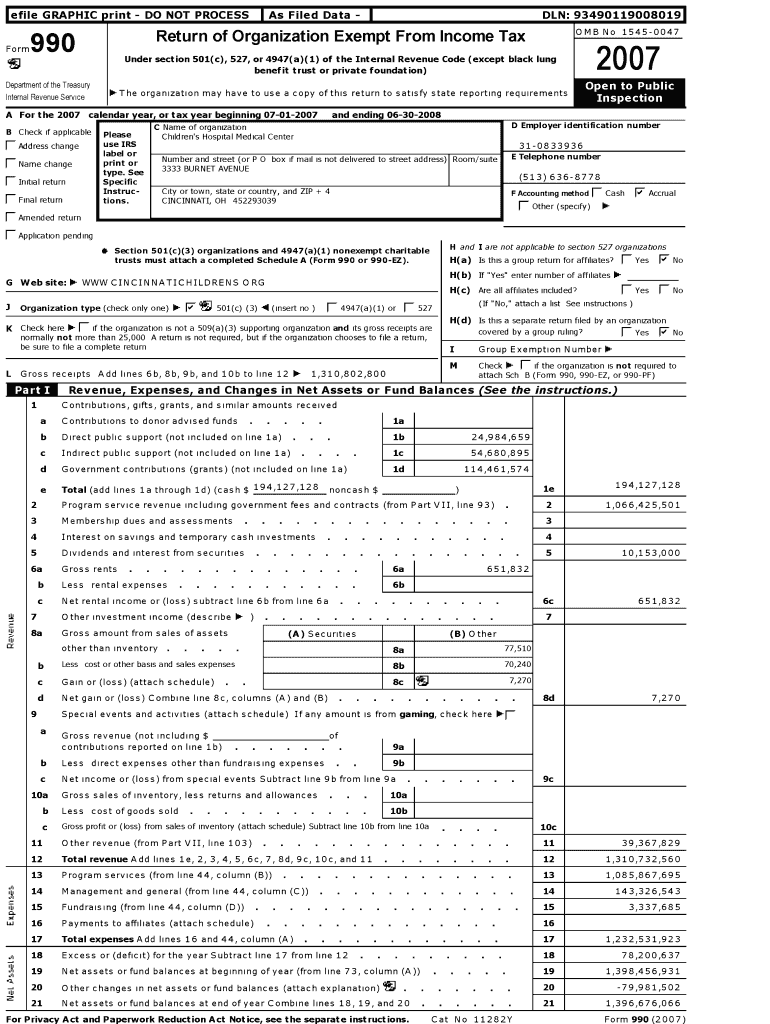

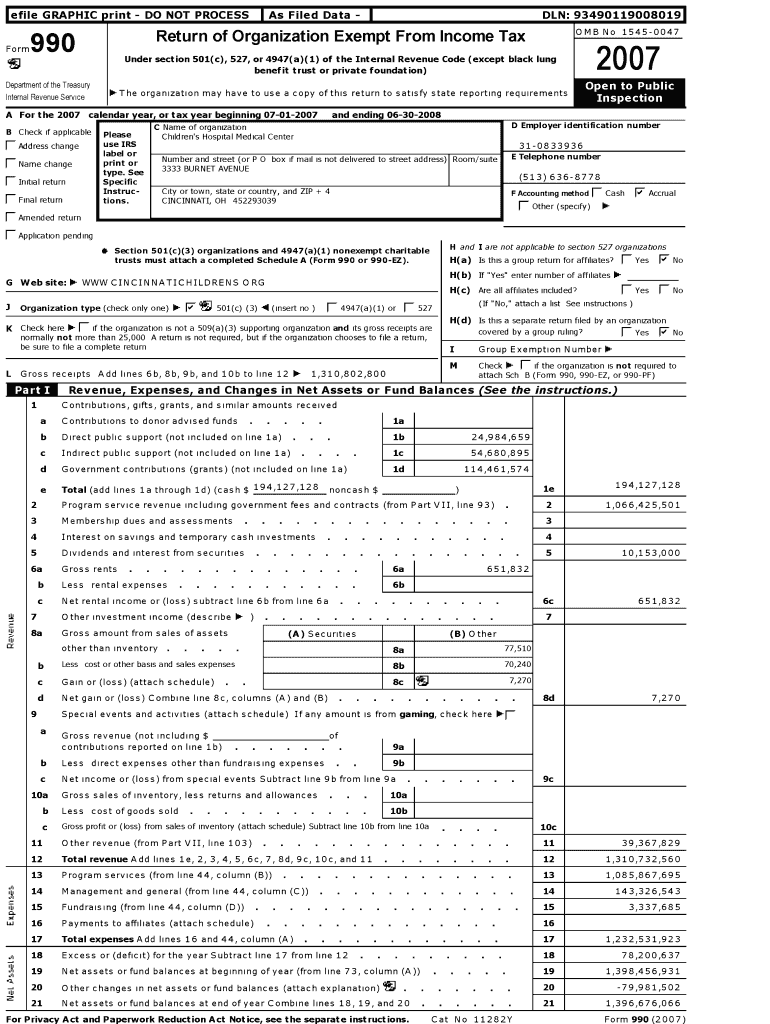

L file Form GRAPHIC print — DO NOT PROCESS As Filed Data DAN: 93490119008019 OMB No Return of Organization Exempt From Income Tax 990 1545-0047 Under section 501 (c), 527, or4947 (a)(1) of the Internal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign if accounting method

Edit your if accounting method form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your if accounting method form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit if accounting method online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit if accounting method. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out if accounting method

How to fill out the accounting method:

01

Understand the different types of accounting methods: There are two main types of accounting methods: cash basis and accrual basis. Cash basis accounting records revenues and expenses when cash is received or paid, while accrual basis accounting recognizes revenues and expenses when they are earned or incurred.

02

Determine which accounting method is appropriate for your business: Consider the size and nature of your business, as well as any legal or tax requirements. For small businesses, cash basis accounting may be simpler and more straightforward, while larger businesses often prefer accrual basis accounting for more accurate financial reporting.

03

Consult with an accountant or bookkeeper: If you are uncertain about which accounting method to choose or how to fill out the necessary forms, it is recommended to seek professional assistance. An accountant or bookkeeper can guide you through the process and ensure compliance with relevant regulations.

Who needs the accounting method:

01

Small businesses: Many small businesses may choose the cash basis accounting method due to its simplicity and ease of use. This method can be particularly beneficial for companies with minimal inventory and straightforward revenue and expense transactions.

02

Large corporations: Larger corporations often opt for the accrual basis accounting method, as it provides a more comprehensive view of financial performance. Accrual accounting takes into account accounts receivable, accounts payable, and other complex transactions, allowing for a more accurate representation of a company's financial health.

03

Non-profit organizations: Non-profit organizations typically require accrual basis accounting, as they are often subject to specific reporting and compliance guidelines. Accurate financial reporting is crucial for transparency when it comes to fundraising and receiving grants.

In conclusion, filling out the accounting method involves understanding the different types of methods, choosing the appropriate one for your business, and seeking professional assistance if needed. The accounting method is suitable for both small businesses and large corporations, with each method offering its own advantages. Non-profit organizations also require accurate accounting to comply with specific regulations and guidelines.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get if accounting method?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the if accounting method in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make changes in if accounting method?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your if accounting method to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit if accounting method straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing if accounting method right away.

What is if accounting method?

The If accounting method is a way of reporting income and expenses in the year they are earned or incurred, regardless of when the money is actually received or paid.

Who is required to file if accounting method?

Any individual or business that wants to follow the If accounting method for tax purposes is required to file this method.

How to fill out if accounting method?

To fill out the If accounting method, you must report income and expenses on the appropriate tax forms according to the rules of the method.

What is the purpose of if accounting method?

The purpose of the If accounting method is to match income and expenses more closely to the year in which they are earned or incurred, providing a more accurate picture of financial performance.

What information must be reported on if accounting method?

On the If accounting method, you must report all income earned and expenses incurred during the tax year.

Fill out your if accounting method online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

If Accounting Method is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.